A research report published by CBRE earlier in May this year on Global Shopping Center Development showed that global shopping center development continues to grow, with 11.4 million square meters of new shopping center space completed in 2014, and a further 39 million sq m under construction in the pipeline.

Asia is leading the growth of global shopping center development. According to CBRE’s survey results, Chinese cities account for half of the top 20 most active shopping centre markets globally with a total of 5.7 million sq m of shopping center space completed in 2014, compared to 10.6 million sq m in 2013.

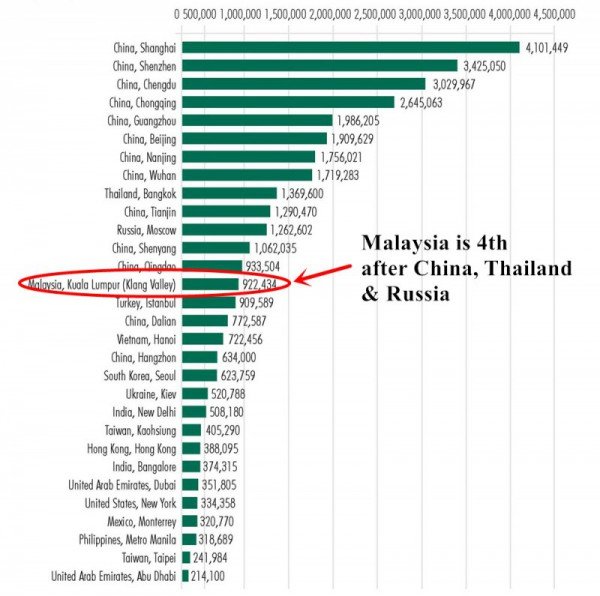

A ranking of global shopping center space under construction shows that Asian cities dominate most of the top spots, with cities in China accounting for 9 of the top 10 active spots, while Bangkok, Moscow, Kuala Lumpur, and Istanbul make the top 15.

However, despite the growth, many Chinese cities in recent years are facing difficulty in attracting occupiers, resulting in empty retail space. This can be attributed to the significant amount of development coming on stream, decelerating economic growth, and e-commerce. Effective implementation of project design, market positioning, and leasing strategy are important factors to solve occupancy woes, especially in decentralized areas of Chinese cities.

In contrast, in other Asian cities of Japan and Taiwan, there is huge demand for locations that can accommodate flagship stores. Tokyo and Taipei are the most sought after markets in Asia this year, driven by growing numbers of mainland Chinese visitors.

“The factors driving the development pipeline of new space remain largely unchanged compared to last year. This includes a growing middle class population in emerging markets, the urbanization of large cities and a lack of high quality retail space required by cross-border retailers. Hence, new construction is dominated by Asia and in particular China”, said Joel Stephen, Senior Director at CBRE Asia.

If this growth in global shopping center development continues in Asia, what does it portend for the future of shopping malls in Malaysia? With 3 of the world 10 largest shopping malls located within the Klang Valley, and Kuala Lumpur listed as one of CNN‘s best shopping cities, I am afraid that even the increasing cost of living and tax rates will not deter developers and shoppers from encouraging the birth of new malls in an already over-crowded city.

(CBRE Group, Inc. is the world’s largest commercial real estate services and investment firm. This year marks the 4th year that CBRE has carried out research to measure the level of shopping center development in major cities around the world. The survey was based on 171 cities and focused on shopping centers over 20,000 sq m, excluding retail warehouses and factory outlet centers.)