So, you’ve bought a property for investment, and thinking of renting it out so you can get some extra cash. Well, in order to (successfully) do that, you’ll need to understand terms like rental yield and return on investment (ROI). What do these terms mean?

Rental Yield

Rental yield essentially means your earnings from renting out a property. However, when it comes to balancing your checkbooks (this is just a figure of speech, nobody really does that anymore, do they?), first of all, it is important to realize that there are 2 types of rental yield: gross rental yield and net rental yield.

1. Gross Rental Yield

The gross rental yield is simply calculated by dividing the property’s annual income by its purchase price, then multiplying by 100 to obtain a percentage.

For example:

Gross rental yield

= (Annual rental income / Property value) x 100

= (RM 30,000 / RM 455,000) x 100

= 6.59%

However, this does not reflect the real, or accurate, amount you earn from renting out your property. You will have to also consider the costs of furnishings, legal fees, maintenance, repairs, renovations, management, current market value, mortgage, insurance, vacancy, and even depreciation, among others. This will significantly raise your overall costs and subsequently lower your earnings or yield.

2. Net Rental Yield

This is where the reality of net rental yield comes in.

For example:

Net rental yield

= [(Annual rental income – Annual expenses) / Total property cost] x 100

= [(RM 30,000 – RM 5,000) / RM 500,000] x 100

= (RM 25,000 / RM 500,000) x 100

= 5%

Your net rental yield will almost always be lower in percentage than your gross rental yield, as it takes into account the various expenses that are incurred from your property. A property can have high gross rental yield, but after deducting all the necessary costs, the net rental yield may be significantly lower.

Nevertheless, if you can get about 5-6% net rental yield in places like Kuala Lumpur, it is considered a very good rate. And as long as your net rental yield does not go into negative territory (preferably upwards of 2%), it can be considered a fairly good investment.

Return On Investment (ROI)

Now, for the oft-cited ROI. Simply put, return on investment (ROI) is used to measure the profitability of an investment. To calculate ROI, the benefit (return) of an investment is divided by the cost of the investment, or dividing net profit by net worth. The result is usually expressed as a percentage.

For example, the cost of your house is RM500,000 (including fees, furnishings, renovations, etc) and you sell it for RM750,000 (after deducting legal costs, etc).

ROI

= [(Gain from investment – Cost of investment) / Cost of investment] x 100

= [(RM 750,000 – RM 500,000) / RM 500,000] x 100

= (RM 250,000 / RM 500,000) x100

= 50%

Of course, that is just a simple example; investments in reality are seldom (if ever) so easily calculated. The main thing to know is this: if your investment has a positive ROI, it’s good; if it has a negative ROI, then you might want to get out of there ASAP!

However, keep in mind that ROI calculations can be easily manipulated to suit the users purposes by using different inputs, so it is important to know which and what numbers are used to produce the ROI given before deciding whether an investment is good or bad.

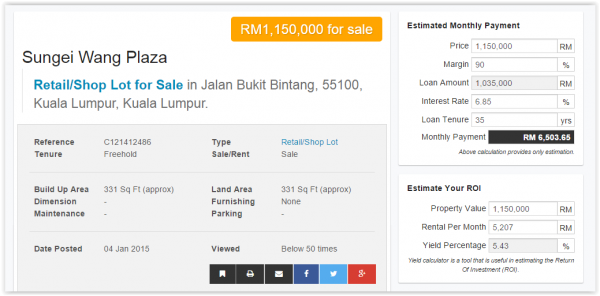

Oh, did you know that the listings on Estate123.com have a built-in calculator that shows you the estimated ROI along with the estimated monthly payment? It’s a really handy function that gives you an approximate calculation automatically when browsing any of our listings!

So, there you have it – a quick guide on what is rental yield and return on investment (ROI).

![[Infographic] Life Cycle of a Housing Bubble](https://insight.estate123.com/wp-content/uploads/2015/07/housing-bubble-thumbnail-e1437380723700-280x264.jpg)