Houses in KL and Penang too expensive

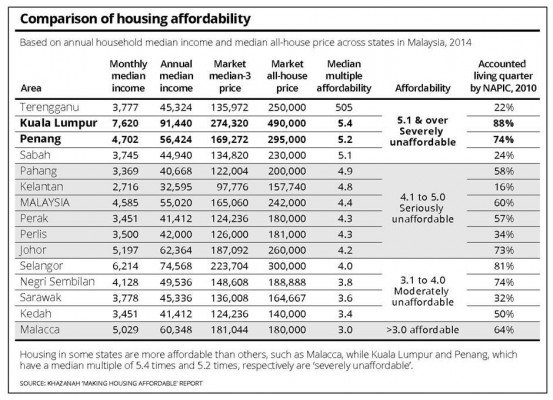

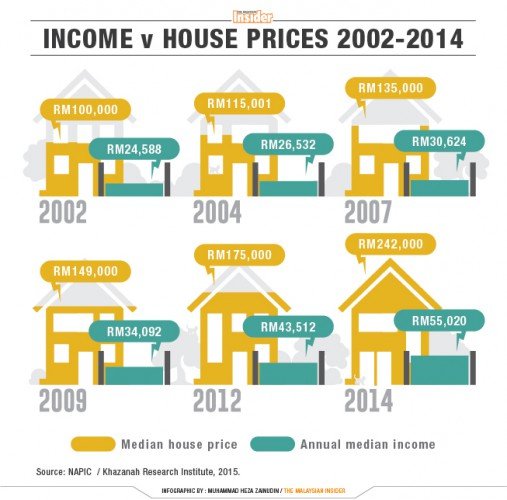

In its latest research report, Khazanah Research Institute (KRI) noted that housing in Kuala Lumpur and Penang are “severely inaffordable”. While housing in other states are more affordable with a well-functioning median multiple of three times, areas in KL and Penang had a median multiple of 5.4 times and 5.2 times respectively, with affordability depending on location. The report also showed that new “cheap” launches dropped to 19.7% in 2014 compared to 36.4% in 2004. The home ownership rate of 72.5% was also deemed misleading as it included informal housing or TOL (temporary occupation licence). (The Star Online)

Middle class may need housing subsidies if property sector not reformed

Middle-class Malaysians may require government subsidies for housing if current property prices continue to rise, said Khazanah Research Institute (KRI) in its most recent report, calling for reforms in the property sector. It was noted that the median price range for housing was skewed towards those in the higher-income bracket, which make up a small portion of Malaysia’s population. In Kuala Lumpur especially, no new projects below RM500,000 were launched last year, despite the maximum house price median of RM274,000 per unit based on the median income of the city’s residents. If this continued, social housing benefits would need to be applied to households in the middle-class who earn up to RM10,000 a month, which means subsidies would be needed not only for the bottom 40% (B40) but also the middle 40%. (The Malaysian Insider)

Mara chairman orders investigation into Australian property scam

Majlis Amanah Rakyat (Mara) chairman Tan Sri Annuar Musa has ordered investigations by auditors into the agency’s Australian property purchases, which was reported in June by Australian daily The Age. Due to complications related to housing, the appointment of audit firm Pricewaterhouse Coopers (PWC) was only settled last week instead of last month. Annuar had given a directive last week that everything must be expedited and advised against delaying when it came to “bureaucracy of appointments”. (The Rakyat Post)

Pelaburan Hartanah buys RM106mil Kuala Terengganu land

Real estate investment firm Pelaburan Hartanah Bhd (PHB) is embarking on its maiden venture into the Terengganu real estate market with its acquisition of a 10.8-acre commercial land in Kuala Terengganu for RM106 million. The land will be used for a mixed development project consisting a hotel, shopping mall and office space, with estimated gross development value of RM700 million. It is currently in the midst of finalising the development plan and expected to launch early next year. (Malaysia Chronicle)

Eco World ‘adopts’ public park with RM1mil upgrade

Eco World Development Group Berhad (EcoWorld) has launched its fully landscaped public park, known as Laman @ Eco Sky, along Jalan Ipoh as part of a park adoption programme with Kuala Lumpur’s City Hall (DBKL). The green space beside upcoming Eco Sky development cost about RM1 million and approximately 4.5 months to upgrade. The group also pledged RM3mil for facilities in the area, which include building a new covered walkway connecting Eco Sky to the Taman Wahyu KTM station. (The Star Online)

E&O 1Q net profit rises on sale of landbank

Eastern and Oriental Bhd (E&O) reported a net profit increase of 22.68% on-year to Rm23.26 million for the first quarter (1QFY15) on the sale of a landbank along Jalan Sungai Besi in Kuala Lumpur. However, its revenue for 1Q declined 46.9% compared to the same quarter last year. The results were due to lower revenue recognized and higher finance costs, partly mitigated by higher share contributions and joint ventures. (The Edge Markets)

MRCB Q2 pre-tax profit falls 33%

Malaysian Resources Corp Bhd’s (MRCB) pre-tax profit fell to RM91.95 million from RM138.76 million for the second quarter compared to the same quarter a year ago. However, its revenue increased to RM530.28 million from RM325.69 million. The company attributed its strong revenue growth to the completion of the Q Sentral development, sale of Platinum Sentral and other on-going projects including the Sentral Residences and 9 Seputeh. (The Malaysian Insider)

SJ Bus gets exclusive Rawang bus routes

Beginning Sept 1, Setara Jaya Sdn Bhd (SJ Bus) will officially take over the operating of the Rawang, Selayang and Bukit Beruntung bus routes, and Metrobus will no longer be serving the route. The decision was made by the Land Public Transport Commission (SPAD) which has notified both SJ Bus and Metrobus. SJ Bus set up office at the Rawang bus terminal over a year ago, and has a fleet of 85 buses with an additional 20 to be received in September. (Paul Tan Automotive News)