News sourced from Bloomberg

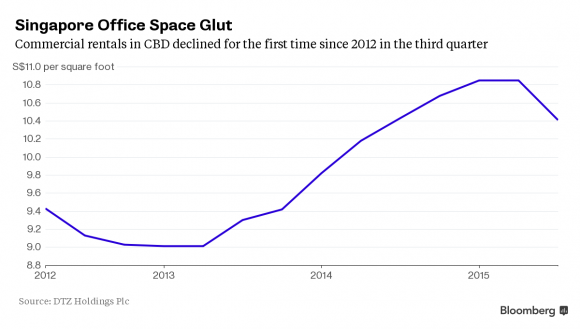

The tables have turned in favour of Singapore’s downtown office renters, as leasing rates in the city-state’s central business district (CBD) declined for the first time since 2012 in the third quarter this year.

Tenants will be gaining the upper hand at rental negotiations for commercial office space in Singapore’s CBD as leasing rates posted their first quarterly drop since 2012, according to DTZ Holdings Plc. The decline is set to accelerate further with a slowdown in both demand and the city-state’s economy. Average monthly gross rents in the CBD area saw a 4.1% decrease quarter-on-quarter to S$10.40 per square feet. It is estimated that rents may fall as much as 7% this year and a further 8% in 2016, said Nai Jia Lee, regional head of research for Southeast Asia at DTZ. Office occupancy also fell almost 1 percentage point to 95% in the quarter.

Rents and occupancy rates for offices in the prime district may be adversely affected in the next few years, following global economic uncertainties and large upcoming supply. “It’s more of a tenant’s market as they have a lot more options now,” said Lee, “The impending supply and lack of a demand pick-up are both going to increase pressure on rents next year. Rents will continue to weaken unless the global economy picks up.”

Indeed, more supply is on its way, with 2.6 million square feet of office space set to be added next year in the prime district, the bulk of 1.9 million square feet located at the Marina One project. However, the competition isn’t limited to the CBD; the completion of Duo Tower and Guoco Tower in 2016 will provide an additional 1.5 million square feet at the fringes of the prime districts.

Marina Bay

Average monthly gross rents in Marina Bay – the newer (and definitely swankier) part of the financial district – fell 5.5% to S$13.00 per square foot, while rents in the older but established Raffles Place area decreased 3.4% to S$10.45 per square foot, DTZ data showed. Weaker global growth and the economic slowdown in China have contributed to the gloomy outlooks for Singapore, hurting leasing demand.

On the flip side, the decline in rental prices for both the office and housing market may restore the attraction Singapore has as the ideal place to live and work, according to Savills Plc. The city-state’s living and working costs posted the biggest decline across 12 global cities, in a study by the property brokerage. Tokyo and Dubai also posted declines in their live/work costs. Cheaper rents will help correct affordability and may be seen as a competitive advantage on the global stage.

This puts the bargaining chip in office tenants’ hands. “Lots of companies are shelving their expansion plans so landlords have become more flexible on the lease terms too,” Lee said. “Older buildings will face a greater challenge in retaining their tenants.”