Oil services companies in Singapore relocating to Malaysia

Multinational oil services companies in Singapore, including McDermott, Technip, and Subsea 7, have relocated to Kuala Lumpur over recent months in order to cut costs, a further sign of the impact of crude price slump. Not only is the cost of real estate lower in Malaysia than Singapore, which helps to reduce expenditure on commercial property and staff housing, it is also significantly cheaper to buy or lease company cars in Malaysia. The engineering companies also cite the advantage of being closer to customers in Malaysia’s offshore oil and gas sector. In addition, the plunge in the ringgit’s value last year had made the relocation to Malaysia more attractive, highlighting the difference in costs with operating in Singapore. (Financial Times)

Artist’s impression of the mall planned for BBCC (Image from The Star)

Mitsui LaLaPort mall planned for BBCC

Japan’s Mitsui Fudosan is planning to develop a nine-storey, 45 billion yen ($397 million) mall in Malaysia with its local partners as part of an effort to solidify its overseas earnings base for the future. It plans to open a LaLaport mall, similar to the one in Chiba Prefecture, in Kuala Lumpur by 2021. The development will mark the biggest project by a Japanese real estate developer for a commercial facility abroad. Mitsui Fudosan will set up a special purpose company with Eco World Development Group and two other local partners to build the mall, which will sit on the 78,500-sq.-meter premises of the Bukit Bintang City Centre, a project co-led by Eco World that includes residential and office space. Construction of the mall is expected to begin in 2017, and will comprise 5 floors above ground and 4 underground with a total of about 300 businesses. (Nikkei Asian Review)

Prime land near KL Tower up for sale

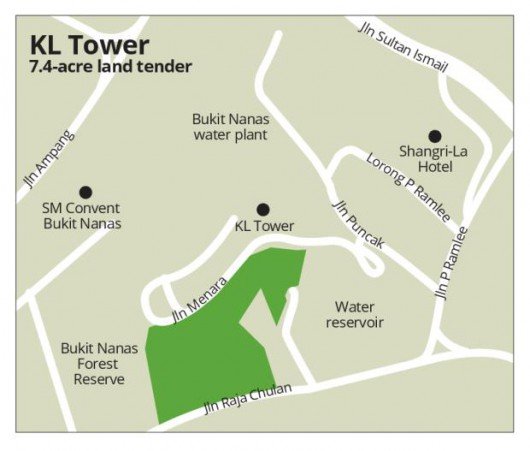

A 7.4-acre plot of freehold commercial land in the highly-coveted golden triangle of Kuala Lumpur city has finally been put up for sale by tender, after a series of legal battles spanning 27 years and several countries. The land belongs to businessman Cheah Theam Swee, whose major asset was Malaysia-based United Securities Sdn Bhd, which owns the 7.4 acres through subsidiary City Centre Sdn Bhd, which is in liquidation. The sale of the land, which has a plot ratio of 1:7, will be carried out via tender exercise. It is located next to KL Tower, between Jalan Menara and Jalan Raja Chulan, with the shopping belt of Bukit Bintang and the Raja Chulan monorail station within walking distance. Henry Butcher chief operating officer Tang Chee Meng said this was probably one of the last few pieces of privately-owned prime commercial land of this size available in the city centre, as usually only around one acre would be available. Land of this size would be suitable for a mixed commercial development. No reserve price has been set but it is estimated to cost between RM2,000 to RM3,000 per sq ft. (The Star Online)

Location map of the plot for sale (Image from The Star)

More funds from federal government to build and repair houses in 2016

The federal government has allocated RM275 million this year to build and repair 11,223 houses for the poor and those affected by disasters. Deputy Rural and Regional Development Minister Datuk Ahmad Jazlan Yaakub said, of the total, 3,055 units were new while the rest would be repaired. “In Kelantan alone, the federal government has allocated RM11.5 million to build 173 houses and to repair 418 units with the cooperation of the Urban Well-being, Housing and Local Government Ministry under the National Blue Ocean Strategy (NBOS),” he said. (The Malay Mail Online)

Prasarana plans to increase non-rail revenue

Prasarana Malaysia Bhd, the country’s largest asset owner and operator of public transport services, is planning to have its property and non-fare businesses contribute 50% of the group’s revenue by 2020. It currently obtains 85% of revenue from rail and bus ticketing. President and group CEO Datuk Azmi Abdul Aziz said the non-fare contribution would be led by transit-oriented developments (TODs) in the Klang Valley. It plans to develop TODs at certain stations along the Ampang and Kelana Jaya LRT lines, with 10 sites currently under development. (New Straits Times Online)

Turiya, Chase Perdana sue John Hopkins over terminated medical university deal

Turiya Bhd and Chase Perdana Sdn Bhd are suing US-based Johns Hopkins University and its medical education unit Johns Hopkins Medicine International LLC over the 2014 termination of a project to set up a medical university and medical degree programme in Malaysia. Turiya, an industrial machinery manufacturer and property investment firm, and Chase Perdana are claiming for general damages, aggravated damages, interests, costs, and any other relief deemed appropriate by the court. In November 2010, Academic Medical Centre Sdn Bhd (AMC) – which is majority owned by Chase Perdana and the rest by Turiya – signed a collaboration agreement with John Hopkins University to develop a four-year graduate medical school and teaching hospital. However, the partnership turned sour in 2014 after a dispute over payment. (The Star Online)

Palm oil output to drop by 2mil tonnes due to El Nino

Malaysia, the world’s second-largest palm oil producer, has estimated the output of palm oil to fall by 2 million tonnes from the previous year due to the effects of El Nino. The decline in production, its sharpest in at least seven years, could bring stronger rallies to benchmark palm oil prices , which have risen 5 percent in the last two weeks to a two-year high of RM2,726 ($676) a tonne on Friday. The scorching heat across Southeast Asia brought by El Nino phenomenon has effected oil palm’s fresh fruit yields and lowering output in Malaysia and Indonesia, which produce about 90 percent of global palm oil. (The Star Online)