Just how pricey are houses in Malaysia?

It is well-known that housing in Malaysia is not cheap, particularly in major towns and cities like Kuala Lumpur and Penang. Property prices increase every year, to the point that many Gen Y and millennials do not have the means to purchase their own house and are forced to rent or continue living in the family home.

Many property investors are leading comfortable lives just by buying early and sitting it out for a number of years for the property to appreciate – while collecting rent in the meantime – before selling it off. As long as you are able to wait at least 5 years, the real property gains tax (RPGT) will work in your favour. However, those are considered the lucky ones now, because it looks like Malaysia’s property price hikes have overtaken even the United States (US) and United Kingdom (UK).

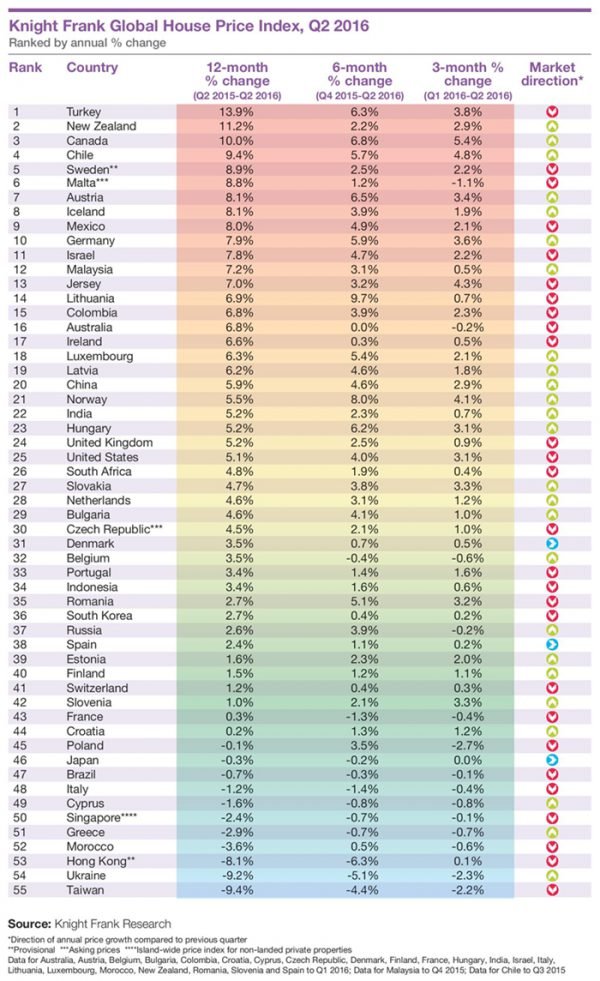

According to Knight Frank’s Global House Price Index Q2 2016, the increase of house prices in Malaysia in the second quarter this year was among the highest in the world, topping the US, UK, Hong Kong or Singapore. Malaysia ranked 12th with an increase of 7.2%, while the UK (24th) and US (25th) saw prices rising by 5.2% and 5.1% respectively. Turkey topped the list at 13.9%, although its house price growth had slipped from 19% last year. Despite being known for having some of the world’s most expensive housing, Singapore and Hong Kong ranked in the bottom six of the index, with house prices dropping 2.4% and 8.1% respectively.

Knight Frank’s Global House Price Index Q2 2016

(The Knight Frank Global House Price Index Q2 2016 full report can be viewed here.)

Last year, a housing affordability report by Khazanah found that housing in Malaysia was generally ‘seriously unaffordable’, while houses in several states – namely Terengganu, Kuala Lumpur and Penang – were ‘severely unaffordable’. Housing in Malaysia is deemed too expensive for regular households to afford, with residential properties about 5 times the median income of the local population. The ideal range for an affordable property market is less than 3 times the median household income.

Fortunately, starting from last year, many property developers have realised that there is big demand for affordable housing, and turned their focus to launching affordable housing projects, or incorporating affordable residential properties into their existing developments.

One of the hot topics recently is the proposal to allow property developers to provide house buyers with housing loans if they are unable to successfully obtain the loan from a bank. There have been mixed reactions to it. Those who support the suggestion, especially property developers, say that it will help boost the ailing property market, and more people will be able to realize their dream of owning a house.

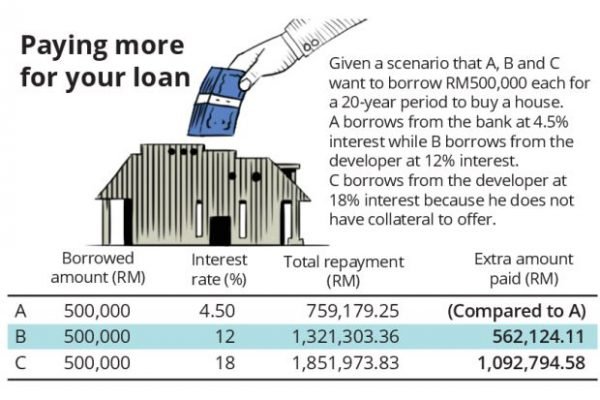

However, there are also many who do not support the proposal, as they feel that it will result in the developers becoming a sort of ‘ah long’ (loan shark). The effective interest rate for a conventional housing loan, from banks and financial institution, ranges between 4.6% and 5% depending on various factors such as the amount borrowed, risk profile of the borrower, duration of the housing loan and the type of property. Urban Well-being, Housing and Local Government Minister Tan Sri Noh Omar was quoted to have said that the “interest rate for loan taken under the scheme varies from maximum 12% with collateral and up to 18% without collateral.” This interest is more than double what is typically offered by banks and will greatly burden the borrowers of such a “scheme”, making it no different from borrowing from moneylenders.

(Image from The Star Online)

So, is the issue of unaffordability due to low income, inflated property prices or a mix of both? Let’s see what the experts have to say about this topic in the next few months before 2016 ends.