Source: The Straits Times

Mega office deals have driven foreign investment in Singapore’s real estate market to its highest level since 2007. About $8.85 billion from overseas has been pumped into Singapore property so far this year – the best result since the $15.27 billion outlay in 2007, before the global financial crisis.

Analysts say the pace of foreign investment could well carry over into next year, depending on how the economy fares. The influx of foreign funds is due partly to the view of Singapore as a safer investment destination during a time of turbulence and uncertainties in the global market. “It could be due to global market volatility as a result of Brexit and the oil and gas sector. Foreign investors see Singapore as a defensive play where investment is fairly protected due to the strength of the Sing dollar,” said Ms Christine Li, research director at Cushman & Wakefield.

Data from property consultancy CBRE, which records investment deals over $10 million in value, shows foreign expenditure at $8.85 billion, accounting for 41.7% of total property spending so far this year, compared to $5.46 billion last year. It was also markedly higher than the foreign investment volume of $4.67 billion in 2014.

The office sector drew the most interest, with 76.5% or about $6.77 billion of the foreign capital spent so far in 2016. “Over the next three, four years, there’s… very little new office space being completed… The more forward-looking investors are looking at that period of little supply, which will then result in rental growth,” said Mr Jeremy Lake, executive director for investment properties at CBRE Singapore.

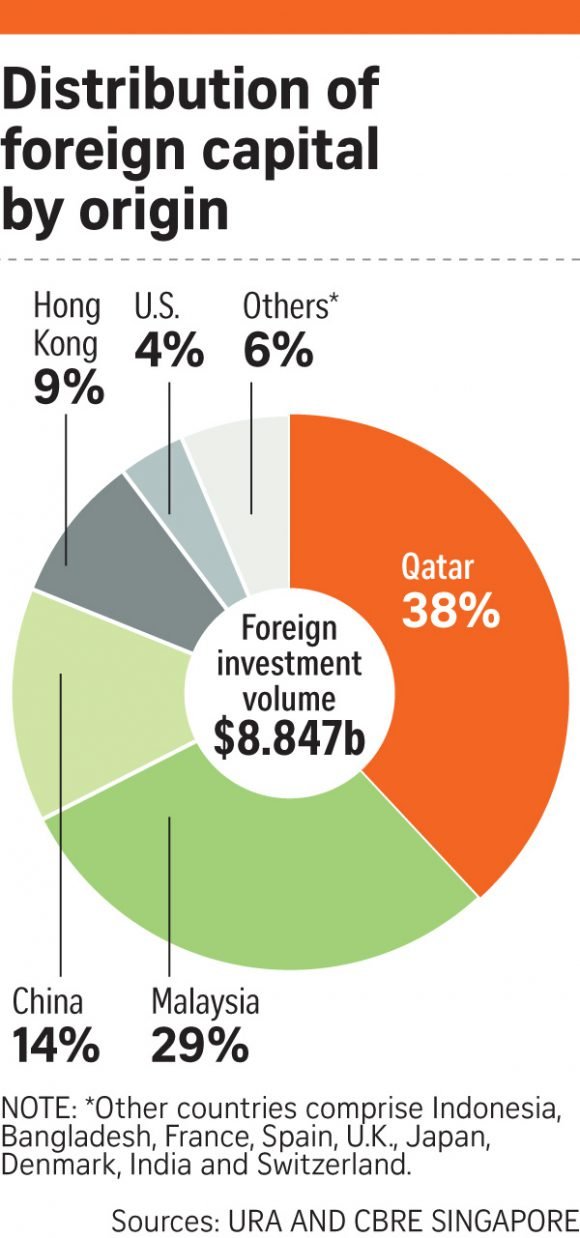

Real estate consultancy Edmund Tie & Company said investors typically look towards 2020, when the market is projected to pick up. A huge chunk of foreign investment went into the Asia Square Tower One deal in June, when the Qatar Investment Authority stumped up nearly $3.4 billion for the trophy asset in Marina Bay.

Just last month, Malaysian developer IOI Properties Group’s unit, Wealthy Link, smashed public land sales tender records with its $2.57 billion bid for a white site in Central Boulevard, also in Marina Bay. Foreign investors have also been active in the residential sector, notably Chinese developer Qingjian Realty’s $638 million purchase of Shunfu Ville via a collective sale in May. It also won the tender for a mixed development site in Bukit Batok West for $301 million in the same month.

Graphic from The Straits Times

Those deals have made Qatar, Malaysia and China the top three sources of foreign investment in Singapore’s real estate so far this year. JLL noted that slower economic growth and efforts to cool the property market have weighed on the real estate sector in recent years. “During this period, other major markets across Asia have experienced a strong market upturn, making Singapore an increasingly attractive investment proposition on a relative basis,” said Mr Greg Hyland, head of capital markets, Singapore at JLL. He added that foreign investment volume in 2017 could keep pace with this year’s activity, but “the recent run-up in long-term interest rates will see investors cautiously pricing opportunities”.

The market next year could get a boost from Jurong Point mall which is on the market, and Asia Square Tower Two – for which its owner BlackRock is said to be sussing out interest from potential buyers.

Visit Estate123 Insight for more property news updates, or head over to Estate123 Singapore to list or search your Singapore properties!