Bank Negara takes steps to increase demand for ringgit

Bank Negara announced several measures to increase the demand for the ringgit and reduce its volatility against the US dollar. Among the measures are that exporters are to convert 75% of their proceeds into ringgit effective Monday. As an incentive, companies could place their proceeds from exports in local banks and earn a special deposit rate of 3.25% per annum. The amount held by exporters in foreign currencies is estimated to be close to RM90bil. Other measures to increase the demand for the ringgit include placing a cap on the amount that companies and individuals can invest locally or abroad in foreign currencies. Effective today, local companies and individuals with borrowings can only invest up to RM50mil and RM1mil respectively in foreign currency denominated assets in the domestic market. (The Star Online)

Mass-market projects the way to go in 2017

The slowdown in the property market has seen many developers force-tweaking their business strategies – from reviewing product portfolio, delaying or downsizing launches, to revising annual targets. According to CIMB Research, developers focusing on mass-market projects will be better prepared to withstand the slowdown going into 2017. “Those that have lined up major launches of mass-market housing projects for next year, in our view, offer the highest chance of sustaining, if not beating, their 2016 sales in 2017.” Most developers within its coverage – Mah Sing, Sime Darby, IJM, Sunway, MRCB, and IOI Properties – are expected to deliver strong quarter-on-quarter sales growth in the third quarter of 2016, driven by new launches for the mass-market buyers. (The Star Online)

Sunsuria to launch projects worth RM1.55bil

Property developer Sunsuria Bhd is expected to launch development projects with a total GDV of RM1.55bil for the financial year ending Sept 30, 2017 (FY17). The company is aiming for greater growth backed by several launches and developments in the next few years. It is expecting positive change not only from the current projects, but also the project expansion in its first township – Sunsuria City by 2017. These include the first residential development of Sunsuria City, The Olive condominium, Bell Suites serviced apartments that face the main entrance of Xiamen University Malaysia and an upcoming landed residential development known as Monet Residences. Apart from the township projects, Sunsuria will also focus on its second phase expansion of the mixed commercial development dubbed as The Forum, in Setia Alam. (The Star Online)

Ampang residents want condominium project stopped

Residents in Taman Bukit Permai, Ampang, are calling for the 42-storey condominium project in their hilly neighbourhood to be scrapped. A memorandum with over 400 signatures was submitted to Ampang Jaya Municipal Council (MPAJ) president Abdul Hamid Hussain on Nov 30, urging the council to rescind the development order issued for the project. Residents had complained about the single access road going in and out of the densely-populated housing area, which would be further congested by increased volume of vehicles. Others issues brought up were low water pressure resulting in water disruption, which would be further exacerbated by the high-density project, as well as frequent landslides. (The Star Online)

McDonald’s sells Singapore, Malaysia franchise to Saudi group

McDonald’s Corp has sold its Malaysia and Singapore franchise to a Saudi Arabian group. Effective Dec 1, 2016, Lionhorn Pte Ltd is the developmental licensee (DL) for McDonald’s business in Malaysia and Singapore, which includes 390 restaurants, more than 80% of which are company-owned. “This transaction marks another milestone in our company’s ongoing efforts to identify strategic partners who share our values and vision to accelerate our growth and scale across diverse markets, drive innovation and place us closer to our customers and the communities we serve,” McDonald’s president and CEO Steve Easterbrook said in a statement last Friday. (The Sun Daily)

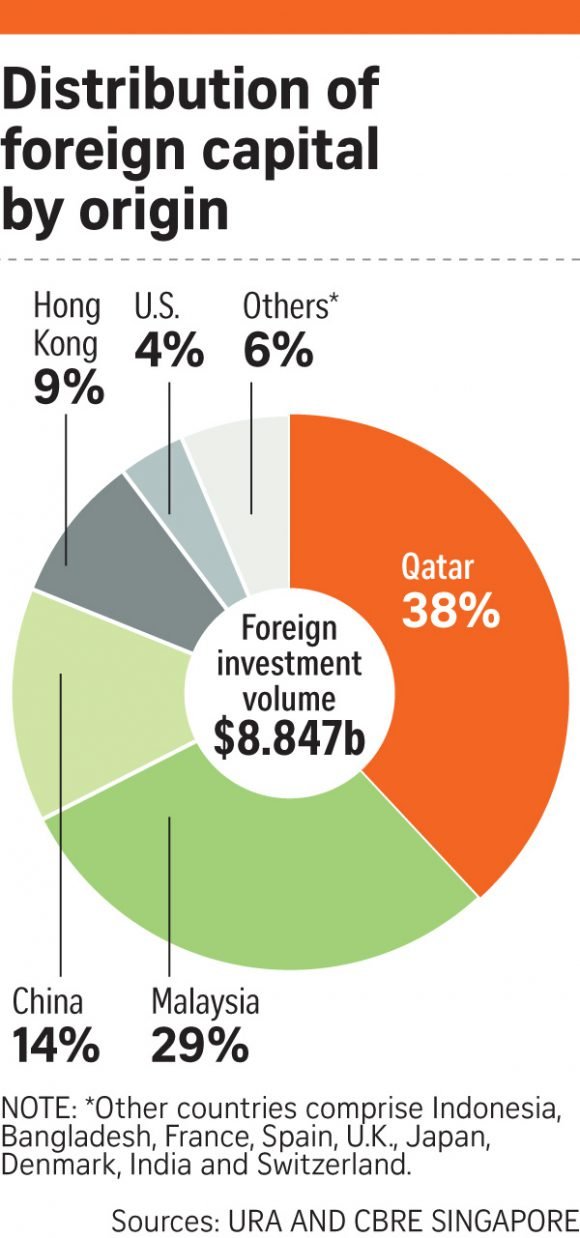

Foreign investments in Singapore property at 9-year high

Mega office deals helped drive foreign investment in local real estate to its highest level since 2007. About $8.85 billion from overseas has been pumped into Singapore property so far this year – the best result since the $15.27 billion outlay in 2007, before the global financial crisis hit. Analysts say the pace of foreign investment could well carry over into next year, depending on how the economy fares. The influx of foreign funds is due partly to the view of Singapore as a safer investment destination in a world roiled by uncertainties. (The Straits Times)

Graphic from The Straits Times