(Source: The Edge Markets)

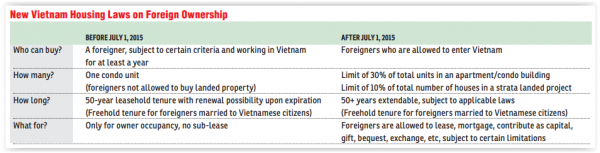

It’s not all baguettes (also known as bánh mì), rice paper rolls and beef noodles in Vietnam. In recent times, the Southeast Asian country’s property market has been heating up since the government relaxed its foreign ownership rules in July 2015.

Interest and appetite for Vietnamese properties have skyrocketed among investors, especially those from Singapore. Keppel Land sold more than 50 units of its The Estrella project in Ho Chi Minh City (HCMC) over a single weekend in October 2015. CapitaLand likewise sold over 100 units of its projects in HCMC during a showcase in Singapore over the following weekend. Singaporean serial entrepreneur and property investor Adam Khoo reportedly scooped up 100 apartments at Diamond Lotus Lake View project in Tan Phu District, HCMC in December 2015.

With prices starting from VND678 million (S$41,656 or RM128,551) a unit, it’s easy to see why property investors are lured to invest in Vietnam. It’s not even enough to get a Certificate of Entitlement (CoE) on a new car, let alone an HDB flat in Singapore.

Attractive Yields

“For S$1 million, you can buy five to six high-end condos in Ho Chi Minh City, or up to 10 units in a mid-tier condo,” said Alvin Ong, a Singaporean businessman and property investor who relocated to Ho Chi Minh City with his family in 2012. He and his wife have amassed a portfolio of more than five properties in Vietnam, primarily in Hanoi and HCMC. Currently, gross yields are at about 6% to 7%, which is considered “very attractive” for investors from Singapore and Taiwan. These investors tend to focus on smaller units priced between US$150,000 and US$250,000, which can be easily leased out, and achieve higher yields.

Ho Chi Minh City, Vietnam

Large, Young Population

One of Vietnam’s biggest assets is its population of 95.2 million, of which more than half are aged between 15 and 39. They form the majority of the workforce. Vietnam is set to reap the benefits of this “demographic dividend” for the next 10 to 15 years. The rapidly growing middle class and the young population have also fuelled strong demand for affordable housing, with the “sweet spot” in the price range of US$40,000 to US$120,000. This has led to real estate companies shifting their focus to low- to mid-tier residential developments.

Tourism & Hospitality Boost

Increased affordability via budget airlines and tourism promotions have led Vietnam’s hospitality sector into a boom period, with strong demand for city-centre hotels as well as seaside resorts. According to the General Statistics Office, Vietnam recorded 10.1 million international visitor arrivals in 2016, up 26% from 2015. The city of Da Nang (the third largest city in Vietnam in terms of urban population) in particular, has seen strong growth in recent years as tourism boomed, supported by rapid growth in the number of direct flights from other cities across Asia.

A train heading up to Bà Nà Hill Station, a tourist destination and hill resort in Da Nang, Vietnam

Manufacturing-Led Economy

In Vietnam, the manufacturing sector is fueling household income and promises a sustained trade surplus in Vietnam. Economists have forecast economic growth of 6.4% for Vietnam for the whole of 2017, and the same level of growth in 2018. Besides reporting “the strongest quarter” since 2011 for 1Q2017 and “near-record increase in employment”, the country’s economy has been bolstered by its other regional alliances, including the Asean Economic Community; Free Trade Agreements with the EU, Russia, South Korea, Chile; and the upcoming Regional Comprehensive Economic Partnership.

Retail Growth

Another booming sector in Vietnam is retail. While supply of prime shopping centres and retail space remained flat, convenience stores operated by domestic and foreign retailers saw rapid expansion in HCMC and Hanoi. The retail market in Hanoi and HCMC is likely to see more local and foreign retailers expanding their footprint in good locations, according to the property consultancy.

High Office Occupancy Rates

There is also strong demand for quality office buildings in HCMC. The occupancy rate of Grade-A office space hit a record 95.6% in 1Q2017, while that for Grade-B office space stood at 91.8%, according to JLL. Office rents in HCMC are expected to continue their upward trend as supply will remain unchanged until 2H2017, and there will not be any new supply of Grade-A office space this year. “Demand for new and modern office space with a reasonable rent is expected to increase over the next quarters.”

Infrastructure Boom

Both Hanoi and HCMC have ambitious transport infrastructure programmes, according to Savills Vietnam Research. HCMC is expected to invest more than US$20 billion in infrastructure, including five planned elevated roads stretching 71km and five new metro lines of 106km. Similarly, Hanoi has eight metro lines of 260km and six elevated roads in the pipeline. The first metro line, scheduled to be fully operational by 2020, is expected to shift development focus. Properties near transit hubs can have significant capital appreciation, and building infrastructure has become vital to economic growth as more people are buying cars, due to decreased import duties and increased incomes.

Challenge in Acquiring Land

As there is a limited amount of government land for public auction, the big local Vietnamese developers are turning to farmers to purchase big land parcels to develop large townships. As the rules concerning buying government land are opaque, the biggest challenge for foreign developers is finding a greenfield site that is free and has a clean ownership title. Issues include having to buy a site from multiple shareholders, or dealing with clearance and compensation of existing households on the site, which can be time-consuming.

Foreign Ownership Concerns

The biggest concern among individual foreign buyers of apartments is the withdrawal of their funds when they sell their property in the future, and also whether the 50-year lease is renewable. Another major concern that surfaced recently is the issue of ownership certificates (or pink book) to foreigners. It was reported that the municipal land registration office in HCMC has stopped issuing ownership certificates to foreigners. The issue has not dented demand in Vietnam’s housing market, though. More new launches and higher sales volume are expected in 2Q2017.

Sign up with Estate123.com to list your properties for FREE today, and follow our Facebook page for more interesting property news and updates!

![Estate123 Exclusive: Interview with Bank Negara Malaysia on the Housing Watch [Part 2 of 2]](https://insight.estate123.com/wp-content/uploads/2018/01/housing-watch-estate123-interview-part-2-e1517217547902-440x264.png)