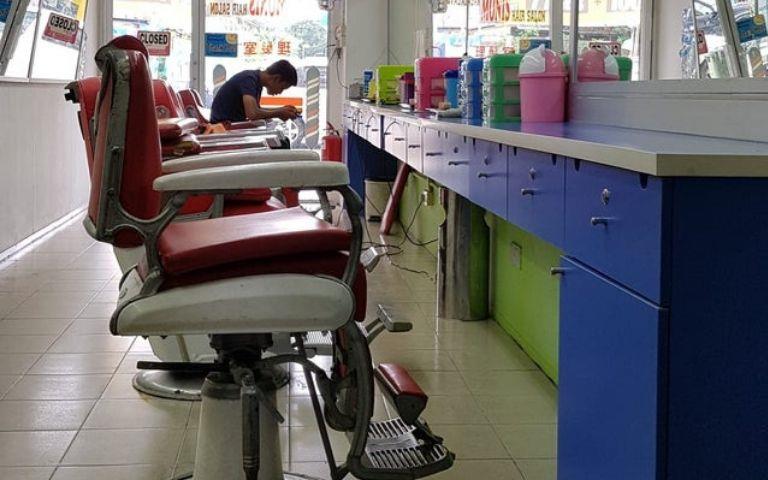

No go for hairdressers, opticians and Ramadan bazaars

The government will not go ahead with plans to allow barber shops, hair salons and opticians to operate during the rest of the movement control order (MCO) period. In addition, there will be no Ramadan bazaars this year. The aim, said Senior Minister Datuk Seri Ismail Sabri Yaakob, was to ensure the effectiveness of the measures for preventing the spread of Covid-19. The government also decided that students of local universities and colleges must remain where they are now, if they have not gone home. The government announced last week that it would allow certain businesses to re-open throughout the rest of the MCO, including traditional and complementary medicine, hardware and electrical shops, opticians, manned laundrettes, and hair salons and barbers in green zones. (The Star Online)

ADB triples Covid-19 response package to US$20bil

The Asian Development Bank (ADB) said on Monday (April 13) it tripled the size of its response to the COovid-19 pandemic to US$20bil and approved measures to streamline its operations for quicker and more flexible delivery of assistance. The Manila-based bank said the package expands ADB’s US$6.5bil initial response announced on March 18, adding US$13.5bil in resources to help ADB’s developing members counter the severe macroeconomic and health impacts caused by Covid-19. The new package includes about US$2.5bil in concessional and grant resources. This pandemic threatens to severely set back economic, social, and development gains in Asia and the Pacific, reverse progress on poverty reduction, and throw economies into recession, said ADB President Masatsugu Asakawa. (The Star Online)

Buying property after end of Covid-19, MCO good for owner-occupiers and long-term investors

Buying property post-Covid-19 and the movement control order (MCO) is a good idea, but only for owner-occupiers and long-term investors who can still afford to do so. Property developers are adding value to properties, asking prices are decreasing and the financing environment is conducive. In addition, interest rates will be forgiving thanks to Bank Negara Malaysia’s (BNM) Overnight Policy Rate (OPR) cuts, compared to 8-9% or double-digit rates in the past. The numerous financing catalysts which have been introduced recently, including BNM’s reduction of the statutory reserve requirement ratio to 2%, BNM’s moratorium on financing payments, and revised voluntary Employees Provident Fund contribution guidelines, are further impetuses to buy. However, right now it may be a good time for short- and medium-term investors to flip, as current conditions favour speculative investors since they have the option to secure good assets. (The Sun Daily)

Kiara park will remain as it is, says FT minister

Federal Territories Minister Annuar Musa today assured Taman Tun Dr Ismail residents the public park in their neighbourhood will not be sacrificed for development. He said that based on records, the Taman Awam Rimba Kiara cannot be touched as it is government land and the National Landscape Department is maintaining the park. “However, there was a dispute over the plot of land beside the public park… This issue is now before the courts and it is not appropriate to discuss the development until a decision has been made,” he said. TTDI residents are challenging the so-called Taman Rimba Kiara project, consisting of a 29-storey apartment block with 350 units of affordable housing, as well as eight blocks of serviced apartments and eight storeys of parking facilities. (Free Malaysia Today)

Glovemakers now more valuable than casino, airport operators

Top Glove Corp Bhd, the world’s largest glove manufacturer in terms of capacity, saw its market capitalisation (cap) hit a record high of RM17.09 billion yesterday, as its share price climbed 2.6%. In the span of about four and a half months, Top Glove’s market cap has ballooned by about 41.91% or RM5.06 billion, following unprecedented demand spikes in protective medical equipment like rubber gloves amid the relentless spread of the Covid-19 pandemic. Likewise, its rival Hartalega Holdings Bhd’s share price has also been on the climb. Notably, Top Glove’s market cap is now more than two times the market cap of Malaysia Airports Holdings Bhd (MAHB), and surpassed those of casino and plantation owner Genting Bhd and its listed entity Genting Malaysia Bhd. Top Glove’s market value has overtaken Southeast Asia’s largest aluminium smelter, Press Metal Aluminium Holdings Bhd, and topped the RM14.06 billion of KLCC Stapled Group. (The Edge)