Four Air Selangor Water Treatment Plants stop operation due to pollution

A total of 1,196,457 Air Selangor account holders in 1,292 areas in the Klang Valley are experiencing another unscheduled water supply disruption when operation of four Sungai Selangor Water Treatment Plants (LRA) has to be suspended due to pollution at the raw water source. The pollution was detected at 2 am today, following which operation of the Phase 1, Phase 2, Phase 3 and Rantau Panjang Sungai Selangor Water Treatment Plants was stopped. “The stop work of the four plants has caused unscheduled water supply disruption in Kuala Lumpur, Petaling, Klang/Shah Alam, Kuala Selangor, Hulu Selangor, Gombak and Kuala Langat,” said Air Selangor Corporate Communications head Elina Baseri. The public will be informed on unscheduled water supply disruption from time to time through all Air Selangor communication mediums and and at www.airselangor.com. (Bernama)

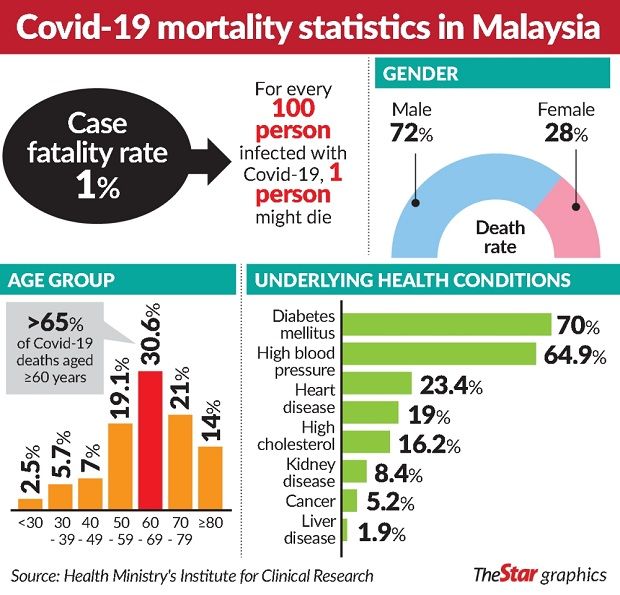

Malaysia’s fatality rate lower than global figures

The country’s Covid-19 fatality rates are much lower compared to other countries globally despite recording higher deaths lately, say health experts. As of Saturday, Malaysia’s case fatality rate (CFR) was 0.9%, said Universiti Malaya Department of Social and Preventive Medicine Faculty of Medicine Prof Dr Moy Foong Ming. “By comparing total Covid-19 deaths and CFR in selected countries and global trends, Malaysia’s statistics are on the low side, ” she said. CFR is the ratio between total confirmed deaths and total confirmed cases. According to the Our World in Data Covid-19 dataset in Asean region, Singapore recorded the lowest CFR with less than 0.1% while Thailand, the Philippines, Brunei, Vietnam and Indonesia recorded 1.6%, 1.9%, 2%, 2.4%, 3.1% and 3.5%, respectively. Outside Asean, the United States recorded a CFR of 2.7% while the United Kingdom (6.3%), South Korea (1.8%) and Japan (1.8%). (The Star Online)

CMCO may impact recovery of REITs

Consumer sentiment and domestic travel patterns are likely to turn more cautious after the re-implementation of conditional movement control order (CMCO) and this will have an impact on the recovery of retail and hotel REITs. CGS-CIMB predicted a cautious recovery outlook in the second half of 2020 for the retail malls and hotel players and had retained its “neutral” stance on the REIT sector. It also pointed out the downside risks of the extension of the CMCO beyond the current two-week period, saying there would be severe negative rental reversion for retail malls, and more subdued occupancy rates for hotels. The research house said it anticipated a stunted recovery in retail mall footfall and tenant sales, as the CMCO poured cold water on the encouraging recovery statistics since July. The outlook for the hotel sector is expected to turn negative in the second half, given the resurgence of Covid-19 cases. (The Star Online)

Malaysia property market will rebound in 2021

Malaysian real estate industry expects a strong market rebound in 2022 after prolonged sluggish growth in 2020 and 2021, according to Juwai IQI’s research. According to its “Property Survey and Index Q3 2020” report, the National Price Expectations Index remains its downwards trend with a 4.8% fall over the next 12 months, before climbing again to post a cumulative growth rate of 10.6% over the next two years. The states with the strongest forecast price growth over the next two years are Penang and Perak, with price growth of 15.9% and 14.3%, respectively. Kuala Lumpur and Selangor have the lowest forecast price growth over the next two years with a lower but still impressive rate of 8.5%. Meanwhile, the industry outlook is for rental rates to follow a similar trajectory as residential prices, by first falling substantially before recovering strongly. However, in the case of rental rates, the swings look less extreme. Generally, agents are more bullish about rents in Perak than in any other state. (The Edge)

NUBE warns of ‘poverty clusters’, calls for loan moratorium extension

The National Union of Bank Employees (NUBE) is demanding urgent reinstatement of the blanket loan moratorium by a further two to three months across the country at least for the bottom 40% (B40) and middle 40% (M40) income groups as well as small and medium enterprises (SMEs). Its general-secretary J Solomon said thousands of lowly-paid workers had either lost their jobs or are clinging to it, making them unable to service their loans at this time. He also said the targeted moratorium by banks is not enough to help many of those who are suffering. Solomon said that based on feedback from NUBE members, many are struggling to pay their loans despite retaining their jobs. He also urged for the moratorium to be extended until year end and subject to a review in 2021 if and when the economy picks up. He said that banks would not suffer losses if the moratorium is extended as repayments would merely be delayed. “The RM6 billion would not be a loss incurred by banks, but merely a delay in collecting the amount from customers until the economy is on a better footing and the blanket moratorium is no longer needed,” he added. (The Edge)