Ask anybody on the street “What is BR?” and you’ll probably get answers of “Brazil” or “Baskin Robbins” from more than a few people. Yes, they’re right, but today we’re not talking about football or ice-cream. The BR we’re discussing today is short for Base Rate. What is it? Come, let us take a short walk with you through it.

All About That Base

(I bet you have that song stuck in your head now.) Effective 2 January 2015, Base Rate (BR) has replaced the previous Base Lending Rate (BLR) framework. BR is a reference interest rate used by banks to decide how much to charge for various products (loans) they offer. In Malaysia, home loans are normally quoted as a percentage above or below the BR. This means that if the BR changes, the interest rates on floating rate loans changes as well.

Since the current Base Rate (BR) framework has been in place for several months now, we’ll skip over explaining the differences between the two (since BLR is no longer relevant) and go straight to BR.

Why did they change it to Base Rate (BR)?

The previous framework was deemed to lack transparency, and banks were frequently lending below the base rate to attract customers. Under the new framework, Bank Negara Malaysia will still have the flexibility to adjust interest rates without affecting the interest rates of borrowers, while banks will not be able to lend below the BR. Banks in Malaysia will have their own power to adjust their BR without intervention from Bank Negara., and determined by each bank’s cost of funding and Statutory Reserve Requiment (SRR). This means that a bank that is more efficient with more savings, fixed desposit will be able to offer much more attractive and competitive rates compared to other banks.

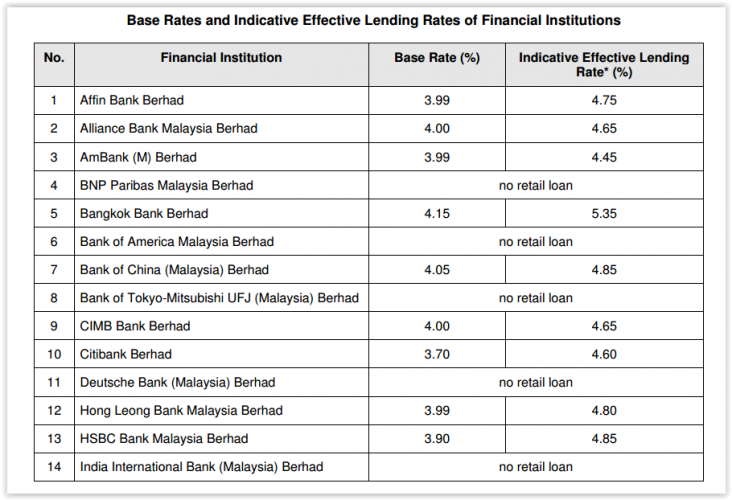

You can check out the 2015 BR and Effective Lending Rates for some banks in the screenshot below, or see the full list from Bank Negara here.

In Conclusion…

The base rate (BR) mainly depends on the individual bank’s effectiveness, and will fluctuate more than the previous BLR as it is referenced against the Kuala Lumpur Interbank Offered Rate (KLIBOR) and Statutory Reserve Requirement (SRR). It is thus likely to be revised every 3 months, although changes will be minimal. BR will apply to all loans with floating interest rates, which effectively excludes car loans and fixed interest rate personal loans. Even though the new BR framework is said to be more transparent, allows customers to make better financial loan decisions, and promote competitiveness among banks, the effective lending rate will not differ much from the old BLR framework. Customers with a higher risk profile such as those with bad credit, low income or poor employment histories will enable the bank to set the ELR higher and make more profit, but that’s about the extent of change from BLR to BR.

You can check out the various banks’ home loan interest rates and their respective base rates on iMoney to help you decide which loan to apply.

References

BR.my

Business Insider Malaysia

BaseRate.co

RinggitPlus

PTLM

![[Infographic] The Home Buying Process](https://insight.estate123.com/wp-content/uploads/2016/06/The-Home-Buying-Process-e1464936478596.jpg)