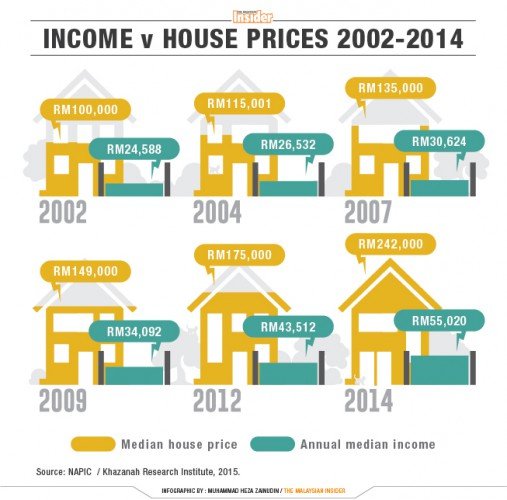

For those keeping an eye out for news regarding the Malaysian property market this week, the “Making Housing Affordable” report by Khazanah Research Institute (KRI) confirmed what most people were already saying – houses in Kuala Lumpur and Penang are far too expensive for regular households to afford.

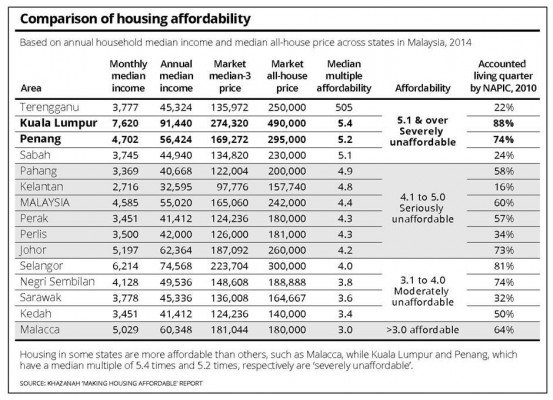

The ideal maximum median range for an affordable property market is one where the median house price or mortgage is less than 3 times the median household income. A median multiple affordability rate of 3.1 to 4.0 is deemed “moderately unaffordable”, 4.1 to 4.9 is “seriously unaffordable”, and anything from 5.1 is labeled as “severely unaffordable”.

States within the severely unaffordable bracket include Terengganu (5.5), Kuala Lumpur (5.4), Penang (5.2) and Sabah (5.1). Malacca was the only state that had an “affordable” rating of 3.0 within the whole of Malaysia.

There were no new properties launched in Kuala Lumpur in 2014 below RM500,000, with majority of newly launched properties in the capital being in the RM500,000 to RM1 million category. The median house price in Kuala Lumpur is now RM490,000 per unit, while in Selangor the median house price was RM300,000.

Although the statistics for major cities like Kuala Lumpur and Penang only served to confirm people’s fears, Terengganu being the most severely unaffordable state, at 5.5 times above the median income of the local population, came as a surprise for many.

The perception that increasing land prices were the cause of soaring housing prices were untrue, as according to the report, construction costs have been going down. The fact was that developers already know the price and value of the properties they are going to sell, therefore they are capable of bidding higher for land, and that is why land prices become high.

KRI called for institutional reforms in Malaysia’s approach to housing policies, saying that middle-class Malaysians may soon end up needing government subsidies for housing if current property prices continued to soar. This means not only the bottom 40% of households (B40), which was the focus on the 11th Malaysia Plan (11MP), but also the middle 40% of the Malaysian population would need help in buying homes. The institute suggested new production methods by developers, such as the use of prefabricated components, along with a moratorium on house prices under a new scheme, and a national repository to properly plan for areas in need of housing and amenities.

It can be noted that in 2015, more affordable housing have been launched such as the government’s 1Malaysia People’s Housing Programme (PR1MA) initiative, as well as developers who realise the market’s needs for more affordable housing options.

Sources

Free Malaysia Today (link)

The Malaysian Insider (link, link)