When it comes to purchasing residential property, do you come across the question of whether to buy new property, or search for secondary property in a specific location?

The property market can be divided into two categories: primary market and secondary market. The primary market consists of new properties, which include new launches and projects in construction by developers.

The secondary market is made up of secondary properties, which are previously owned houses in matured locations and established residential areas. To further elaborate, secondary properties are properties that have been completed after its launch, and being introduced into the market for tenancy or for sub-sale which will either be tenanted or owner-occupied by subsequent owners.

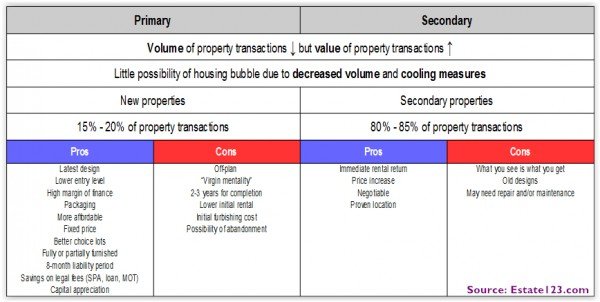

According to Malaysian Institute of Estate Agents (MIEA) vice president Lim Boon Ping, the volume of property transactions in Malaysia is decreasing by the year, but it has not affected the value of property transactions. In fact, the total value of property transactions in the country has increased steadily each year.

Worried about a housing bubble? There’s no need for concern, assures the MIEA, as the volume of property transactions is lower, and the government has implemented cooling measures on the property sector to avoid such a situation from happening.

It is normal for industry outsiders to think that the primary market, or new properties, contribute to the most number of sales in Malaysian real estate, due to the overwhelming advertising and marketing of new developments popping up almost every day. However, contrary to popular belief, the secondary property market takes up the bulk of the volume (approximately 80-85%) of residential property transactions in Malaysia, as opposed to the primary property market (about 10-15%). This is mainly because the secondary property market offers more choices in already established locations. It should also be noted that over half (50-60%) of secondary property transactions comprise high-rise residential units.

Many young aspiring home buyers are drawn into only checking out primary market (new) properties, thus the term “virgin mentality”, and are disappointed when most new projects are above what they can afford. They overlook the fact that there are many more affordable homes are available in the secondary market.

We’ve compiled a list to showcase the pros and cons of both primary and secondary properties to help you (re)consider and (re)evaluate your residential property purchases.

Primary Properties:

Pros

- Latest design

- Lower entry level

- High margin of finance

- Packaging

- Fixed price

- Better choice lots

- Fully or partially furnished

- 8-month liability period

- Savings on legal fees (SPA, loan, MOT, etc)

- Capital appreciation

Cons

- Off-plan

- “Virgin mentality”

- 2-3 years for completion

- Lower initial rent

- Initial furbishing cost

- Possibility of abandonment

Secondary Properties:

Pros

- Immediate rental return

- Price increase

- Negotiable

- Proven location

Cons

- What you see is what you get

- Old design

- May need repair and/or maintenance

*This is a series of short articles from our Maspex 2015 Penang experience. Although the exhibition focuses on secondary property and its corresponding market, most (if not all) of the information here is applicable to the Malaysian property market within the proper context. We hope you find these articles helpful and interesting, regardless of whether you are a real estate agent, property investor, or just a member of the public trying to learn more about property and real estate in Malaysia.