World Bank expects 4.7% growth for Malaysia this year, gradual rise in 2017

The World Bank expects Malaysia to record a 4.7% growth this year, close to 4.2% in 2016, and a gradual rise again in 2017, said Sudhir Shetty, its chief economist for the East Asia and Pacific region. Malaysia’s current policies provide a good base for navigating global uncertainties, but needs to further improve its public sector, accelerate human capital development and review economic growth. Structural reforms are needed to enhance medium-term prospects, with an ongoing adjustment process due to lower commodity prices. Shetty said to raise revenue in the short term, the government needed to reduce corporate tax, limit the exemptions for the goods and services tax and expand the base of the personal income tax. (The Malaysian Insider)

Malaysian property developer M101 to create ‘cloud-based integrated metropolitan hub’

Malaysian property developer M101 Holdings plans to create an integrated cloud-driven metropolitan hub for new development projects, following a partnership with four IT companies – Alcatel-Lucent, Nutanix, Select TV and Panduit. M101 plans to incorporate the cloud-based integrated solution to all its future property projects, starting with its M101 Dang Wangi and M101 Bukit Bintang properties, which have a combined GDV of RM600 million and expected to complete in 2017. Both projects will be identical in concept providing integrated commercial and retail development with SoFo (small office/flexible office) features. Future properties to be incorporated with the integrated metropolitan solution include M101 Sky Wheel, M101 Railway Station and M101 Kampung Attap. (MIS Asia)

Condo owners eager to dispose properties for cash as economy sours

A growing number of investors are eager to sell their properties for cash – even at below market prices – as many are losing confidence in the state of the Malaysian economy. While this is not a widespread trend, this pattern of selling at below market value has been going on for the past four months, a real estate agent observed. Several condominiums in the Klang Valley – some brand new, others in hotspots such as around KLCC – are being sold at prices lower than bank valuation, or even lower than the purchase price. According to the latest report by the Valuation and Property Services (JPPH), the residential overhang and unsold situation in Kuala Lumpur is not encouraging. Rentals are also taking a dip, as tenants lose their jobs in the high-paying oil and gas industry, while those coming in are bringing a much lower budget. (The Malay Mail Online)

UEM Sunrise sells Aussie property for RM371mil

UEM Sunrise Bhd’s unit, UEMS LaTrobe, is selling a block of serviced apartments in Melbourne for A$120mil (RM370.8mil) to Ascendas Hospitality Trust. The property developer will dispose a 252-unit serviced apartment which is part of the La Trobe Street mixed-use development known as Aurora Melbourne Central. The project is UEM Sunrise’s maiden project in Australia with a GDV of A$770mil. Construction of the project has started, with completion scheduled for 2019. (The Star Online)

Hua Yang plans RM311mil mixed project in Penang

Property developer Hua Yang Bhd is planning to develop six parcels of freehold land in Penang into a mixed-development project with GDV of RM311 million. It plans to acquire Penang-based property developer G Land Development Sdn Bhd for RM16.55 million, which would then be used to buy the six parcels of freehold land for RM25 million cash from GIM Standard Development Sdn Bhd. The land measuring 8.59 acres is located on the mainland, about 3km from the Penang Bridge, and has a net book value of RM7.98 million. (The Star Online)

MQREIT acquires Menara Shell from MRCB for RM640mil

Malaysian Resources Corp Bhd (MRCB) is disposing its 33-storey Menara Shell to MRCB-Quill Real Estate Investment Trust (MQREIT) to unlock RM640 million worth of investment value in the property. MRCB’s wholly-owned subsidiary has entered into an agreement with MQREIT for the disposal of the office tower located next to KL Sentral at Jalan Tun Sambanthan. The office tower commenced operations in May 2013, and has achieved almost 100% occupancy with tenants like Shell People Services Asia Sdn Bhd, AmGeneral Insurance Bhd, and Tradewinds Corp Bhd. (The Edge Markets)

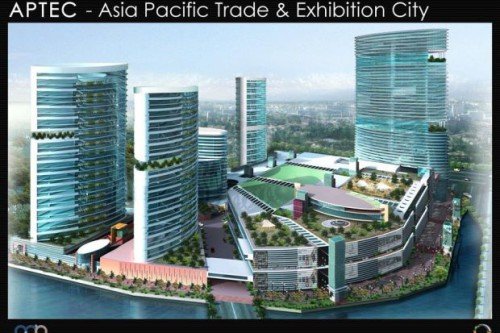

MPCorp’s ambitious Asia Pacific Trade and Expo City project scrapped

Malaysia Pacific Corp Bhd’s (MPCorp) has scrapped its plan to partner with China state-owned Black Sea Horizon Investment Holdings Ltd to build the ambitious Asia Pacific Trade and Expo City (Aptec) project in Iskandar Malaysia, Johor. The property investment and development company had signed and extended the memorandum of understanding (MoU) with Black Sea Horizon since 2013. However, the MoU was not extended and had therefore lapsed, and no reason was given. MPCorp and Black Horizon had intended to promote Malaysia as Asia “economic corridor” of trade and services link with China, Asean, India and the Middle East. Aptec was to be a consumer products trade hub, serving as a platform for the China-Malaysia strategic economic partnership. (The Star Online)

Singapore’s PropertyGuru unit buys out Indonesia’s RumahDijual.com

Indonesian property portal Rumah.com, a unit of Singapore’s PropertyGuru Group, has acquired Indonesian realty website RumahDijual.com for an undisclosed sum. The deal follows the group’s recent acquisition of project marketing solution, ePropertyTrack, in July. The deal will see Rumah.com and RumahDijual.com controlling 43% market share of the online property space in Indonesia, double that of its closest competitor. (Deal Street Asia)