EPF buys RM1.1bil UK assets

The Employees Provident Fund (EPF) has purchased a portfolio of industrial and logistics assets in the United Kingdom from IM Properties plc, one of the largest British privately owned property groups, for close to £200 million (RM1.1 billion). Among the assets include The Hub in Witton, along with a host of industrial and distribution sites from IM Properties. The Telegraph reported that the portfolio acquired by the EPF is the largest sold in the Midlands, which is an area spanning central England with Birmingham as its largest city. Last year, EPF sold its One Sheldon Square at Paddington Central, London to British Land Co plc for £210 million, which may be used to finance the acquisition. Besides the UK, the EPF also has real estate investments in Germany, France, Australia and Japan. (The Edge Markets)

MyDeposit scheme to provide up to RM30k for first time home buyers

The First Home Financing Scheme (MyDeposit) has been implemented to help the middle 40% income bracket (M40) with household incomes of between RM3,000 and RM10,000. The scheme involves a contribution of 10% of the sales price, or a maximum of RM30,000, to first-time house buyers to help them buy a house costing less than RM500,000. Applications can be made through the website of the National Housing Department, Ministry of Urban Wellbeing, Housing and Local Government, and the scheme is open to all types of houses from all registered developers except PR1MA. It is also available for both secondary properties as well as new homes. (The Rakyat Post)

Pavilion REIT still hungry for more buys

After the completion of two major asset purchases for RM646.84 million, Pavilion Real Estate Investment Trust (Pavilion REIT) still has appetite for more yield-accretive acquisitions. Besides external assets, the trust is also eyeing those to which it has the rights of first refusal, including sister company Malton Bhd’s Pavilion Bukit Jalil, Pavilion Damansara Heights, as well as Pavilion Extension. Last year, Pavilion REIT announced that it was buying the Da:men Mall in Subang Jaya for RM486.84 million, and the Intermark Mall in Kuala Lumpur for RM160 million. The proposed acquistions are expected to expand Pavilin REIT’s portfolio from RM4.6 billion to RM4.8 billion. (The Edge Markets)

PR1MA, TNB to jointly develop apartment

Perbadanan PR1MA Malaysia has signed an agreement with Tenaga Nasional Bhd (TNB) to develop two blocks of apartments on 3.33ha land owned by TNB in Kajang. One block will be given to TNB for its employees and the other would be sold by PR1MA. It is expected to be completed by end-2019. PR1MA CEO Datuk Abdul Mutalib Alias said this was the first government-linked company that is working collaboratively with the PR1MA, and it was looking forward to more collaborations with other GLCs, property developers and the government to develop more PR1MA homes. (The Star Online)

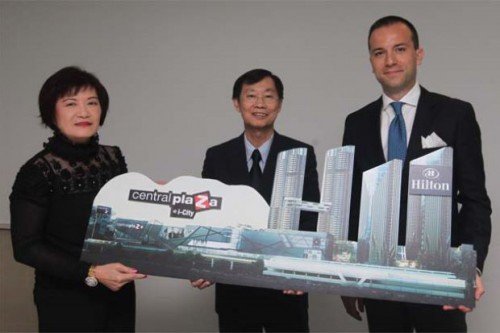

Photo from The Star Online

Double Tree by Hilton a boost for i-City

Groundbreaking works have started for the four-star Double Tree by Hilton at i-City yesterday. The RM200 million hotel will be the second hotel in the RM1 billion tourism master development by I-Berhad in Shah Alam, after the opening of the three-star Best Western hotel in November 2014. The Hilton hotel is slated to be completed by 2018. i-City is a tourist attraction that comprises leisure park, Central i-City mall, three hotels, a convention centre and a wellness hub. I-Berhad spent RM80 million as at end of last year on various rides and attractions and is planning to spend another RM20 million this year to upgrade existing rides. (New Straits Times Online)

Gabungan AQRS’s unit sells Selangor land for RM50.4mil

Construction and property development firm Gabungan AQRS Bhd’s 52%-owned Prestige Field Development Sdn Bhd (PFDSB) has entered into a sale and purchase agreement with Stratmont Development Sdn Bhd for a proposed disposal of a 3.228ha leasehold land in Selangor for RM50.38 million. The proposed land sale was to realise a gain as well as to raise funds as working capital and/or repayment of PFDSB’s bank borrowings. (The Star Online)

Shutterstock image

Airlines in uproar over 1000% hike in aviation fees

Airlines operating out of Malaysia will be expected to pay up to ten times more in fees charged by the Department of Civil Aviation (DCA) Malaysia effective April 15, under a review after 40 years. The increase in fees will apply to everything from the usage of air space, air traffic facilities and other services to the air operator’s certificate (AOC) and the pilot’s flight licence. The rise will lead to a ten-fold increase in airlines’ monthly air navigation flight charges (ANFC), which forms the bulk of DCA services charge. Under the revised fee, the bigger the aircraft, the more the cost, and even the smaller jets, cargo planes and helicopters have not been spared. The worst hit by this new charges would be airlines like AirAsia, Malaysia Airlines and Malindo Air that have several hundred domestic flights per week. (The Star Online)

New pasar tani site in Permas Jaya

The third permanent site for Pasar Tani (farmer’s market) in Johor will be built in Permas Jaya. The new facility on 0.6ha land will cost about RM2.5 million and will provide consumers with produce at cheaper prices compared to other places. He said the new site will accommodate 76 lots for the sale of fresh produce and another six lots for food stalls as well as other facilities. On another matter, Ismail said there were plans to set up the first MyFarm Outlet in Johor Baru at the Jalan Datin Halimah FAMA site. (New Straits Times Online)