(Sourced from The Edge Financial Daily)

It looks like real estate investment trust (REIT) companies in Malaysia are maintaining a cautious view on the overall operating environment and property market amid subdued consumer sentiment. Rental reversion rates are likely to be lower for upcoming expiring net lettable areas (NLAs) with slower year-on-year store sales growth. This is further dampened by huge NLA supply in the pipeline and rising e-commerce popularity among shoppers.

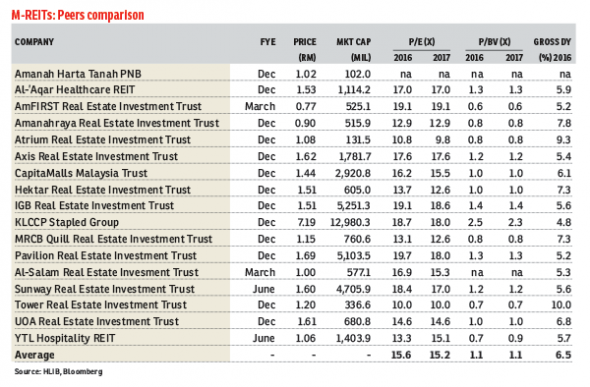

Notwithstanding the above cautious sentiment, Malaysian REITs (M-REITs) have outperformed the FBM KLCI into the fourth month of 2016, driven mainly by yield-seeking sentiment among investors in the low-interest rate and uncertain economic environment. The retracement of 10-year Malaysian Government Securities (MGS) yield to 3.75% from 4.1% in December and speculation on an overnight policy rate cut also led to strong buying interest in fixed income securities.

Local consumption is expected to improve gradually in the second half of 2016, given the normalisation of the goods and services tax (GST) effect and measures to support disposable income (an Employees Provident Fund contribution rate cut, tax relief, civil servant pay rise and minimum wage hike). Hong Leong Investment Bank Research continues to remain “neutral” on the M-REIT sector with a preference for yields and stocks with good asset quality and strong management, given the challenging outlook and recent rally in share prices.

There should not be any unpleasant surprises in upcoming results due to the seasonally strong first quarter, which is likely to be offset by the high-base effect of pre-GST buying last year. Catalysts include potential acquisition of quality assets to achieve growth as a softer property outlook presents such opportunities. Higher disposable income may spur retail spending, which will in turn boost retail REITs.

Risks include:

- monetary policy tightening by Bank Negara Malaysia;

- prolonged erosion in consumer sentiment;

- failure to execute planned asset injections; and

- a significant slowdown in broad economic activities.

The research house also maintained a “neutral” stance on M-REITs, given the overall cautious outlook despite strong yield-searching activities, based on the latest insights and updates gathered.

Read more on M-REITs in the following articles:

1. What is a REIT?

2. Why invest in Malaysian REITs?

3. Different types of REITs in Malaysia

4. Common Answers & Questions about REITs

![[Infographic] 5 Emerging Trends in Malaysian Investment](https://insight.estate123.com/wp-content/uploads/2017/01/Emerging-Trends-in-Investment-e1483951912786-350x264.png)