Bina Puri-Cahya Mata JV bags Pan Borneo Highway job

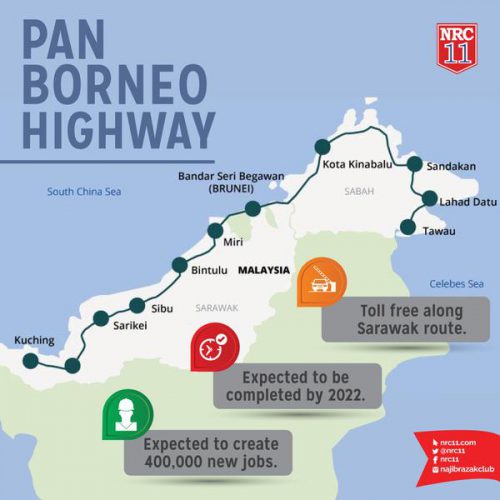

A joint venture between Bina Puri Holdings Bhd and Cahya Mata Sarawak Bhd has won the letter of award from Lebuhraya Borneo Utara Sdn Bhd for the proposed development and upgrade of the Pan Borneo Highway in Sarawak for a contract sum of RM1.36 billion. The award is for Phase 1 of the construction of roads and bridges from Sg Awik to Bintangor Junction in Sarawak. Packages worth up to RM10 billion are expected to be dished out for the 2,083km Pan Borneo Highway project connecting Sabah, Sarawak and Brunei. The cost of the project is estimated to be RM16 billion. (The Edge Markets)

McDonald’s to sell Malaysia, Singapore franchises

McDonald’s Corp is planning to sell its 20-year franchise rights in Malaysia and Singapore that could collectively fetch at least US$400 million, sources said. Interested parties for the fast-food operations in the two Southeast Asian markets have begun sounding out banks for financing, with one potential bidder in talks for as much as US$300 million in funding. McDonald’s is seeking local franchise partners to run its restaurants in Malaysia and Singapore as it pursues an international turnaround plan put in place after CEO Steve Easterbrook took over last year. The fast-food chain is revamping its ownership models throughout Asia, including plans to sell operations in China, Hong Kong and South Korea. The chain aims eventually to have 95% of its restaurants in the region under local ownership for Malaysia and Singapore. (The Star Online)

Image from Free Malaysia Today

DBKL to offer special rebate for traffic compounds starting Aug 6

Kuala Lumpur City Hall (DBKL) is offering discounts for traffic compound rates in conjunction with a “Settle DBKL Arrears” campaign starting Aug 6 to 20 at 32 locations throughout the city. During the period, motorists with traffic summonses only need to pay RM20 for motorcycles, RM30 for cars, MPV, van, small lorry, pickup and SUV and RM100 for heavy vehicles. Through the campaign, city folks could also pay their assessment, public housing rent and market stall rent at the counters provided. (Astro Awani)

Ringgit slide halts as dollar demand wanes with Fed looming

The Malaysian ringgit halted its longest losing streak in 8 months, as demand for the dollar wanted due to expectations of a US Federal Reserve interest rate raise. The ringgit climbed 0.1% to 4.0640 after falling as much as 0.6% earlier. Malaysia is looking to deploying more stimulus for its economy. The government hasn’t dealt with individuals named in a US probe related to state investment fund 1Malaysia Development Bhd and will not protect persons who committed offenses abroad. (The Edge Markets)

Tun Mustapha Park, Malaysia’s largest marine park, is officially launched

Malaysia’s biggest marine park, the Tun Mustapha Park (TMP) in Sabah was officially launched on July 24. The marine park is located off the districts of Kudat, Kota Marudu and Pitas right up to the Balabac Strait. It spans about 898762.76 hectares and promises better marine protection and conservation in this part of the world. It was declared a protected area under the Sabah Parks Enactment 1984 on May 19. The success of the gazettement was part of the state government’s efforts in advancing the people’s socio-economy through various sectors. (New Straits Times Online)

The Tun Mustapha Park spans nearly 2000 hectares off the Sabah coastline. (Image from Treasure Images)

Maybank IB named Malaysia’s best investment bank

Maybank Investment Bank Bhd (Maybank IB) has been named Malaysia’s Best Investment Bank by Euromoney Awards for Excellense for the second year in a row. The award was given in recognition of Maybank IB’s strong performance during the period under review. Euromoney said the award was given due to Maybank’s transition from a largely domestic investment bank to one that operates in 10 countries, with a serious presence across ASEAN thanks to the strong foundation of a growing domestic business. Euromoney commended Maybank IB for being on all five of the largest Malaysian Equity Capital Market (ECM) deals, led by the Malakoff IPO – the biggest in ASEAN during the time period and handled three of the five biggest placements. On the debt capital market side, Maybank IB was on seven of the biggest ringgit bonds and sukuks in Malaysia and has been building up particular strength in sukuk. (The Star Online)

Hua Yang maintains RM500mil sales target for FY17

Property developer Hua Yang Bhd is maintaining its sales target of RM500 million for the financial year ending March 31, 2017 (FY17) despite only recording RM53.2 million of new sales in the first quarter (1QFY17). To achieve the sales target, the company has lined up new launches worth RM721 million in the second half of 2016. It is confident that the Astetica Residence in Selangor and Meritus Residensi in mainland Penang, which will be launched in September/October, will able to boost sales due to encouraging registrations for both. The group also plans to concentrate on improving sales from ongoing projects and converting bookings to sales, with RM333 million worth of ongoing stocks available for sale and bookings worth RM50 million pending loan approvals. (The Edge Markets)