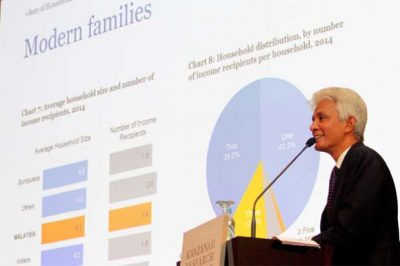

Khazanah: Malaysians borrowing too much, not saving enough

According to the “The State of Households II” report by Khazanah Research Institute (KRI), Malaysians are borrowing too much and not saving enough. While household debt growth has been moderating since 2010 (2015: 7.3% year-on-year), the ratio of household debt to gross domestic product remains high, at 89.1% in 2015 against 87.4% in 2014. Most household debt was undertaken to finance house purchases, where housing loans have expanded by 11% between 2014 and 2015. Public records up to 2013 show that household savings stood at 1.4% of adjusted disposable income, averaging at 1.6% for 2006-2013. By comparison, the United States household savings rate, which is generally acknowledged as being very low, is much higher at 5%. KRI’s previous State of Households report had proposed several measures to reform household debt, such as requiring all providers of consumer credit to prominently advertise the true annual percentage rates, realigning the regulation of consumer credit between the various Government agencies currently in charge, and mandating the teaching of basic financial literacy in schools. However, these proposals have yet to be implemented. (The Star Online)

IOI Properties plans third mixed-use project in China

IOI Properties Group Bhd will begin its third property project in China, after winning the tender to acquire a 6.2-acre parcel of leasehold land in Xiang An central business district in Xiamen, China for 2.32 billion yuan (RM1.4 billion). The group has been sourcing for land banks following the completion of its maiden property development, the IOI Park Bay and the launch of its second projectm IOI Palm City, both of which are located in the Jimei district of Xiamen. Key future developments in the vicinity of the proposed land include schools, a new Xiang An hospital and a new Xiamen international airport, which will be completed in 2020. (The Edge Markets)

Unsold units continue to dampen Malaysia property market

The number of unsold residential and commercial units have climbed 16%, amounting to RM9.4 billion, in the first quarter this year. According to the National Property Information Centre (Napic), 18,908 of the 81,894 units of residential and commercial properties launched in the first quarter of 2016 have yet to be sold. Macro-economic factors affecting the property market include increased cost of living, weaker purchasing power, as well as growing household debt and difficulty in obtaining housing loans. NAPIC statistics showed that most of the residential units launched in 1Q this year were priced between RM500,001 and RM1 million. The data also singled out Johor as having the most number of units launched as well as the most number of units unsold. (Malay Mail Online)

New projects along the coast leading to Kota Kinabalu, Sabah’s capital city. — Pictures by Saw Siow Feng/MMO

Sabah developers optimistic of riding out property slump

Sabah property developers are confident of weathering the sluggish property market, by shifting from profit-driven luxury properties to smaller, more affordable housing projects that target the masses. Developers have responded to the slump and several upcoming projects are aimed at middle-income earners who constitute the major share of potential buyers. They are now scheduled to enter the market later in the year or early next year, thus starting the wheels again by the second quarter of 2017. Recovery is highly dependent on a change in government policy, especially to loosen the stringent housing loan criteria particularly for projects that qualify as affordable homes. (Malay Mail Online)

UEM Sunrise 2Q net profit falls 34.8%

UEM Sunrise Bhd posted a 34.8% decline in net profit to RM54.7mil for its second quarter compared to the previous corresponding quarter due to a couple of one-off gains a year ago. The drop in earnings was also attributed to lower margins recognised in the quarter from additional rebates and discounts and more affordable product offerings. However, it chalked up a higher revenue of RM537.8mil for the quarter, contributed by sale of developed land and revenue from properties in Australia. (The Star Online)

UDA settles land dispute with Tanjung Tokong villagers

Property developer UDA Holdings Bhd has resolved all issues with Tanjung Tokong villagers and begun the groundwork for its mixed development project, which has a GDV of RM1.8 billion. It will be located on two plots measuring about 4ha and will comprise retail and premium low-rise residential components. UDA chairman Datuk Dr Mohd Shafei Abdullah said the land issue had been resolved with the villagers and local authorities. A 544-unit low-medium cost apartment project, estimated to complete in the first half next year, had been bought over to house the Tanjung Tokong villagers. (New Straits Times Online)

Top Glove buys Selangor freehold property for RM51.5mil

Top Glove Corporation Bhd has proposed to acquire a freehold property in Selangor for RM51.5 million. Its wholly owned subsidiary TG Medical Sdn Bhd entered an agreement with Star Shine Marketing Sdn Bhd to acquire the property, which spans 34,499 sq m. The land is currently occupied by a single storey detached factory with annexed double storey production office and five storey integral office building, a guard house, a refuse chamber and a pump house. Top Glove said it intends to use this property for its future expansion by building more glove production lines.The proposed acquisition is expected to be completed by the first quarter of next year. (Business Times)