Over half of developers not launching projects in 2H16

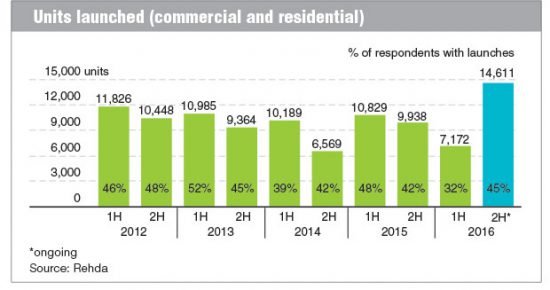

About 55% of the 157 property developers surveyed by the Real Estate and Housing Developers’ Association Malaysia (Rehda) are not planning to launch any projects in the second half of this year (2H16). However, it is an increase compared to 68% in 1H16, and 58% in 2H15. According to Rehda, the number of units opens for sale in 2H16 will be 14,611, double the 1H16 figure. The survey also found that Rehda members were optimistic about the real estate industry for 1H17, even though slightly less than half were ‘neutral’ about next year’s outlook. (The Edge Markets)

(Image from The Edge)

Cabinet orders review of policy allowing developers to give loans

The Cabinet has ordered the Urban Wellbeing, Housing and Local Government Ministry to review and improve the current policy which allows housing developers to provide loans to home buyers. Its minister, Tan Sri Noh Omar, said several companies have been given moneylending licences to provide loans to help buyers with their deposit payments. The review will be in terms of its effectiveness in helping the public purchase houses, interest rates and repayment period, as well as proper guidelines for developers and borrowers. Rehda president Datuk Seri Fateh Iskandar said the scheme definitely has risks and only developers with healthy balance sheets would participate, and that some developers already had the licence. (The Sun Daily)

Developers concentrate on high-end homes amid declining sales

Upscale houses remain the preferred type of property for developers, despite calls by the government to focus on the affordable segment. Data by REHDA showed that 49% of new launches for 2016 were priced above RM500,000 compared to 41% of launched units below RM500,000. There was a 14% increase in launches of houses priced RM200,000 and below, but the total number of affordable homes was still 8% lower than overall high-end launches. High land prices have been blamed for the high cost of houses, but a report by Khazanah refuted the claim, saying that high house prices were the reason for the increase in land prices. There is also the increase in cost of doing business and rise in “compliance cost” charged by the government. (Malay Mail Online)

Rental rates may drop by 30%, says property analyst

Low demand and oversupply of high-rise residential units may see rental rates drop by as much as 30 per cent over the next two years, The Malaysian Reserve reported. Thousands of new units are expected to come on-stream in 2017 and 2018, causing a further strain in the market. Many unit owners cannot afford any losses as they have to pay mortgages, and they have no choice but to put up their units for rent. Rents are expected to drop by as much as 30% from the projected rental return of 2-3 years ago. In a research report on the property sector, real estate agency Knight Frank Malaysia revealed that property owners were willing to compromise on lower rents to secure and retain tenants due to job cuts from low oil prices. (Free Malaysia Today)

(Picture by Saw Siow Feng/The Malay Mail)

MRT Corp planning 3rd line for Klang Valley

MRT Corp is planning the construction of a third line for the Klang Valley MRT project. The third route, which will be known as the circle line due to its circular track, will be built entirely underground and will provide shorter travelling time and better connectivity between rail lines. Line 3 is expected to cover Ampang Jaya, Kuala Lumpur City Centre, Jalan Bukit Bintang, Tun Razak Exchange, Bandar Malaysia, KL Ecocity, Pusat Bandar Damansara, Mont Kiara and Sentul. It will be integrated with the Sungai Buloh-Kajang (SBK) Line 1 and Sungai Buloh-Serdang-Putrajaya (SSP) Line 2. A feasibility study is currently being carried out for the project. (New Straits Times Online)

AWC gets three subcontracts worth RM27.5mil

AWC Bhd’s 51%-owned environment division has bagged three independent subcontracts from Malaysia, Taiwan and India for a total value of RM27.5 million. The first contract, worth RM7.8 million, is for a waste handling system for a new inflight catering facility at Taoyuan International Airport, Taiwan. The second is for the design and supply of Automated Vacuum Waste Collection System in India worth RM9.5 million. The third contract is for the implementation of a sold waste handling system for the KL118 Tower project, worth RM10.2 million. (The Edge Markets)