Vision Valley set to boost Sime Darby fortunes

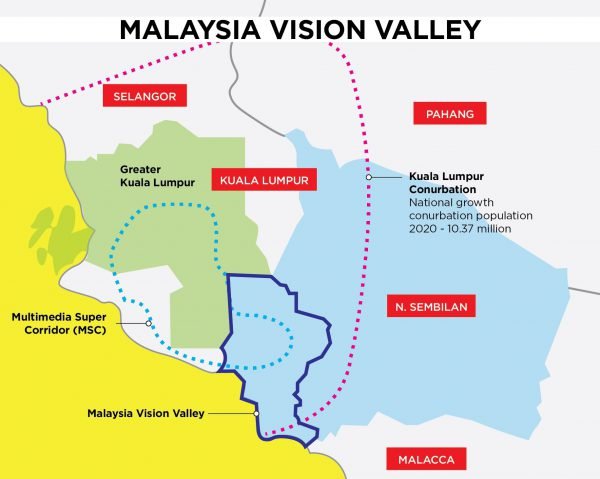

Sime Darby Property Bhd’s fortunes are set to improve next year, spearheaded by the new economic corridor, Malaysia Vision Valley (MVV), as well as an expected pick-up in the property market. The MVV, which will change Greater Kuala Lumpur’s property scene, will be the linchpin of Sime Darby Property’s growth. MVV is a public-private partnership project covering up to 152,566ha over 30 years. It is expected to generate investments of more than RM417.6 billion by 2045. The development will start with industrial parks, followed by an education city, sports culture and townships. The government is expected to spend some RM6 billion in initial infrastructure works, while the larger sum will be poured in by the consortium of Sime Darby Bhd, Employees Provident Fund and a third party which is still being finalised. (New Straits Times Online)

Location of the Malaysia Vision Valley (Image from Lifestyle@9)

One card for all public transport

According to a report by the Land Public Transport Commission (SPAD) launched yesterday, an Integrated Common Payment System (ICPS) will be introduced in 2018. The ICPS is a unified ticketing system managed by SPAD which aims to allow travel on all bus, rail, metro and monorail networks using a single smartcard. Users of the card will be able to ride all rail and bus services in the Klang Valley and park at nearly 4,000 spots at transit stations. It is part of the government’s plan to boost public transport use in Greater Kuala Lumpur from 20% last year to 30% by end of 2020. Additional information on SPAD’s website said commuters using the ICPS could save money as special discounts will be given for customised products, suited to each group of commuters. The commission expects an estimated one million passengers to use the ICPS daily in its first year of operation. (The Star Online)

Sale of highway and Menara Shell to reduce MRCB debts by half

The sale of a highway to Johor that links to Singapore, and an office building in Kuala Lumpur, is expected to shave off almost 50% of MRCB’s debts. The company is looking at lowering its gearing to 0.7 times from its current 1.28 times once the sale of the Eastern Dispersal Link (EDL) and the disposal of Menara Shell to its real estate investment trust (REIT) is completed. The disposal process could take up to half a year to complete. MRCB has been monetising its assets this year with the sale of Menara Shell to MRCB-Quill REIT for RM640mil. In the pipeline is Menara Celcom, which will be up for sale in the second half of 2017, which is worth about RM640mil and completed early next year. (The Star Online)

New Acts to be tabled next year to regulate e-hailing services

The government will table amendments to two Acts next year, which will enable the implementation of the Taxi Industry Transformation Programme (TITP) – including regulating taxi service using e-hailing applications such as Uber and Grab. The two Acts involves are the Land Public Transport Act 2010 and the Commercial Vehicles Licensing Board Act 1987. The move to regulate is to ensure the safety of passengers and drivers, and the rise of e-hailing in the country is based on high demand by consumers along with growing use of mobile technology. The TITP will focus on improving the income and welfare of taxi drivers, deliver quality service using technology, and create a healthy and ideal taxi industry environment for drivers, passengers and operators. (The Rakyat Post)

Gamuda eyes bigger role in Sabah

Gamuda is eager to expand its wings to Sabah with bigger business collaborations, especially in Kota Kinabalu. The company sees high potential in the state capital from a development perspective, and the government has been active in developing infrastructure like the Pan-Borneo Highway which will create spill-over effects. Gamuda is keen on joint ventures to penetrate deeper into the development sector in the state, following its maiden residential development in Sabah, Bukit Bantayan, which has received encouraging response from buyers since launching in April. (Daily Express)