EPF ‘Akaun Emas’ to lock in savings until 60

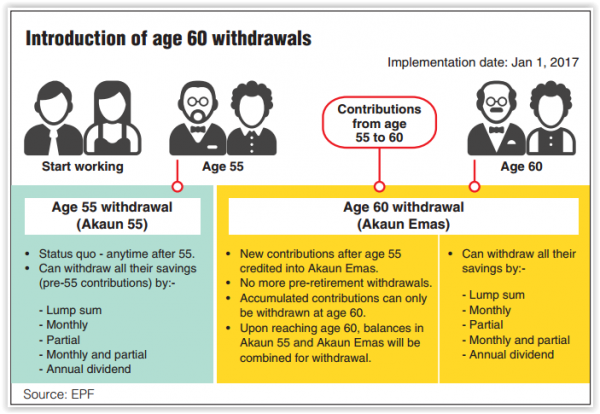

From Jan 1 next year, a new account – Akaun Emas – will be opened for all contributors who turn 55. The money in that account cannot be withdrawn until the member turns 60. All contributions made until the age of 55 will be available to the member. The Employees Provident Fund (EPF) is taking into the needs of its members while making sure they have enough for their golden years. The Akaun Emas will not affect the existing scheme, where members have the option to make full or partial withdrawals upon reaching the age of 55. The partial withdrawal at age 50 also stays. At the age of 60, they will have access to all their contributions. (The Star Online)

State govts told to cut reliance on land, development charges

Khazanah Research Institute director of research Dr Suraya Ismail said state governments should have different sources of income instead of relying on revenue from land and development charges as the main income, which contributed to high property prices. Rehda president Datuk Seri FD Iskandar agreed, adding that increasing conversion premiums is not a sustainable way to boost state revenue. It was suggested that all states find their own niche by making use of their resources and infrastructure to raise revenue and create more high-paying jobs. Land cost is the highest for property developers, followed by construction cost, labour cost and compliance cost. These charges will then be passed on to consumers in the form of higher housing prices. (The Sun Daily)

More Chinese investment possible following Malaysia-China RM144bil deals

Malaysia could see more investments pouring in if its recent multi-billion-ringgit deals with China work out and if conditions remain favourable, say experts. The 14 agreements for planned investments signed earlier this week between Malaysia and China will deepen Malaysia’s “economic and political relations with China”, and Malaysia’s economy is likely to benefit in the medium-term from these projects. However, there does not appear to be much investment from China in the manufacturing sector, which is the real driver of employment. So long as China’s economy remains able to export capital, and so long as economic opportunities and political benefits are to be found in Malaysia, sectors like property, infrastructure and services like banking and e-commerce will see continued investments. (Malay Mail Online)

No decision yet for nuclear power plants in Malaysia

The government has yet to make any decisions on the construction of nuclear power plants in Malaysia. Although the Economic Transformation Programme (ETP) targeted the nuclear power plant to be operational by 2021, it is likely the date will be postponed for further discussion and investigations, especially after the March 2011 nuclear incident in Japan. An initial feasibility study showed that the timeline required for the implementation and completion of a nuclear power plant is at least 11 years, meaning that a nuclear power programme in Malaysia would only be able to operate after 2030. (Malay Mail Online)

Gadang bidding for RM5.2bil worth of construction projects

Gadang Holdings Bhd said it is currently bidding for RM5.2 billion worth of projects, including several packages of the MRT2 and LRT3 projects to replenish its orderbook. The group’s orderbook currently stands at RM603.7 million. The projects the group is currently tendering for includes several packages for MRT2, and it is also shortlisted for LRT3. Other projects is has tendered is for the Cyberjaya hospital project, West Coast Expressway, and East Coast Rail Line project. (The Edge Markets)

KLCC Property’s pre-tax profit up 12% in Q3

LCC Property Holdings Bhd’s pre-tax profit increased 12% to RM230.12 million for the third quarter this year, from RM205.2 million in the same period last year. Revenue, however, was lower at RM329.54 million from RM337.19 million. The lower revenue was attributed to lower occupancy in its retail segment, while its hotel operations suffered from difficult market conditions. On prospects, KLCC Property expects the office segment to remain stable until year-end. (Bernama)

Trive Property cancels EGM for RM19.6mil Terengganu land buy

Loss-making Trive Property Group Bhd has cancelled an extraordinary general meeting, scheduled for Nov 16, related to the purchase of a RM19.6 million Terengganu land. The meeting was called off pending “clarification on a development that may have a material outcome on the proposed acquisition”. Trive Property had on Sept 6 announced that it was acquiring the entire equity stake of Pakadiri Sdn Bhd, which owns a 20.92ha land in Kemaman, Terengganu, for RM19.6 million cash. The land would be developed, via a joint venture, into part of a township called Bandar Baru Kertih Jaya (Kertih Project). (The Edge Markets)

![[Press Release] RM 1.28 billion Sunway Velocity 3 Set for Preview](https://insight.estate123.com/wp-content/uploads/2024/04/sunway-velocity-3-aerial-view-440x264.jpg)