When it comes to property in Malaysia, Mah Sing Group is a well-known name in the industry. One of the top developers in the country, the group has continuously created iconic developments that have bagged more than 100 domestic and global awards for product design, concept, innovation, and quality.

2016 has been a rather subdued year for the Malaysian property market: cooling measures by the government, buyers adopting a ‘wait-and-see’ attitude towards real estate purchases, and financial institutions tightening lending policies. Will 2017 see a recovery in the local real estate market?

In an interview with Ho Hon Sang, Chief Executive Officer (CEO) of Mah Sing Group, Estate123.com asked him some questions about his take on the Malaysian property market in 2017, as well as Mah Sing Group’s plans for future launches and projects.

Mah Sing Group CEO, Ho Hon Sang

What are your thoughts about the property sector in 2017?

The property sector is expected to be challenging this year, due to uncertainties in global and domestic economies. Tight lending policies will also affect buyers’ abilities to get mortgage financing. With the weak market sentiment, many developers have held back new launches, and the period of adjustment to the market situation will continue until the macro environment or approval rates for housing loans improve. However, there is still long-term demand for property in Malaysia, which is supported by a young population demographic, conducive interest rate, continued GDP growth, and urbanisation. Moving forward, we hope that these factors can lift sentiment and the overall market condition.

‘Affordable housing’ has been the keyword for residential property in Malaysia for the past couple of years. Will the demand for affordable housing continue into 2017 and beyond?

Currently, there is a shortage of affordable homes in the right location. Factors such as a young population, urbanisation, and continued GDP growth will ensure that long-term demand for such properties remains strong.

With the MRT/LRT lines connecting the Klang Valley beginning operations, will it affect the property prices in these areas?

Properties in areas near the MRT lines are already seeing appreciation in prices. Our D’sara Sentral development has direct access to the Kampung Selamat Station of MRT Line 1, and has recorded a healthy price appreciation since its first launch in 2014. Tower SA1 which was launched in 2014 recorded RM660 per square feet. The final tower, OLO serviced residence, recorded a starting price of RM777 per square feet.

Demand for properties near to MRT stations has also increased. For example, our Lakeville Residence, which is approximately 2km from MRT Line 2 Sri Delima station, has recorded good take-up rate of over 80%. Another property that has received great response from buyers and almost fully taken-up is Garden Residence in Cyberjaya, which is located within 2km from Cyberjaya North station and Cyberjaya City Centre station.

What about high-end residential projects? Do you think there will be demand for those in 2017?

Just like there are people looking to buy affordable properties, there will also be buyers who have the appetite for high-end properties. Their main concern will be focused on quality, location, capital appreciation, rental income and ease of home ownership. Our “Lock & Roll” campaign that was introduced in November 2016 has seen good take-up for some of our completed high-end units.

What are Mah Sing’s plans to overcome these challenges?

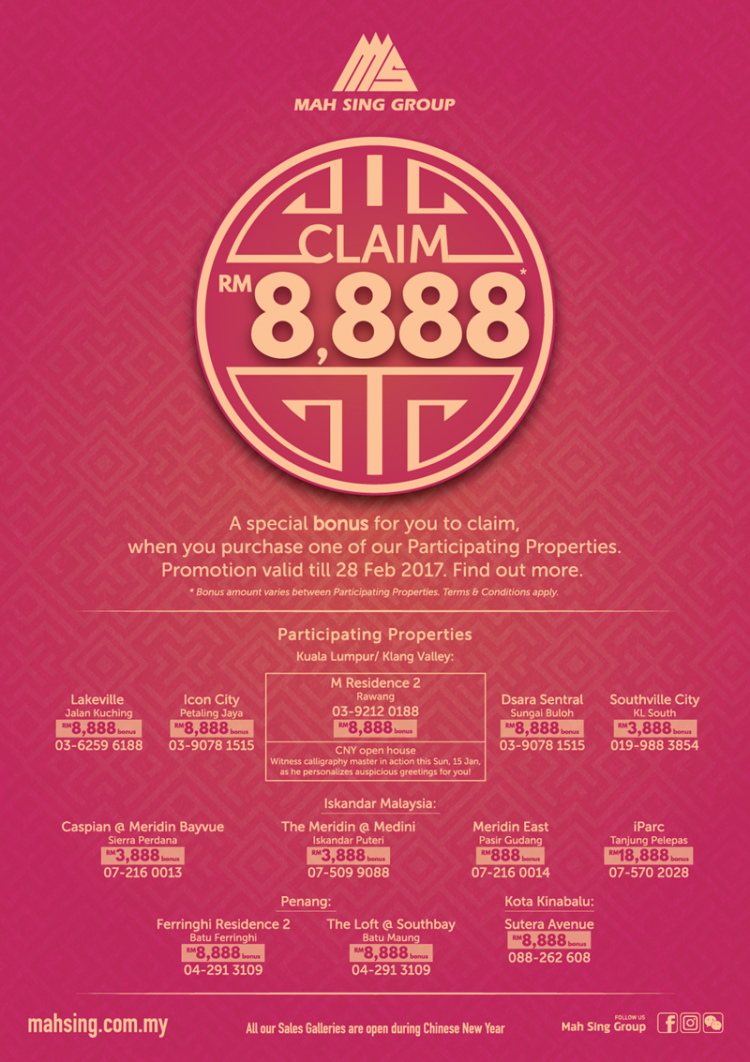

Responding to the challenging market conditions, Mah Sing has launched an innovative pricing strategy, “Luxury Made Affordable” to target first-time buyers. The “Lock & Roll” deferred financing plan was also launched to target home upgraders and investors. In conjunction with Chinese New Year 2017, we are giving out big angpows to celebrate the festive season. Buyers who purchase from one of our 12 participating properties can claim special bonuses worth RM888 to RM18,888 on top of any sales packages. (See the list of participating properties here.) The Group will continue to focus on nimble response to market and quick asset turn. The established Mah Sing brand, track record of delivery and solid financial capabilities will allow the Group to respond to the cyclical market.

Many buyers are facing problems obtaining housing loans. Is it because banks are becoming stricter, or are buyers biting off more than they can chew?

It is true that buyers are facing difficulties in getting their housing loans approved. The inclusion of education loans such as PTPTN in the lending system has also affected many young buyers’ profile. Household debt components for some are currently heavy on credit card debt, personal financing and car loans, which affect their eligibility for a mortgage loan. Besides that, banks have become more cautious with mortgage lending since the implementation of Responsible Financing Guidelines. Ultimately, individuals (especially first-time home buyers) are encouraged to buy their own home. A housing loan is an asset-backed loan and in the long run will be able to create value for homeowners.

A news article in June 2016 reported that Mah Sing is not looking to venture outside Malaysia, but are there any plans for projects in Sabah or Sarawak?

Our main focus areas are the Greater KL and Klang Valley. With the LRT extensions, MRT in operation and potential HSR connection, Greater KL will continue to be a key focus area for future land banking opportunities and growth.

Could you share with us what are some of Mah Sing’s upcoming launches to look out for in 2017?

Among our 2017 launches include:

- Cerrado Residencial Suites (Tower C and Tower D) in Southville City

- Residensi Seri Wahyu (Rumah WIP) in Lakeville Residence

- Landed link homes in Rawang township

- Landed link homes in Meridin East, Pasir Gudang, Johor

- Serviced apartments in Southbay City, Penang

Mah Sing will continue to focus on end-user demand for beginner homes, driven by young demographic, continued new household formation and stable labour market conditions.

Something for our readers: What are the top 5 aspects (or factors) should a first-time buyer consider when buying a property in Malaysia?

It is important for buyers to consider these factors before purchasing a property: location, connectivity and accessibility, developers with good track record, overall development concept, and affordability.

![[Exclusive] Interview with Mah Sing CEO: 2017 Malaysia Property Outlook](https://insight.estate123.com/wp-content/uploads/2017/01/estate123-x-mah-sing-exclusive-interview-malaysia-property-2017-e1484540169784.jpg)