Vincent Tan to restructure his business empire

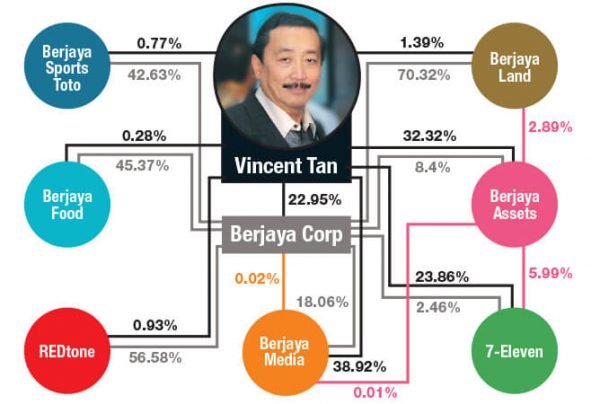

Tan Sri Vincent Tan, who is back at the helm of the Berjaya group, yesterday unveiled his big plan to restructure his business empire that may involve the sale of assets, privatising two companies — 7-Eleven Malaysia Holdings Bhd and Berjaya Land Bhd (BLand) — as well as the listing of hotel business in Singapore. The plan will start with asset sale at his flagship Berjaya Corp Bhd (BCorp). The group is in the midst of sealing a deal to sell its Four Seasons Hotel and Hotel Residences Kyoto. Tan will sell his majority 46% stake in 7-Eleven Malaysia Holdings to BCorp, which will then launch a takeover offer to buy out the convenience store chain operator. Meanwhile, BCorp may carve out the hotel assets from BLand and float the assets in Singapore. For U Mobile, the initial public offering plan remains intact and will happen next year, or by 2020. (The Edge Markets)

(Image from The Edge)

Properties valued at RM3.8bil unsold in Johor

Johor topped the list in the country with access properties, with some 5,988 unsold valued at RM3.8bil statewide. State Housing and Rural Development Committee chairman Dzulkefly Ahmad said among the properties not sold include service apartments and properties valued between RM500,000 and RM1mil. There is a mismatch between demand and supply, especially with developers trying to make the most profits by building more high-end properties. Dzulkefly said the situation could benefit the people, as there would be a price correction to reduce the prices of the unsold units. Dzulkefly said the housing sector in the state needs to be reformed in terms of building, distribution, financing and reducing building costs to ensure 100,000 affordable homes could be built by 2023. (The Star Online)

JAG buys land in Klang for RM14.4mil

Property developer JAG Bhd is buying a piece of freehold land in Klang for RM14.4 million for future development. The exact use of the land, measuring 16,720 square metres, has yet to be determined. The purchase, from Hwee Seng & Co Sdn Bhd, will be financed through a combination of internally-generated funds, fundraising exercise and bank borrowings, the group said. The proposed acquisition of land is expected to be completed in the second quarter of 2019. (The Edge Markets)

Court rules developer gets only RM500 instead of RM65,000 admin fee

A developer which attempted to charge a RM65,000 administration fee to provide its consent pending the issuance of a separate strata title, got only RM500 instead in a court ruling recently. Property owner KAB Corporation Sdn Bhd had sought consent from the land’s Master Title holder, Master Platform Sdn Bhd, to assign the property to a bank for additional revolving credit facility for KAB’s related company, Impiana Sdn Bhd. Master Platform had then imposed an administration fee of RM65,000, which is equivalent to 1% of the facility sum. The rate was not stipulated in the agreement between KAB and Master Platform, which led to the lawsuit. (The Edge Markets)

SST has brought down prices of 291 items, says Amiruddin

The Sales and Service Tax (SST) has lowered the prices of 291 items since it was re-introduced in September. Deputy Finance Minister Datuk Amiruddin Hamzah said a study by the Ministry of Domestic Trade and Consumer Affairs (KPDNHEP) showe%d that the prices for 70% of the 417 items comprising six categories had gone down. 27 per cent (115 items) had an increase and 3% (11 items) remain unchanged. However, he said the decline in prices was not being highlighted, while the price increase in 27% of the items has created a perception that the prices of all goods have increased. The government had collected RM4.5 billion in SST from Sept 1 to Dec 17 this year, and aims to collect RM22 billion SST in 2019. (Malay Mail Online)