The government is considering selling some of its assets to further trim the national debt that is currently at valued RM686 billion. Prime minister Tun Dr Mahathir Mohamad gave his assurance that any government asset sold, particularly its land, would only be to Malaysians and not foreigners. He had earlier clarified in the Dewan Rakyat that the country’s gargantuan debt had been reduced from RM1 trillion to a more manageable level now because the GDP had increased. “We have recovered a lot of money that was lost, also those kept by Singapore and all that, so that money helps reduce the debts. We are also working hard on trying to reduce the contract value of ECRL (East Coast Rail Link), because if we don’t continue with the project, we will have to pay very huge compensation,” he added. (Malay Mail)

EPF spending guide vastly understates real costs, finance portal argues

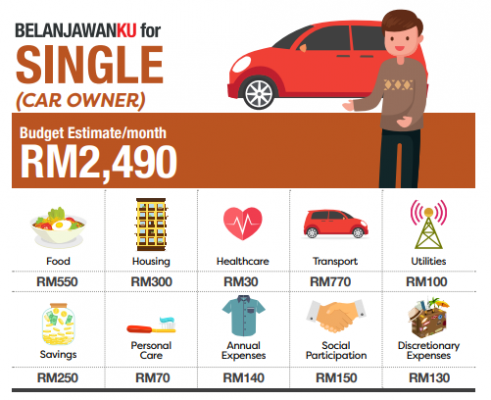

Recommended budgeting in the Employees Provident Fund’s (EPF) Belajawanku is unrealistic for unmarried Malaysians residing in Klang Valley, according to an iMoney survey. Among others, the financial comparison site noted the EPF’s budgeting guide suggested a single person staying in the Greater Kuala Lumpur area should set aside just RM300 monthly for accommodation. However, iMoney’s poll found actual spending to be closer to RM1,100 monthly. According to its other findings, a typical person with one car and residing in Klang Valley must spend an estimated RM2,695 monthly even before personal care expenditure, annual commitments or allocations for savings. With Belanjawanku listing median income at RM2,650, this would mean the majority of singles in Klang Valley would be running a monthly deficit. (Malay Mail)

Screenshot from Belanjawanku spending guide

Utilise waqf trusts to improve affordable housing ownership

Banks should look into utilising waqf trusts as a tool to improve affordable home ownership in the country. International Centre for Education in Islamic Finance CEO Datuk Dr Mohd Azmi Omar said that while waqf trusts are being utilised for the property sector, there is a tendency for trusts to be used to develop commercial properties, as well as middle- to high-end properties. He proposed that one possibility for banks is to create a cash waqf fund, whereby individuals can invest in the fund, which would be used to develop the properties managed by the waqf trust. He acknowledged that properties cannot be sold and bought in the conventional way, but suggested income could be generated by leasing the properties to potential “buyers” for a period of 99 years, after which the property will return to the religious authorities. He highlighted that waqf trusts have been used to develop residential properties not just in Malaysia, but also in Singapore as well. (The Edge)

Housing will be under one roof in the future, says minister

The nation’s housing needs will be managed by a single ministry in the future, said Housing and Local Authority Minister Zuraida Kamaruddin. Pasir Salak MP Datuk Seri Tajuddin Rahman had remarked that multiple housing agencies incurred a lot more in terms of management costs, after Zuraida said that rural housing projects do not fall under her ministry’s purview. “We need to allow the Housing Ministry to stabilise first before we expand to cover all housing needs in the country so it will be standardised with policy and law… When I first entered the ministry, I assumed all housing matters fall under the Housing Ministry but that isn’t the case,” she said. (Malay Mail)

OPR cut good news for REITs, says property firm

The real estate investment trusts (REITs) industry will be among the winners if Bank Negara Malaysia (BNM) cuts interest rates this year, according to property company KLCCP Stapled Group. Some analysts recently viewed the central bank as likely cutting the Overnight Policy Rate (OPR) by 25 basis points sometime in May this year amid slowing economic growth. “(OPR cut) is not only good news to us, but (also) to the industry as any lowering of OPR would give a better spread to the yield,” said KLCCP CEO Datuk Hashim Wahir. Malaysia government securities (MGS) is a typical benchmark that investors use to compare REITs, which are seen as a comparatively riskier investment. (The Sun Daily)