Property prices expected to decline by as much as 20% post-Covid-19

Property prices are expected to decline by as much as 20% in the next few months with more motivated sellers, as the impact of Covid-19 continues to unfold. Malaysian Institute of Estate Agents (MIEA) president Lim Boon Ping said that the Malaysian real estate market will shift to a buyer’s market, from a seller’s market previously, as a result of Covid-19. As such, property prices at best could decline by 10%, and at most could decline by 20%. However, despite the MCO — which has resulted in no property viewings, moving in and out of properties, and sale and purchase (S&P) agreements being signed — there have been some property deals that have been closed without viewings. He added that real estate agents in Malaysia should learn to use technology to enhance the services they provide following the MCO and Covid-19. (The Edge)

Police: KL crime rate sharply lower

Kuala Lumpur police said the crime rate declined by more than half during the first and second phase of the government’s movement control order (MCO), while 930 individuals have been arrested for flouting the MCO in the past four weeks. Kuala Lumpur police chief Comm Datuk Seri Mazlan Lazim said the first phase of the MCO from March 18 to March 31 saw the crime index in Kuala Lumpur fall by 57.4%. “Violent crimes recorded a decline by 62.8% and property crimes recorded a decline of 55.5%,” he said. During the second phase of the MCO, Mazlan said violent crimes declined by 74.3%, while property crimes declined by 59%. Mazlan said the Kuala Lumpur police would continue to ramp up action via roadblocks and inspections to ensure the public complies with the MCO. (Malay Mail)

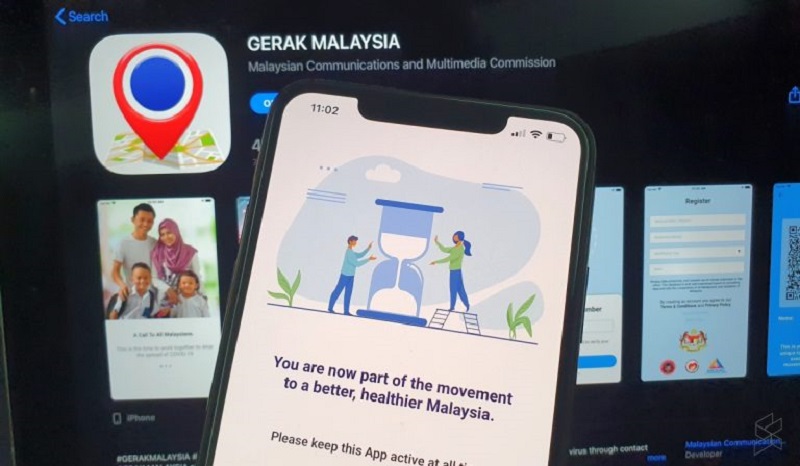

Malaysia already has a contact tracing app and it’s downloadable now

In the battle to contain the spread of Covid-19, contact tracing is an important tool which helps health authorities such as the Ministry of Health to identify every person that an infectee may have made contact with. The Malaysian Communications and Multimedia Commission is testing a beta app called Gerak Malaysia that can do just that and it uses location tracking. The beta app is an initiative by the MCMC with the support from the Malaysian telcos. It is developed based on the same contact tracing models that are being implemented in South Korea and in China. Since it tracks your location, you would need to grant the app permission to access your phone’s GPS. At hospitals, the QR code can be used to determine your risk level and it will allow frontliners to assign you to the right queue. The QR code can also assist the police and armed forces at the roadblocks as they can determine whether you’re travelling within the permitted radius. (Malay Mail)

Crest Builder has upcoming property projects worth RM2.5 billion

Crest Builder Holdings Bhd may go ahead and launch its three new property development projects in Klang Valley, worth about RM2.5 billion collectively, albeit cautiously. This includes the long-delayed mixed commercial project, Latitud8, a joint-venture (JV) development with Prasarana Malaysia Bhd. Crest Builder, whose maiden project is 3 Two Square, launched 13 years ago in Petaling Jaya, has said that Latitud8 is scheduled for launch in the second half of 2020. The company is looking at the possibility to launch Latitud8 towards the end of the year, subject to the outcome of the Covid-19 situation and also market conditions. Latitud8 will be developed on top of the Dang Wangi LRT station, codenamed “The Bank”, at Jalan Ampang, Kuala Lumpur. It has a GDV of about RM1.1 billion, marking Crest Builder’s first billion-ringgit property development project. Its second launch is a mixed development in Kelana Jaya, which has an estimated GDV of about RM1 billion. The third launch is a residential project in Klang, with an estimated GDV of RM450 million. (NST Online)

IDEAS: Malaysia may lose RM31 bil per year if oil prices remain at US$30 per barrel

The Institute for Democracy and Economic Affairs (IDEAS) said that Malaysia may lose RM30.9 billion in fiscal revenues per annum if oil prices remain low, which would further strain the nation’s finances. Malaysia is also expected to lose per annum US$1.7 billion in new capital investment as well as US$7.1 billion (RM30.9 billion) in fiscal revenue from the oil and gas (O&G) segment, which would put further pressure on the country’s finances. The oil sector is affected by a decline in demand due to the COVID-19 outbreak as lockdown measures have put mobility to a halt.Ttransportation makes up 57% of all oil demand. The oil sector was hit particularly hard in March as Saudi Arabia initiated a price war with Russia and OPEC partners in March, when there were fewer than 150,000 of COVID-19 cases. (The Edge)