Malaysia to ink Covid-19 vaccine MoU with China

The government will sign a memorandum of understanding (MoU) with China to ensure Malaysia will be among the first to receive the COVID-19 vaccine from the country once it is, as expected, successfully developed by end of the year. Prime Minister Tan Sri Muhyiddin Yassin said that through talks between Foreign Minister Datuk Seri Hishammuddin Tun Hussein and his visiting Chinese counterpart Wang Yi, China had agreed to list Malaysia as a priority recipient of the vaccine after it has completed clinical trials. “I am quite pleased with this guarantee and I have asked that this cooperation be inked in the form of an MoU to be made with China,” he said. Muhyiddin said the government had also agreed to join the COVID-19 Vaccine Global Access (COVAX) Facility, a global partnership that can help developing nations obtain vaccines for COVID-19 and other diseases. (Bernama)

Limited economic impact from CMCO in Klang Valley, says MIDF

The conditional movement control order (CMCO) in the Klang Valley will not have a major impact on business activities as firms are allowed to operate according to the standard operating procedures (SOPs) that have been rolled out for each industry, said MIDF Research. It recognised that the major impact of the CMCO on the economy would be weaker consumer spending and its spillover effects on the services industry, particularly consumer-related sub-sectors such as retail trade, restaurants, hotels, travel, education and recreation services. MIDF Research believes that consumer spending will be supported by growing online purchases facilitated by the availability of e-commerce platforms, home delivery services and online financial services, including e-wallets and online banking. It also said telecommunications services will also benefit from greater dependence on Internet services due to increased online purchases and employees shifting to a work-from-home arrangement. However, it recognised that properties and REITs will be affected the most. (The Edge)

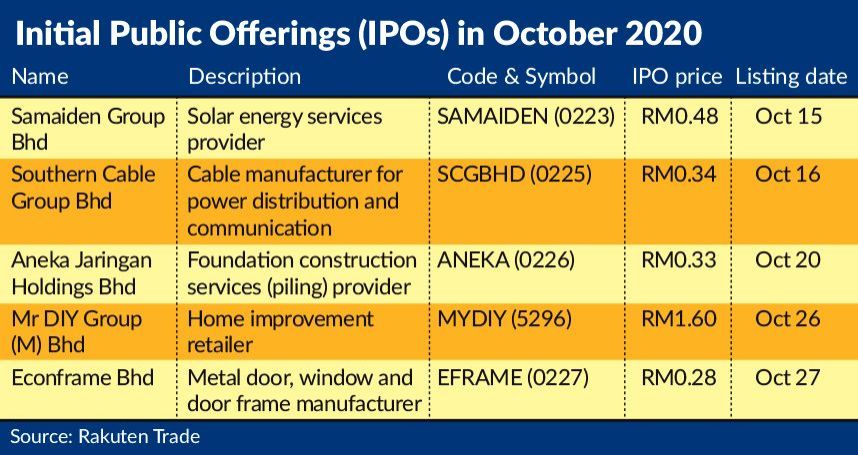

IPOs expected to be well received

Despite market uncertainty amid the rise in local Covid-19 cases, the initial public offerings (IPOs) slated for this year are expected to be well received by the investment community. The month of October will see five companies making their debut on Bursa Malaysia, of which one, MR DIY Group (M) Bhd, will be listed on the Main Market. According to Rakuten Trade Research vice-president Vincent Lau, this is evident in the oversubscription rates of the public portions of IPOs to be listed this month. “Investors will continue to favour high-yielding assets like equities given the greater liquidity and low interest rate environment,” he said. Lau noted that there should be another one to two more Ace Market IPOs scheduled before the year end, though it remains to be seen how soon the approvals for the prospectuses can be obtained. Pending the relevant approvals and market conditions, these IPOs could be postponed to next year, which is expected to be a recovery year. (The Star Online)

Khazanah to have controlling 43% stake if UEM Sunrise merges with Eco World

Two property giants, Eco World Development Group Bhd (EWDG) and UEM Sunrise Bhd (UEMS), are reportedly in talk to form a merger, with sources saying that things are still at the exploratory stage and that any deal is some time away. But they add that one thing is clear: based on the numbers, if the merger does happen, Khazanah Nasional Bhd will end up as the controlling shareholder with a stake of around 43%. EWDG’s controlling shareholder Tan Sri Liew Kee Sin, on the other hand, will have a stake of only 8.5%. Liew and his EWDG team will effectively be working for Khazanah as the controlling shareholder if the merger proceeds. The sources also say any deal will not involve cash and will be a pure share swap. Khazanah currently has a 66% stake in UEMS, while Liew has a 15% stake in EWDG. Eco World International Bhd, which is a unit of EWDG with development projects in the UK, is unlikely to be part of any merger. (The Edge)

Reinstate maximum loan tenure to 45 years from the current 35 year, says Mah Sing founder

Mah Sing Group Bhd founder and group managing director Tan Sri Leong Hoy Kum hopes the government will offer additional ‘goodies’ in Budget 2021, to promote homeownership for first-time home buyers. He wishes that the government will reinstate the maximum loan tenure to 45 years from the current 35 years, and use gross income rather than net income in the loan application review. Leong hoped that the government will also consider implementing Developer Interest Bearing Scheme for first-time homebuyers as the current interest rate is low enough for such a scheme. Leong said the property industry has a multiplier effect on over 140 industries. In efforts to spur more activities in the property industry and related sectors, he hopes the government will consider reducing compliance costs, and resume Malaysia My Second Home Programme (MM2H). Leong said compliance cost remains one of the most significant factors affecting developers’ cash flow. Meanwhile, real estate agents in the country have urged the government to eliminate or reduce stamp duty on property purchases. (NST Online)