CTOS provides tenant screening for landlords, property agents

Credit reporting agency CTOS Digital Sdn Bhd is expanding its services by providing its tenant screening solution for landlords and property agents. It said the fully-digitised solution offers landlords and property agents quick and accurate checks on potential tenants, resulting in a more reliable application selection process. Dennis Martin, CEO of CTOS Digital Sdn Bhd, the holding company of CTOS Data Systems, said the “CTOS Tenant Screening” is the latest in its move to bring digital business solutions to more diverse industries across Malaysia. The digital platform provides users with access to tenant screening reports that demonstrate the tenant applicant’s ability and willingness to pay their bills on time. The consent to get this report can also be done online. By using CTOS Tenant Screening reports, landlords will be able to receive background checks including ID verification, financial checks, legal cases & bankruptcy (if any). (The Star Online)

More retail shops allowed to operate, dine-ins at restaurants begin

The National Security Council (MKN) has agreed to allow more retail shops to operate and for dine-ins to be allowed at restaurants from Wednesday, says Senior Minister (Security Cluster) Datuk Seri Ismail Sabri Yaakob. Ismail Sabri said the decision was made to ensure the sustainability of retail businesses such as clothing and accessories, car accessories, handicrafts, children’s toys, and sports equipment. On the permission to dine at restaurants, Ismail Sabri said it was limited to two customers per table, and operators must ensure physical distancing is observed at the restaurant and that customers have recorded their details. Ismail Sabri said for photography services, only photos for passports, visas and licences were allowed to be taken. He said more details on the SOP can be found on MKN’s website. (Bernama)

Malaysia listed among top ten in global logistics ranking

Malaysia has been named among the top ten attractive nations to logistics providers, freight forwarders, shipping lines, air cargo carriers and distributors. Freight forwarding and contract logistics provider Agility said Asia-Pacific nations led all emerging market regions with China, India and Indonesia being the world’s top emerging markets in the 12th annual Agility Emerging Markets Logistics Index. The Index ranks 50 countries by factors that make them attractive to logistics providers, freight forwarders, shipping lines, air cargo carriers and distributors. Agility said that among ASEAN countries, Vietnam climbed three spots to No. 8 overall. Indonesia (3), Malaysia (5) and Thailand (11); the Philippines rose one spot to No. 21. Across 50 countries, China, India and Indonesia rank highest in the Index for domestic logistics. China, India and Mexico are on top for international logistics with Vietnam 4th, Indonesia 5th, and Malaysia 7th. UAE, Malaysia and Saudi Arabia have the best business fundamentals, it said. (The Edge)

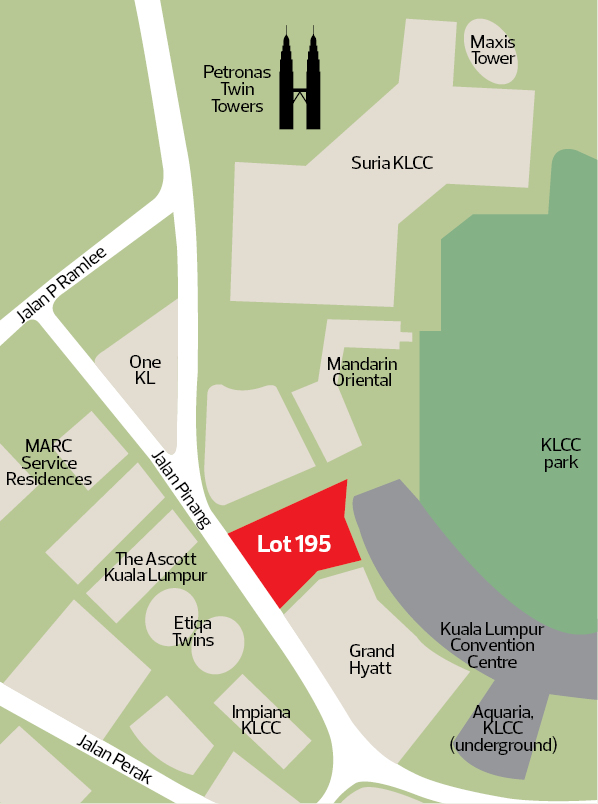

Jakel Group planning to build ‘74-storey-tall building’ in Golden Triangle

A property developer company within the Jakel Group “is planning to build a 74-storey-tall building within the Golden Triangle near the Petronas Twin Towers in Jalan Pinang”, reported The Edge. Sources said the GDV of the development is estimated at RM2 billion and “when completed, it may be as tall as Four Seasons Place.” The report added that the site of the building is “adjacent to the Kuala Lumpur Convention Centre and next to the Grand Hyatt Kuala Lumpur”. The building plans reveal “Plans for the freehold parcel, measuring 57,447 sq ft, include three floors of retail and four floors of exhibition space. Other components include a hotel, office and serviced apartment”. A source said the project will “only likely to commence in three years”. The source added that its components will depend on the demand at the time, and “an established operator from the Middle East” would be brought in to run a shariah-compliant hotel. (The Edge)

Public Mutual launches carbon efficient fund

Public Bank’s unit Public Mutual has raised its benchmark in its investing strategy, focusing on the environment, with the launch of a fund named Public e-Carbon Efficient Fund (PeCEF) on Tuesday. PeCEF aims to invest primarily in companies with efficient carbon footprints which are component stocks of a global environmental, social and corporate governance (ESG) index. “The fund may target to invest in sectors including technology, healthcare and consumer sectors that are well-positioned for earnings growth while registering low carbon emissions or demonstrating a clear carbon reduction strategy. In order to achieve long-term capital growth, the fund will invest 75% to 98% of its net asset value (NAV) in equities globally with the balance invested in liquid assets, ” it said. Rising levels of carbon in the atmosphere have been one of the leading contributors to global warming. Public Mutual said the fund is available exclusively online via its Public Mutual Online (PMO) platform with a minimum initial and additional investment amount of only RM100 and the sales charge is as low as 3.75%. (The Star Online)