The Employees Provident Fund (EPF) in Malaysia has introduced a new structure for its members, known as Account 3 or Akaun Fleksibel, which officially commenced on May 11, 2024. This restructuring divides the EPF savings into three accounts: Account 1 (Akaun Persaraan), Account 2 (Akaun Sejahtera), and the newly added Account 3 (Akaun Fleksibel).

But did you know? Besides the three aforementioned accounts, you also have two more EPF accounts that will be ‘unlocked’ when you reach the age of 55 and 60!

Your Three (Main) EPF Accounts

- Account 1 (Akaun Persaraan): This account retains 75% of the contributions and is primarily intended to secure members’ income during retirement.

- Account 2 (Akaun Sejahtera): This account receives 15% of the contributions, focusing on members’ well-being and addressing various life cycle needs.

- Account 3 (Akaun Fleksibel): The new account gets 10% of the contributions and offers flexibility for short-term financial needs. Members can withdraw savings from this account at any time, with a minimum withdrawal amount of RM50.

Key Features of Account 3

- Flexibility: Account 3 allows members to withdraw funds at their discretion, which is not permitted with the other two accounts. This is particularly beneficial for managing immediate financial requirements.

- One-Time Transfer: From May 11 to August 31, 2024, members can opt to transfer a portion of their savings from Account 2 to Account 3. This transfer is facilitated through the KWSP i-Akaun app or at EPF branches and is processed within three to five days.

- Dividends: Dividends for Account 3 are aligned with those for Accounts 1 and 2, ensuring consistent growth of savings across all accounts.

Contribution Percentage (%) Changes

From May 11, 2024, contributions to EPF are divided into:

- 75% to Account 1 (Persaraan)

- 15% to Account 2 (Sejahtera)

- 10% to Account 3 (Fleksibel)

Existing savings in Accounts 1 and 2 remain unchanged, while Account 3 starts with a zero balance and accumulates new contributions moving forward. More details about Account 3 can be obtained at www.kwsp.gov.my/w/epf-account-3-info

Withdrawal and Transfer Rules

While Account 3 allows for withdrawals, it also permits transfers to Accounts 1 and 2 under specific conditions. However, transfers are one-way, meaning once funds are moved to Account 1 or 2, they cannot be transferred back to Account 3. This ensures that the primary purpose of Account 1—securing retirement funds—remains intact.

Age 55 & Age 60

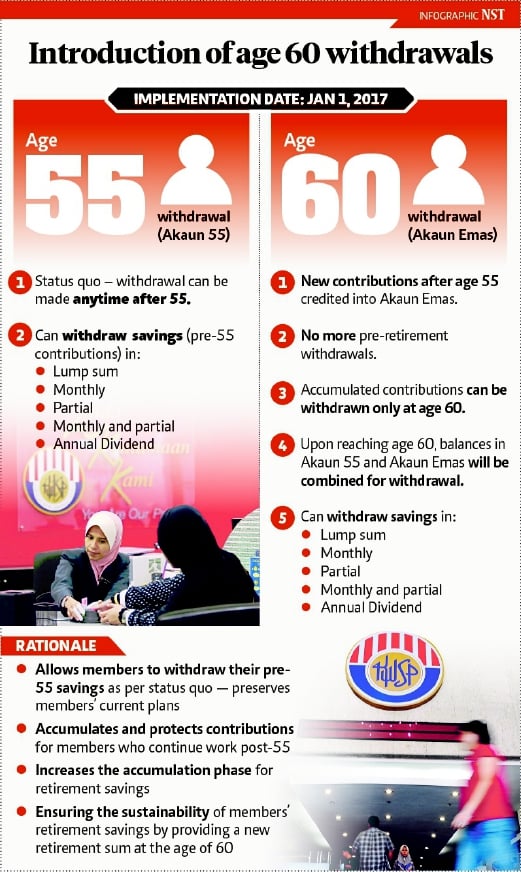

Upon reaching the age of 55, you “unlock” two accounts known as Akaun 55 and Akaun Emas (Gold). Any remaining savings across the three accounts will be transferred to Akaun 55. You may withdraw all or part of the savings from this account at any time.

However, if you continue working after the age of 55, contributions received thereafter will be credited to Akaun Emas, which can only be withdrawn when you reach the age of 60. This is to secure members’ savings within the five years from age 55 to 60.

At the age of 60, all accumulated savings in Akaun 55 (if any) and Akaun Emas will be combined for withdrawal. You may then choose to make a lump sum or partial withdrawal at any time to fund your retirement.

For more details on EPF accounts and withdrawals, visit the KWSP website www.kwsp.gov.my.

![[Pre-Budget 2017] What Do Malaysians Want From Budget 2017?](https://insight.estate123.com/wp-content/uploads/2016/10/budget-e1477019470501.jpg)