The Malaysian government has announced a revised and expanded Sales and Service Tax (SST) regime under Budget 2025, which will take effect on 1 July 2025. These changes are part of broader efforts to strengthen the country’s fiscal sustainability while ensuring essential goods and services remain affordable for the rakyat.

Here’s a quick breakdown of what’s changing and how it affects you.

📦 What’s New with Sales Tax?

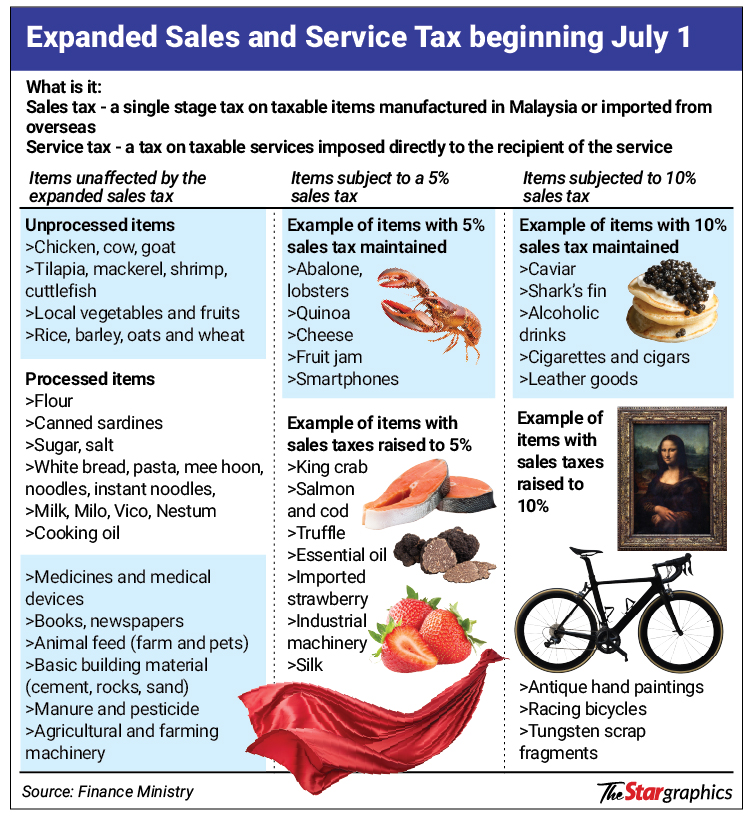

Sales tax is now being fine-tuned to better reflect consumption patterns:

- Essential goods like rice, vegetables, bread, and medicine will remain tax-exempt (0%).

- Non-essential items such as perfumes, imported fruits, luxury apparel, and high-end bicycles will now be taxed at 5% or 10%, depending on their classification.

This means everyday necessities are protected, while luxury spending contributes a bit more to national revenue.

🧾 Expanded Service Tax Coverage

For the first time, six new service sectors will be included under SST:

| Sector | Rate | Notes |

|---|---|---|

| Leasing & Rental | 8% | Applies to high-value rentals; residential leases exempt |

| Construction Services | 6% | Only applies to contracts above RM1.5 million; residential works excluded |

| Financial Services | 8% | Covers service fees and commissions; core banking remains exempt |

| Private Healthcare | 6% | Only applicable to foreign patients |

| Private Education | 6% | Applies to annual fees above RM60K/student and services to foreigners |

| Beauty & Wellness | 8% | Includes spas, salons, and aesthetic services exceeding RM500K annual turnover |

These changes aim to broaden the tax base by including more high-value and discretionary services while keeping the burden off average consumers.

⚖️ Why This Matters

This updated SST structure is designed to be fairer and more progressive, ensuring that those who can afford luxury or premium services contribute more to national development. At the same time, Malaysian citizens benefit from key exemptions, especially in education and healthcare.

🕓 Grace Period for Businesses

To help businesses adjust, a grace period until 31 December 2025 has been announced. No penalties will be imposed during this time for those making genuine efforts to comply.

✅ The Bottom Line

- You won’t pay more for everyday essentials.

- You may notice higher prices for imported luxury or beauty services.

- Businesses in newly taxed sectors must register and comply by July 1.

Stay informed and make sure your business or household budget reflects these upcoming changes!