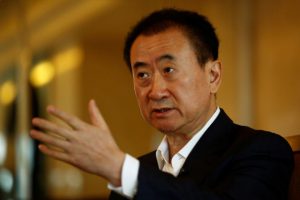

Property tycoon warns of real estate bubble in China

China’s richest man, real estate tycoon Wang Jianlin, has warned the country’s property market is the “biggest bubble in history” – the latest alarm bell in the world’s second largest economy. Wang said property proces continue to rise in big cities, but falling in smaller ones which are saddled with huge inventories of unsold new homes. Urbanisation and property development have fuelled China’s economy, the world’s second largest and a vital driver of global growth. China’s property boom made fortunes for many owners, but in the last two years, new buyers have been priced out despite government borrowing restrictions keeping soaring costs in check. Many more peripheral cities have become “ghost towns” full of empty and unsold residential property, even while in the larger metropolises property prices skyrocket. (Malay Mail Online)

Johari: Real estate industry must strive for productivity growth

Second Finance Minister, Datuk Johari Abdul Ghani, is urging the real estate industry to strive and achieve productivity growth, as well as work to secure market share based on quality products and services, innovation, creativity and entrepreneurship. This was in line with the country’s progressive move towards becoming a high-income nation, as competitiveness achieved by employing low-cost labour and resources would not be sustainable. The real estate industry has multiplier effects, with over 120 other industries relying on construction. The construction sector, encompassing real estate, property as well as infrastructure industries, is one of the driving forces of Malaysia’s successful economic development. (Astro Awani)

Penang Master Builders: RM200bil projects likely this year

The Penang Master Builders and Building Materials Dealers’ Association (PMBBMDA) is optimistic that RM200 billion worth of construction jobs will be given out in the country this year, creating over 7,000 jobs compared to 6,885 with a value of RM135bil last year. According to the Construction Industry Development Board (CIDB) report, the first six months saw 2,179 jobs valued at RM58.6bil being given out. In the second half, many new job opportunities from mega-infrastructure schemes are expected, including LRT, MRT, West Coast Expressway, Central Spine Road linking Kuala Krai in Kelantan and Simpang Pelangai in Pahang, and the Pan-Borneo Highway in Sabah, which will raise the value of jobs to RM200bil. (The Star Online)

Sime Darby sells Singapore property for RM250mil

Sime Darby Bhd, which plans to raise RM1.8 billion by selling property assets in Australia and Singapore, sold one of its investment properties in Singapore on Thursday for S$82.55mil (RM249.64mil) cash. Its unit Sime Darby Property Singapore Ltd (SDP Singapore) had sold off its entire equity interest in Sime Darby Property (Alexandra) Pte Ltd (SDP Alexandra) to Aster Investment Holding Pte Ltd. SDP Alexandra was mainly engaged in property investment and management, but there was no mention of what property it owned in the republic. (The Star Online)

Titijaya to acquire 100% stake in property firm NPO Builders

Titijaya Land Bhd is proposing to acquire a 100% stake in property company NPO Builders Sdn Bhd for RM115.61 million via share issuance, which will give it access to two pieces of prime freehold land that has proposed developments worth RM2.4 billion and estimated gross profits of RM600 million. The two parcels of land are located in Mukim of Bukit Rajay, District of Petaling, Selangor, an area now known as Damansara West. The proposed development, which will likely comprise of commercial shops, serviced apartments and affordable homes, will have some 6,000 to 7,000 units of affordable homes. (The Star Online)

Singapore home prices drop most in more than seven years

Home prices in Singapore dropped by the most in more than seven years, as developers offered more discounts amid signals from the government that property curbs initiated in 2009 will not be rolled back. An index tracking private residential prices fell 1.5% in the three months ended Sept 30 from the previous quarter, the biggest decline since June 2009. Prices fell for the 12th straight quarter, the longest streak of quarterly losses since prices were first published in 1975, according to preliminary data from the Urban Redevelopment Authority. The city-state doesn’t plan to ease property curbs soon, even as home prices have fallen 11% from a peak in September 2013 and sales have halved, thus increasing pressure on developers to offer discounts, payment programs and other incentives to boost sales. (The Star Online)