How many did you check off the reasons why Malaysians can’t seem to save money? If you ticked most (or all; we’re not judging) of them, here are some tips to help you save a little bit more in a month. Trust us, you’d be surprised at the amount you can save just by making a few small changes!

#1 – Cut your landline and change your mobile plan

With everybody owning at least one mobile device these days, landlines are pretty much a thing of the past for most homes. If you don’t get any important calls on your landline anymore, it’s probably time to cut it and save on the monthly utility fees.

As for mobile plans, many usually sign up for a certain plan just to buy the mobile device at a lower price, and continue using the mobile plan even after the contract period is over. Take a quick look at your service provider’s website or visit their outlets; perhaps you can change to a better and cheaper deal that fits your needs without having to pay for unused extras.

Amount saved: RM10 to RM60

#2 – Buy it later

Eyeing that new smartphone? Tempted by that designer bag? Want that new laptop or TV? Chances are, if you wait a month or three, prices for these items will drop as new items are launched, or you’ll simply realize you didn’t really need it in the first place.

Amount saved: RM150 to RM1,500

#3 – Cash only

This is one of my favourite, and most effective, tips. Withdraw a limited amount of money (e.g. RM200) that will be enough to last you for a week – including parking and petrol – then set aside the ATM and credit cards. Since humans are more motivated by loss than by gain, handling real cash instead of plastic will make you more conscious of your spending, as you will be acutely aware of the dwindling amount of cash you have at hand.

Amount saved: RM50 to RM300

#4 – Buy generic for everyday items

More often than not, our spending habits are prompted by familiarity – and brand consciousness. Most of the time, hypermarkets like Giant, AEON Big or Tesco have their in-house brand for items like toiletries, food, and clothing. They are often cheaper than established brand names and work just as well. Consider buying generic for items you don’t care about, such as tissue, dishwashing liquid, tinned sardines and tuna, biscuits, and cornflakes; you’ll find that you can save quite a lot, and won’t even notice the difference.

Amount saved: RM50 to RM100

#5 – Cancel that subscription and gym membership

Let’s be honest here: we barely have time to watch TV, we toss aside magazines after flipping through them, and tell ourselves we will definitely go to the gym over the weekend only to end up lazing in bed until afternoon then head out for brunch. So cancel that magazine and Astro subscription, and ditch the fancy gym membership for a normal gym daily entrance pass instead, if you’re not the type to go for regular gym sessions. The internet is your best friend for videos, and you can always buy magazines at newsstands if they catch your attention.

Amount saved: RM200 to RM300

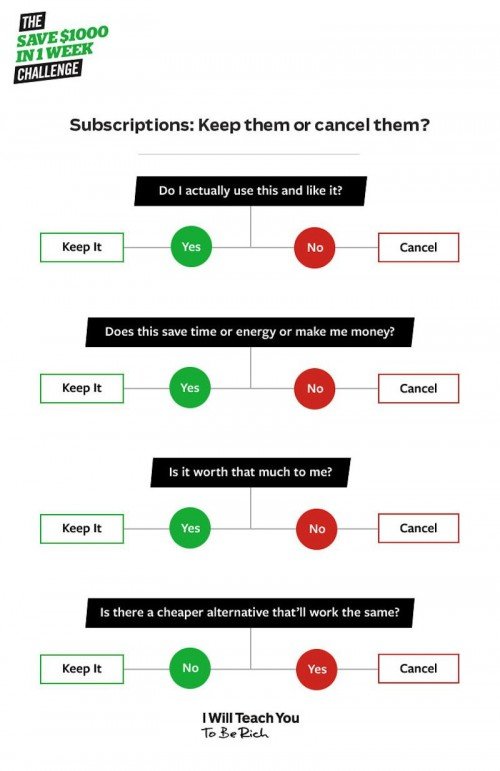

Use these 4 questions to decide whether a subscription should stay or go. (Image taken from Business Insider MY)

#6 – Potluck instead of eating out

Gathering and eating out with friends over the weekend can be an enjoyable but pricey affair, so instead of dining at a restaurant outside, why not organize a potluck? Everybody gets to share and savour delicious home-made food, and saves a bunch on petrol, parking fees, marked up food and drinks, tax, tips, and other miscellaneous things that can easily add up. Even if you don’t (or can’t) cook, ordering a few pizzas and watching movies at home can do the trick too.

Amount saved: RM50 to RM100

Total savings so far: RM 500.00 (approximate)

Has reading the 6 tips so far convinced you yet? Find out more tips on how you can save more money within a month in Part 2 of this article!

References

Business Insider Malaysia (link)

MoneyTalks News (link)

![[Infographic] 7 Reasons Why Women Are Better Investors](https://insight.estate123.com/wp-content/uploads/2017/10/7-reasons-why-women-are-better-investors-header-e1509090445678-380x264.png)