Investors will say that you need to diversify your investments, so you’ll stay afloat the wave of perpetual economic fluctuations and minimise risks. But what do you need to know about investment-specific risks? The investment risk pyramid tells you the why’s and how’s of the investment game.

Investment Pyramid

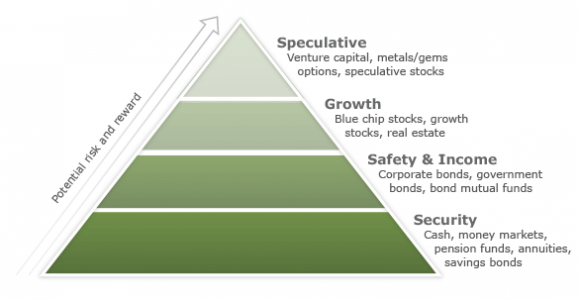

According to Investopedia, an investment pyramid is a portfolio strategy that allocates assets according to the relative safety and soundness of investments. The bottom of the pyramid is comprised of low-risk investments, the mid-portion is composed of growth investments and the top is speculative investments.

With great risk, comes great reward.

When weighing your options, you have to first understand where your potential investments fall within the various levels of the investment risk pyramid. Use the investment risk pyramid as an asset allocation tool to diversify your portfolio investments.

The base of the pyramid is made up of items like cash, money markets, pension funds, annuities and savings bonds, as well as government bonds and mutual funds that provide a small but steady trickle of income. This is the strongest and largest portion, comprising the bulk of your assets, and consists of investments that are low in risk and have foreseeable returns.

Next, the middle portion of the pyramid. This section is made up of medium-risk investments that offer stable returns while allowing for capital growth, such as stocks and real estate. These are more risky than items in the base/foundation level of the pyramid, although still relatively safe if the market remains fairly stable.

The topmost part of the pyramid, also known as the summit, consists of high-risk investments, and is (usually) the smallest portion of the pyramid. Items in this level will include venture capital, precious stones/metals, collectible items and speculative stocks. While they are expensive to acquire, assets in the summit should be fairly disposable, and don’t have to be sold prematurely unless in the event of capital losses.

In a nutshell: The higher you go up the pyramid, the greater the risk and potential return on investment.

Using an Investment Risk Pyramid in 5 Steps:

- Understand – Familiarize yourself with the concept of a risk pyramid

- Analyse – Assess your needs and goals as an investor

- Decide – Determine which investment vehicles you prefer and where they would be placed in the pyramid

- Match – Ensure that your investment goals and your pyramid allocation coincide

- Adjust – Make adjustments to your risk pyramid as required

Every investor has a different appetite (or tolerance) for risk, that is why the investment risk pyramid is such a useful tool for investors to view or represent their portfolios, and customized to show each individual’s risk preference. Once you have an idea of how your own investment pyramid looks like, you can act and adjust it accordingly. After all, that’s the beauty of it.

References

Investopedia (link) (link)

Property Insight (link)

wikiHow (link)