Hua Yang: Property market will improve in H2

Hua Yang Bhd is optimistic that the property market will improve in the second half of the year, as the impact of the Goods and Services Tax (GST) becomes clearer and market sentiments improve. The past six months was soft due to uncertainty regarding GST, and also tightening loan measures by Bank Negara. Hua Yang’s net profit rose 34.6% from a year ago, while its revenue increased 14.5%. (The Sun Daily)

Drop in rates of Klang Valley factory space rental

There has been a drop in rental rates of factory space in certain areas of the Klang Valley, as owners struggle to find tenants for their property. A property negotiator remarked that the drop in prices would mostly apply to larger factory lots, while smaller lots would retain their pricing as they are still in demand. Some buyers were also holding back purchases due to the implementation of GST. Prices of factories in Shah Alam and Klang have remained steady so far. (The Star Online)

Upcoming Langkawi projects worth RM1.5bil

Bina Darulaman Bhd is planning four projects with an estimated total gross development value (GDV) of RM1.5 billion on Pulau Langkawi over the next five to seven years. The projects include a mixed property development in Pekan Kuah, an Eco Tourism Project, and upgrading works on the Kuah jetty, which are expected to begin next year. The company is also focusing on building affordable homes in Kedah over the next two years. (The Rakyat Post)

Land Lease dismisses concerns over TRX project with 1MDB

Australian developer Lend Lease has dismissed concerns over its joint venture with 1MDB to develop a RM8bil project at the Tun Razak Exchange (TRX). The development, dubbed the Lifestyle Quarter, will include a shopping centre, three residential towers and a hotel, and is scheduled to start construction later this year. A spokesperson for the company said that it has “undertaken due diligence and put in place appropriate protection for Lend Lease”. Lend Lease has operated in Malaysia for over 35 years, and previous projects include the Petronas Twin Towers and Setia City Mall. (The Star Online)

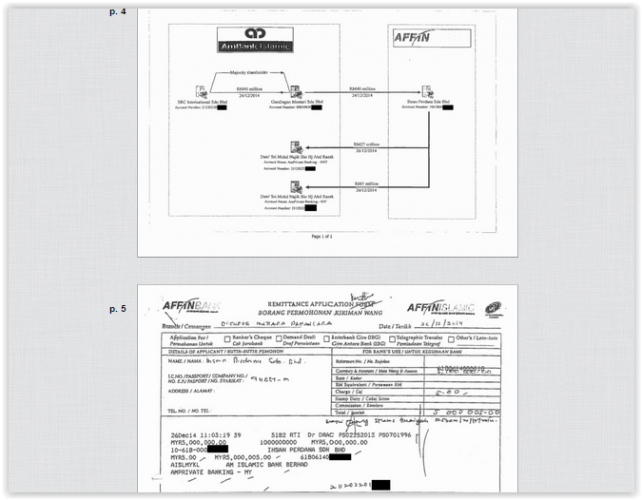

WSJ: Frozen accounts different from those reported

A source close to the investigations has cited that the six accounts frozen by the special task force investigating the alleged US$700 million money trail “were different from those described in the Journal report last week”. The task force’s statement did not name the frozen bank accounts, but sources later confirmed with The Malaysian Insider that three of the frozen accounts belonged to Datuk Seri Najib, and were with AmBank and Affin Bank. The WSJ yesterday also released redacted documents online showing flowcharts and bank documents relating to transactions from 1MDB to Najib’s personal bank accounts. (The Malaysian Insider)

Umno Youth deputy denies involvement in Melbourne property buy

Deputy Umno Youth chief Khairul Azwan Harun has denied his involvement in the RM63 million Mara property scandal in Australia. He claimed that NOW director Rafizi Ramli’s claim was false and defamatory, and warned him to correct the statement or face legal action. Yesterday, Rafizi said that several Umno Youth members had been involved in the Australian property deal, and produced documents that alleged five individuals unrelated to Mara had signed off the property purchase. (The Malaysian Insider)

More subsidy cuts coming soon

The government is planning to cut more subsidies and transfer billions in housing loans into off balance sheets to bolster its finances. Subsidies from petrol, liquefied petroleum gas and cooking oil will be gradually removed in coming years, while a statutory body will be created to move about RM40 billion in civil servants’ housing loans into off balance sheet liabilities to reduce official debt figures and strengthen fiscal consolidation. (The Malay Mail Online)