According to Wikipedia, the definition of a real estate investment trust (REIT) is

…a company that owns, and in most cases, operates income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and even timberland.

Well, that sort of explains it, but I’m pretty sure most people who’ve never heard of REITs will still be scratching their heads wondering what it actually is.

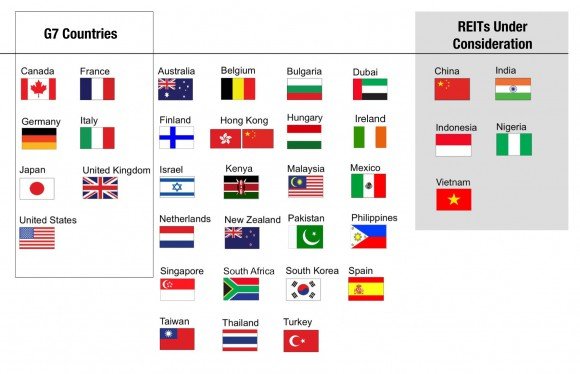

REITs were first formed in the US in 1960, followed by Europe in 1969, and consequently launched in countries all over the world. There are now over 30 countries which have REITs. Malaysian REITs are often referred to as M-REITs, although you have to be careful not to confuse it with mREIT, which can mean mortgage REITs.

The easiest way to explain it would be to just think of REITs as a type of stock. (Not chicken soup kind of stock; the stock market, Bursa Malaysia KLCI kind of stock!) REITs that are listed on the stock exchange are traded just like stocks. It evolved from property investment due to market demand.

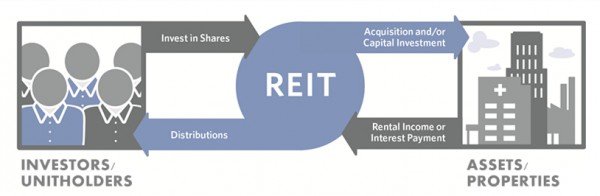

As the name implies, real estate investment trusts (REITs) are trusts that invest in real estate, or properties. These trusts own or purchase a lot of properties, ranging from shopping malls and office towers to hospitals and condominiums and many other types of properties. As it would be impossible for individual investors or companies to amass a large sum of money to buy multiple properties, the REIT is listed on the stock market, and the purchase of its units from investors (called unitholders) will help it to raise enough funds to acquire properties. Thus, the REIT is able to invest in many different properties – be it within the same sector or across different sectors – and distribute earnings as dividends to its investors.

REITs are required by law to pay out 90% of their income as dividends, which make them very popular among investors looking to earn good dividend payouts with good liquidity and without a huge amount of risk that conventional property investment usually involves. In Malaysia, REITS have to pay out at least 90% of their income as dividends in order to be eligible for the exemption from 25% corporate tax rate. The small amount of capital needed to start investing in REITs also encourages small-time investments in the local property sector. This means that normal folk like you and me can invest in REITs too!

Today, REITs are tied to almost all aspects of the economy, including residential and commercial properties, retail, office, mortgage, medical and healthcare facilities, hospitality and tourism, industrial, infrastructure, offices, storage, and even timber.

In the following REIT series chapters, I will go into detail about why you should invest in REITs, and what are the different types of REITs available in Malaysia.