Now you’ve got the basic idea of what is a real estate investment trust (REIT), and it sounds pretty good, doesn’t it?

So why should you start investing in listed REITs right now?

Affordability

Unlike physical real estate, which requires you to pay a few thousand ringgit in downpayments upfront, REITs are bought and traded just like stocks in the stock exchange. By buying units of a REIT, investors can purchase a partial ownership of a big portfolio of high quality real estate (like the KLCC twin towers, Pavilion mall, Sunway Lagoon theme park, etc) and enjoy the income produced from it as well as its appreciation in value. In addition, the minimum subscription a unitholder can invest in a REIT is 100 units, which means that you and I can get started with less than RM1,000.

Liquidity

As REITs are traded just like stocks, they are much higher in terms of liquidity than physical real estate or properties. Units of listed REITs can be easily converted into cash as they are traded on the stock exchange, as opposed to properties that may take some time to be sold or rented.

Stable income stream

REITs tend to pay out steady dividends to unitholders, which are derived from existing rents paid by tenants occupying the REITs’ properties. Most REITs pay a quarterly dividend, which is as good as collecting monthly rental fees from tenants, without the hassle of chasing for overdue rents or bad tenants. Who doesn’t like a stable income stream, right?

Exposure to large-scale real estate

As mentioned in my previous article, since it would be impossible for most of us to buy and own a retail shop lot in Pavilion or KLCC (for example), we can still have a (very) small share of the pie by investing in its REIT’s units. This is how REITs allow investors or unitholders to own a property of very high value, through an organized structure where one can enjoy the yield as payout dividends or dispose of units quickly to gain profit.

Professional management

A REIT is operated and managed by a professional management company, known as the REIT manager, which complies to the Securities Commission and Bursa Securities’ regulations. The REIT manager is involved in asset management, ensuring minimum vacancy, prompt rental collection, dividend payments, responsible capital management and acquisition of assets when needed. Besides that, many REITs recognise the need for best practice and good corporate governance to promote investor confidence. In a nutshell, it’s akin to having a property manager that handles all your tenants’ demands so that you don’t have to do it yourself.

What are the returns can you get from investing in REITs?

- Income distribution based on the distribution policy of the REIT; and/or

- Capital gains arising from appreciation of the REIT’s price.

Even if you don’t know exactly what type of real estate each REIT is involved in, many of the company names will be familiar to the man on the street, such as KLCC (malls and office), Pavilion (mall), Sunway (mall, theme park, hotel), AmFirst (office), YTL (hotels), etc. It doesn’t matter if you’re a new hand at this particular type of investment; simply take some time, maybe a few hours over the weekend or after work, to do some research into the different REITs available and compare their gains and losses over the year. Couple that with your personal purchasing preferences and judgment, I’m sure you’ll be able to discover a REIT or two that will suit your needs and investment portfolio.

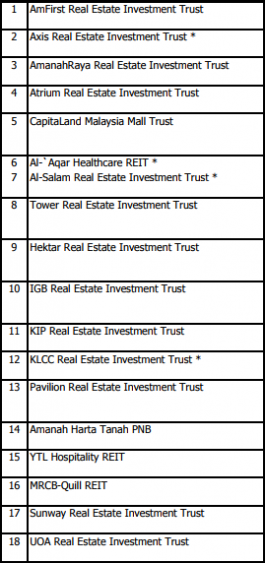

List of all Malaysian REITS (as at 31 July 2017) (Source: Securities Commission Malaysia)

But wait! It all sounds too good to be true, right?

Just like any other investment, REITs also carry their own share of disadvantages or risk, but compared to conventional stocks or physical properties, REITs are considered to have a relatively low risk with pretty good returns. Just be sure to take note of these few factors before you start waving your money at your broker:

Market Factors

REITs are also subject to market demand and supply. As such, market fluctuations, confidence in the economy and changes in interest rates may affect the price/value of REITs.

No Guaranteed Returns

Low occupancy rates and increased vacancies can hurt revenue, which in turn affect yield and subsequently the payout you receive.

No Control Over Investments

Investors will not have direct control over the management company’s investment decisions like when to buy or sell certain real estates, or how they will be managed.

Alright, now that you know the pros and cons of investing in REITs, next we’ll take a look at what are the different types of REITs in Malaysia.