1MDB to Dr M: We’ve broken even on debts

In response to the latest criticism by former prime minister Tun Dr Mahathir Mohamad, 1Malaysia Development Bhd (1MDB) said that it had broken even on its investment with the sale of its power assets. Besides its sale of Edra Global Energy Bhd and subsidiaries to achieve debt reduction of up to RM17 billion, the state-owned investment firm also received RM2 billion cash dividends over time throughout its ownership of the power assets. The debt reduction is well within the anticipated RM16 billion to RM18 billion range outlined in the rationalisation plan. (The Malaysian Insider)

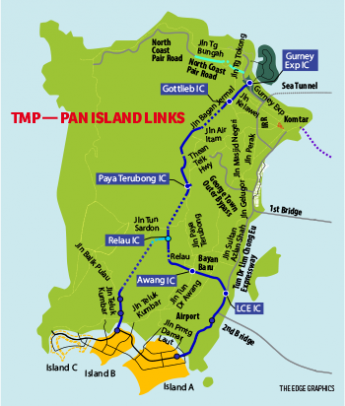

Reclamation of two islands to cost Penang RM8bil

The cost of reclaiming two islands for the Penang Transport Master Plan (PTMP) is estimated to be about RM7 billion to RM8 billion, according to Gamuda-led SRS Consortium Bhd. The reclamation, identified as a land swap model to finance the RM27 billion PTMP, is expected to begin in 2018 once federal and state approvals for the project are attained. An 800-acre island next to these two islands was also identified for further reclamation in the future, pending state needs. Project manager Szeto Wai Loong said the islands with flushing channels would have 700 acres or 15% green space, 5km beach stretch, 25km coastal park, a 30 km-long waterfront, sheltered pedestrian walkways, and designated bicycle lanes. The consortium has forked out over RM10 million to date to fund preliminary studes, including soil and aquatic research, on the reclamation. (The Edge Markets)

Strong interest from investors in Penang Turf Club

Overseas and local investors are showing keen interest to participate in join-venture projects in Penang, due to the weakened ringgit and the Penang Transport Master Plan (PTMP), which is underway to ease traffic congestion in the state, and has improved the prospects of property development on the island. One of the prime parcels of development land on the island is the Penang Turf Club, where the controversial Penang Global City Centre (PGCC) project was supposed to have been developed. It is one of the largest pieces of prime land on the island but also one of the most difficult to develop because of its controversial past. Any developer who wants to take over the redevelopment will have to contend with the rise in land prices, cost of development and new development charges, as well as building a new turf club in Batu Kawan. (Malaysia Chronicle)

E&O locks in new property sales worth RM635mil

Eastern & Oriental Bhd (E&O) has locked in new property sales worth RM635 million in the past 6-month period, with unbilled sales standing at RM825 million. The company said that it has been banking on its brand strength and established track record to continue working within the current subdued market conditions, and draw in sales for its properties in Penang, Kuala Lumpur, Medini Iskandar and London by intensifying its sales and marketing efforts to local and international buyers. The company is planning to launch the second tower of The Tamarind and the second phase of its Avira garden terraces projects in the second half of the financial year. (New Straits Times Online)

Daiman to gain from JBCC project

Daiman Development Bhd is expecting the multi-billion-ringgit Johor Bary city centre project to benefit its businesses in the downtown area. The project will transform the city centre into a vibrant place in the next five to seven years, and include upgrading of infrastructures like roads, drainage system and public areas, elevating Johor Baru as a world-class city and making it more attractive to businesses and visitors. The recently-launched mixed development, known as Ibrahim International Business District, would boost the company’s DoubleTree by Hilton project. The company will continue to focus on landed properties for its existing projects in Johor, with its township projects Taman Gaya in the Tebrau Corridor, and Taman Daiman Jaya in Kota Tinggi. Daiman is also in the planning stage to develop its Daiman BizHub @ Sedenak, as it predicts good demand for industrial buildings in south Johor. (The Star Online)

Berjaya Assets 1Q earnings jump 62.6%

Berjaya Assets Bhd posted a 62.61% rise in net profit for the first quarter (1QFY16) from the previous year, due to property development and investment business segments reporting higher profit contribution as revenue rose. Revenue for the quarter came in 1.03% lower compared to the same quarter last year, mainly dragged down by its gaming business segment which was affected by rampant illegal gaming activities that resulted in an 11% drop in revenue. However, this was partly mitigated by higher rental income from property development and investment business, and the hotel and recreation divisions arising from higher occupancy rates. (The Malaysian Insider)

UEM Sunrise YTD property development sales reach RM1.18bil

UEM Sunrise reported that year-to-date property development sales amounting to RM1.18 billion, with 53% contributed by international sales, namely its Aurora and Conservatory projects in Australia. Its unbilled sales for the third quarter (3QFY15) were RM4.1 billion, mainly attributed to Aurora @ Melbourne of RM1.7 billion. For the nine-month cumulative period ended Sept 30, 2015, the group launched a total of four projects, of which high-rise residential The Conservatory at Melbourne contributed the largest chunk (45%; RM930 million). The group is also switching its strategy to landed residential properties, which is in scarce supply in the Klang Valley. (The Edge Markets)

Johor sultan orders ban on vaping, vape shops to close by Jan 1

The sultan of Johor has banned vaping in the state, and ordered that shops selling vape products to close down by January 1. In an interview with The Sunday Star, Sultan Ibrahim Sultan Iskandar said he did not “want to hear any excuses”, as it was “a question of health and its effects on young people. It has nothing to do with businesses and for sure, it has nothing to do with race”. He also expressed his disappointment at people bringing up racial and political threats, and chastised politicians for pandering to the vaping culture for its lucrative business opportunity despite its risks to health. The sultan had ordered the state executive council to hurry the implementation, saying that the state could invoke local government by-laws to close down vape stores. (The Malaysian Insider)