Malaysian banks holding up against regional peers

Malaysian banks are holding up well against their Indonesia, Singapore and Thailand counterparts on a number of key financial metrics amid slowing economic growth in Asean, said regional analysts. Non-performing loans (NPLs) are expected to go up and profitability to decrease, but capital buffers, liquidity and funding should remain strong. The gross NPL ratio of Moody’s rated banks in Malaysia stood at 1.5% as at the end of last year, the lowest of the four markets after Singapore (1.05%). (The Edge Markets)

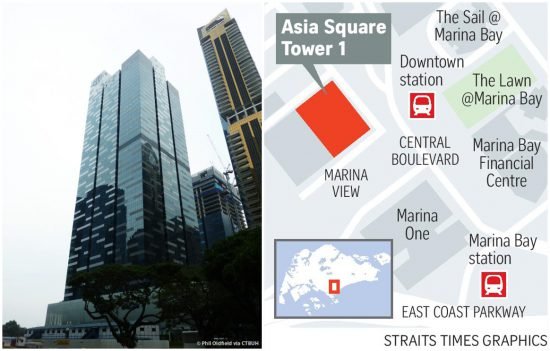

Marina Bay building sold for S$3.4bil in largest single-tower deal in Asia-Pacific

BlackRock Inc is selling a 43-storey office building in Singapore to Qatar Investment Authority, a sovereign wealth fund, for S$3.4 billion ($2.5 billion). It is said to be the largest-ever single-tower real estate deal in the Asia-Pacific region. Asia Square Tower 1, located in the city-state’s financial district, has over 1.25 million square feet of net lettable area and has Citigroup Inc as its anchor tenant. Other tenants include Google and Swiss private bank Julius Baer. The sale comes as vacancy rates in Singapore’s office property sector are nearing their highest level in almost a decade, with the supply of commercial space set to increase amid slowing economic growth. (The Star Online)

Gamuda Land eyes overseas revenue with new launches

Gamuda Land is expecting sales contribution from its overseas developments to account for 40% of revenue from next year, up from 35% this year. The company intends to launch more products overseas as part of its aim to diversify earnings, given the subdued Malaysian property market, said CEO Ngan Chee Meng. Apart from Australia, the company has projects in Vietnam and Singapore. In Malaysia, Ngan said the company had ongoing proejects worth some RM55bil that will sustain the company over the next 15 to 20 years. He also noted that investors were moving away from the US and Europe and looking to places such as East Asia to grow their money. (The Star Online)

Yong Tai plans maiden township development

Garmet maker-turned-property developer, Yong Tai Bhd, is planning to become a major property player with its maiden township development in the near future. Company CEO Boo Kuang Loon said the company is focused on developing its flagship residential development and has decided n the prime Klang Valley area. It is currently scouting and identifying land suitable landbank in the Klang Valley, or its outskirts, to develop the township. Boo acknowledged the scarcity of undeveloped land in the Klang Valley, but pointed out that there were potential tracts in areas such as Ijok, Putrajaya, Dengkil or even further south in Nilai, Negeri Sembilan. (Malaysia Chronicle)

Muhibbah Engineering acquiring Kuantan land for RM26mil

Muhibbah Engineering (M) Sdn Bhd has entered an agreement with Perbadanan Setiausaha Kerajaan Pahang for the proposed acquisition of a land in Kuantan, Pahang, for RM26.45 million. The land would be developed into the Kuantan Maritime Hub over 10 years. The acquisition will provide an opportunity for MEB group to develop industrial activities for ship building, ship repairs, and major fabrication offshore structure. “This will enlarge the group’s maritime and fabrication to enhance the future performance of the group,” it said. (The Star Online)

Singapore malls suffer as locals, tourists curb spending

Singapore’s reputation as a shopping paradise, which saw investors pouring S$10 billion into retail developments in the past five years, is taking a dive due to weakness in the local economy and a drop in spending in tourists. Commercial space has increased by 10% but vacancy rates have risen to 7.3%, and industry analysts expect the numbers to keep rising. The sluggish global economy has not only lowered spending by Singaporeans, but also seen shoppers from abroad spending less in the city state. Wealthy Chinese now have less appetite to buy luxury items overseas and more choices in the form of luxury and duty-free malls back home, while Indonesians, Thais and Malaysians have cheaper versions of the same products due to currency exchange rates. The deteriorating retail outlook is among several challenges faced by Singapore’s property sector, which includes developers and real estate investment trusts or landlords. (New Straits Times Online)