Bank Negara cuts OPR rate from 3.25% to 3%

Bank Negara Malaysia announced a surprise cut in borrowing costs yesterday, lowering the key benchmark interest rate, or Overnight Policy Rate (OPR) from 3.25% to 3.0%. BNM has warned that slow global pace and uncertainties in the global environment could affect the country’s growth, of which domestic demand continues to be the main driver. Inflation is projected to be lower at 2-3% this year, and continue to remain stable in 2017. BNM said the ceiling and floor rates of the corridor for the OPR are correspondingly reduced to 3.25% and 2.75% respectively. (New Straits Times Online)

Analysts: Housing loan interest rates may be lowered

Banks in Malaysia are expected to revise their base rates (BR) to reflect the new reduced Overnight Policy Rate (OPR), but the change will likely be insignificant, say analysts. Interest rates on housing loans offered by some banks will likely be adjusted lower in the coming weeks, following the 0.25% cut in the OPR. At least one analyst said some banks might not follow suit, as banks are free to set their BR. The BR currently offered by local and foreign banks range from 3.20% to 4.15%. The last OPR adjustment was in July 2014, when the central bank raised the benchmark interest rate by 0.25% to 3.25%. (The Star Online)

InvestKL sees RM788mil investments from 10 MNCs in 2015

InvestKL, a government-owned entity formed to attract investments from global firms, has pulled in 10 multinational companies (MNCs) with a combined RM788 million investment in 2015. In its Performance Report 2015, InvestKL reported that these ten MNCs have also created 672 high skilled regional jobs. It also stated that a total of 51 MNCs with approved and committed investments of RM5.9 billion had been drawn from 2011 to 2015, with 32% or RM1.9 billion realised. The report also highlighted the MNCs’ impact in boasting the real estate market in Kuala Lumpur and Selangor, contributing an estimated RM39.9mil in office space rental. For 2016, InvestKL aims to attract 13 MNCs. (The Star Online)

Harn Len, Jotech sign deal to purchase RM18mil land

Harn Len Corp Bhd has signed a SPA with Jotech Metal Fabrication Industries Sdn Bhd to acquire three pieces of land and a factory building for RM18 million. The properties are located near to factories operated by reputable firms such as Meiban, Toyoplus and London Biscuits, therefore the appreciation in value is foreseen. The purchase is part of the group’s plan to invest in properties for value appreciation. (Daily Express)

Image from Free Malaysia Today

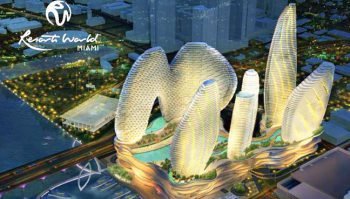

Genting to build US$3.1bil marina project in Miami

A subsidiary of Genting Berhad has purchased the rights to build a 20-slip marina at the vacant Miami Herald newspaper building site in Miami’s arts and entertainment district. This could bring progress to Genting Group’s proposed Resorts World Miami project, as the casino giant is in a legal battle with the Miami-Dade County over a property tax dispute. Resorts World Miami is a 5.6-hectare development. At 10,000,000 square feet, and with an estimated cost of USD3.1 billion, it is considered one of the largest developments in the history of the state. (Free Malaysia Today)

Murder of real estate agent linked to Ponzi scheme

Police are investigating whether the shooting incident in Taman OUG was linked to a Ponzi scheme in China. A real estate agent was gunned down in broad daylight as she was leaving a restaurant with her children and maid. According to City CID chief SAC Rusdi Mohd Isa, the victim’s husband admitted to running an illegal Ponzi scheme in China and returned recently after making a profit. This could be a possible motive for murder, but the police have not ruled out other possibilities. It is understood the husband ran “several businesses” in Malaysia and China and had returned recently, and believed the attack could be due to an investment deal gone wrong. (The Malay Mail Online)