(Sourced from Bloomberg)

Despite decreasing average rents since 2012, and falling three spots in the latest Accommodation Survey by ECA International, Singapore’s property market is far from gloomy. In fact, Singapore’s home prices are set to make a comeback after a three-year losing streak. And analysts think property developer stocks are the best way to play that rebound.

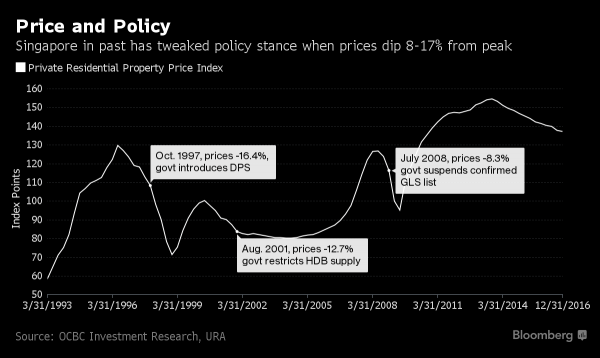

Amid a restructuring push to boost a slowing economy, the Singapore government could signal its intention to reconsider property cooling measures as early as the budget speech in February, said Carmen Lee, head of research at OCBC.

That promises to boost the city-state’s largest developer stocks, including City Developments Ltd., CapitaLand Ltd., UOL Group Ltd. and OUE Ltd. These are Lee’s top picks, as well as those of analysts at CIMB Research Pte, Credit Suisse AG. “Between buying physical property and buying (property) stocks, stocks offer you the liquidity and they are pricing in all the negatives,” she said. “They may not outperform in the next one to two quarters but if you ride this out for 18 months or so, you will see better upside.”

Home prices in Singapore have been driven by the city-state’s cooling measures in recent years, as the government tried to slow down climbing prices in one of Asia’s most expensive housing markets. Prices have declined by 11% since 2013 and sales have dropped to about half of that year’s level. Fourth-quarter private home prices fell 0.5% versus the last quarter, when housing values dropped by the most in seven years, according to data released by the Urban Redevelopment Authority (URA).

Shares of Singapore’s biggest developers rose. UOL Group shares climbed 0.9% to S$6.51 in Singapore trading, set for the highest in 14 months. City Developments added 0.3% to S$8.99, CapitaLand increased 0.6% to S$3.23, and OUE gained 1.7% to S$1.82. The Singapore property index of 44 real estate stocks was little changed.

An equal-weighted index of City Developments, CapitaLand, and UOL Group, Singapore’s three biggest property developers by market value, has outperformed Straits Times Index year-to-date after falling 3.6% in 2016. CapitaLand, South-East Asia’s largest property developer by market capitalisation, has dropped about 20% from 2013 levels, when shares reached a cyclical high.

Developer stocks have moved higher on expectations that there could be an easing of measures, said Raymond Kong, a fund manager at One Asia Investment Partners Pte Ltd. in Singapore. Singapore adopted strict measures to restrict speculation on residential and industrial properties after home prices climbed to a record three years ago. These included a cap on debt-repayment costs at 60% of a borrower’s monthly income, and higher stamp duties on home purchases, after low interest rates and demand from foreign buyers raised concern prices had risen too far too fast.

Singapore’s housing market saw a surge in home sales in 2016 as developers sold more than 8,000 units, a nine per cent increase compared with the previous year. Over 13,000 private residential units are expected to be completed this year, data from URA showed. The pipeline supply will then drop to about 9,300 completed units in 2018 and 7,300 in 2019.d

Sign up with Estate123.com to list your properties for FREE today, and follow our Facebook page for more interesting property news and updates!