Bina Darulaman plans RM1.2bil worth of launches this year

Kedah-based property developer Bina Darulaman Bhd (BDB) has unveiled its development plans for 2017, which include projects with GDV of RM1.24 billion, with a prime focus on affordable housing. 85% of the planned property launches will be affordable housing units in Kedah, which will be sold below RM500,000 each, while the remaining 15% will comprise medium and high-end housing, depending on market demand amid the current slowdown in the property market. Among the projects lined up in Kedah this year are two townships – Darulaman Saujana and Darulaman Sejahtera in Jitra and Sungai Petani respectively. The company is looking to expand into the Klang Valley, but has ruled out expansion into Penang. (The Sun Daily)

Spring Gallery to diversify into property

Ceramics and pottery products manufacturer Spring Gallery Bhd is planning to diversify into property investment and development, which will potentially contribute at least 25% to the company’s net profit. The group believes that the diversification would contribute positively to its future earnings, improving its financial position and complementing its existing construction business. It intends to venture into property development through a residential development project in Kuala Lumpur through the acquisition of an 80% stake in Klasik Ikhtiar Sdn Bhd for RM3.5 million. (The Sun Daily)

Empire Shopping Gallery sold to PHB with buyback option in 5 years

Property developer and asset manager Mammoth Empire Holdings Sdn Bhd has signed a deal to sell its flagship Empire Shopping Gallery in Subang Jaya, Selangor, to Pelaburan Hartanah Bhd (PHB) for RM570 million cash. The deal will enable MEH to raise funds and quash rumours of further delays in the completion of its behemoth Empire City Damansara project near Damansara Perdana, Selangor. MEH has been granted a call option to buy back the shopping mall on the fifth anniversary of the sale. It also has the right of first refusal to buy the mall should PHB decide to dispose of it within the five years. (The Edge)

New campus for Sabah TAR University College ready by 2019

Construction of the new campus for Kolej Universiti Tunku Abdul Rahman (TAR) Sabah, on a 2.42-hectare site in Alamesra, Kota Kinabalu is expected to be ready by early 2019. The campus costing RM50 million will cater to more than 3,000 students, an increase of 10 times compared with the current number of only 340 students in the existing campus in Donggongon, Penampang. The new campus will offer more than 100 courses involving the industry or relevant fields relating to development in Sabah such as tourism, hospitality and marine industries. (Malay Mail Online)

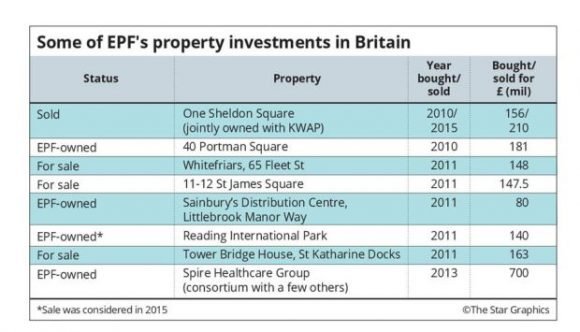

EPF sheds light on UK property sale

The Employees Provident Fund (EPF) has denied that the decision to sell its property investments in Britain was linked to the call by the Government for government-linked investment funds to liquidate their foreign assets and bring the money back to help strengthen the ringgit. The fund decided to put the properties on sale because it felt the prices of the properties had peaked and it was time to reap the profits. The fund also stressed that it was bringing back the profits, while the capital would be redeployed for other investments. The EPF’s investments in Britain and Europe include commercial office space, a private healthcare chain, and industrial and logistics properties. (The Star Online)

(Image from The Star)

SCGM to build new manufacturing facility in Kulai

SCGM Bhd, a thermoform food packaging manufacturer, is set to commence construction of its new RM54mil manufacturing facility in Kulai, Johor. The 7.8ha facility is located about 5km from the company’s existing premises and scheduled for completion in December 2018. The group has earmarked RM125mil in total capital expenditure for the new factory, encompassing land acquisition, building construction and purchase of new machinery. (The Star Online)

Bursa to launch new private market for SMEs

Bursa Malaysia Bhd is expected to launch a new private market, a platform specially designed for the small and medium enterprises (SMEs), on the bourse in the next quarter. The new SME market, yet to be named, would allow Malaysian SMEs to have access to capital, thus helping to achieve the target of 41% contribution to gross domestic product by 2020. With the introduction of the SME Market, there will be three trading markets on Bursa Malaysia, the other two being the Main Market and ACE Market. About 98.5% of business establishments in Malaysia are SMEs. (Daily Express)