Hong Kong’s richest man Li Ka-shing retires at 89

Hong Kong’s richest man, Li Ka-shing, announced his retirement as chairman of CK Hutchison Holdings Ltd last Friday. Li, 89, will retire after the annual general meeting on May 10, passing the mantle to his eldest son Victor Li, who was named successor several years ago. A factory apprentice when he was 13, Li, has been called “Superman” for his business acumen and success. “I’ve been working for a long time, too long,” Li told reporters. He said the secret to his success included factors like continual self-improvement and unstinting hard work. He will stay on as senior advisor. (Reuters)

MAPEX 2018 targeting RM500mil in sales

REHDA is targeting sales of RM500 million for this year’s Malaysia Property Expo (MAPEX 2018), up from the estimated RM300 million last year. Currently, 40 property developers have confirmed their participation in the expo, with more expected to join. Besides property developers, MAPEX 2018 will also see the participation of financial institutions as well as government bodies and agencies. The expo will also feature all kinds of real estates ranging from strata developments, commercial developments to landed homes. MAPEX 2018 will be held at the Midvalley Exhibition Hall from 27 to 29 April. (NST Online)

PR1MA to launch affordable homes in Sabah worth RM7.5bil

PR1MA is planning to launch affordable homes in Sabah with an estimated GDV of RM7.5 billion. The project has been approved by PR1MA Members of Corporation (MOC) to be built in the state. This makes Sabah the state with the second highest number of PR1MA projects approved for development. Some 30,155 units of Perbadanan PR1MA Malaysia (PR1MA) homes will be up for grabs in the upcoming 5-day “Ekspo Jualan Perumahan — Ke Arah Sejuta Impian” in Sabah between March 15 to 19, 2018. The government housing developer encouraged buyers to take advantage of its special end-financing scheme, Skim Pembiayaan Fleksibel (SPEF). (The Edge Markets)

Interest rate hike likely to affect property demand in Penang

The property market in Penang is expected to contract by at least 10% this year compared with 5% in 2017 as a result of the overnight policy rate (OPR) being raised by 25 basis points to 3.25%. A conservative estimate of the incoming supply of residential properties in Penang is about 95,000. With the interest rate hike, the rate of absorption will slow down, as banks are now even more selective. There is also the concern about buying properties near hill slopes and flood-prone areas, as buyers would exercise caution when buying either landed or high-rise properties near such areas. This could slow down property transactions in the state over the next 12 months. (The Star Online)

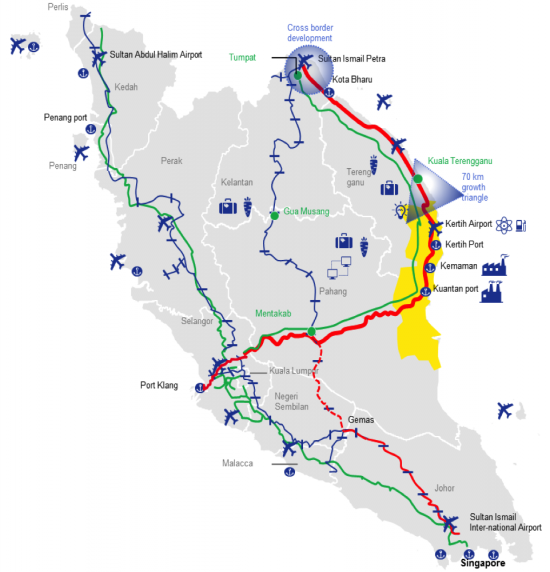

Map of the ECRL project (Image from SPAD)

Consortium formed for ECRL job

Three companies have formed a consortium in an effort to bid for the construction of the Terengganu portion of the East Coast Rail Line (ECRL) project. International off-shore oilfield service provider T7 Global Bhd, construction and engineering firm CMC Engineering Sdn Bhd, and state-owned Eastern Pacific Industrial Corporation Bhd (Epic), formed a strategic partnership to collaborate and explore business opportunities in the construction of the ECRL. The ECRL project would create more job opportunities and bring about economic changes to Terengganu. (The Star Online)

Glomac’s diverse portfolio has RM9bil GDV

Property developer Glomac Bhd has a diverse development portfolio commanding a total estimated GDV of RM9 billion. Group executive chairman Tan Sri FD Mansor said this placed the group in an ideal position to capitalise on the possible recovery in the property market and accelerate new launches to boost future sales. “The group has been selectively pacing its launches, focusing mostly on affordable landed residential and township products to a fair level of success,” he said. Of the group’s targeted new launches, 90% were landed developments comprising terraced, semi-detached and affordable houses. Revenue and earnings were primarily driven by three key ongoing developments, namely Lakeside Residences in Puchong, Saujana KLIA in Dengkil and Saujana Perdana in Sungai Buloh. (NST Online)

IOI Properties to go alone with Singapore property venture

IOI Properties Group Bhd has called off its proposed joint venture with Hongkong Land International Holdings Ltd to undertake a property development project at a land parcel at Central Boulevard in Singapore. After calling off the proposed JV, IOI Properties will now go ahead with the development on its own. In 2016, JV company Wealthy Link had successfully tendered for the site, and obtained permission from URA in February 2018 to start work on the land. The tender for the piling works has been awarded and construction has already commenced. (The Star Online)

Landowners should ‘choose reliable developer’

Second Finance Minister Datuk Seri Johari Abdul Ghani cautioned landowners in Kampung Baru, Kuala Lumpur to choose a reliable developer when developing their lands. Land in the Malay enclave was worth millions of ringgit, hence landowners must choose a reliable developer with the financial capacity and capability to see through the development to the end. Johari said many developers had approached landowners in the past to develop their land, however, after they entered into an agreement, the project gets stalled and that’s when there will be delays and legal complications. Landowners are advised to approach the KBDC (Kampung Baru Development Corporation) and MAS (Malay Agricultural Settlement) for advice when developing their land. (The Star Online)

Najib: Study Australia’s success in building quality homes

Australia’s success in building quality homes without relying on foreign work force may be studied for implementation in Malaysia. Prime Minister Datuk Seri Najib Tun Razak said Australia clearly managed to build quality homes using the Industrialised Building System (IBS). He said Australia did not depend on foreign labour but managed to build quality homes using the latest technology. (The Borneo Post)