The Covid-19 pandemic has been ongoing for more than a year now, and it may still take some time for a full economic recovery. In a survey among landlords and tenants conducted by Landlord123 in May/June 2021, we asked them to share their views on the impact Covid-19 had on their rental property experience, the challenges they faced, and what steps (if any) were taken to overcome these difficulties.

There were a total of 13 respondents who took part in the survey, which consisted of two closed questions (yes/no) and one open-ended question. Below is a summary of the answers obtained from the survey.

At least 50% of landlords affected by the pandemic

From the chart, about half the respondents (50%) answered that they had been impacted by the Covid-19 pandemic in their role as a landlord, while another 50% did not seem to be affected. This showed that even from the small sample size in this survey, the pandemic had affected the property rental experience of the majority of landlords.

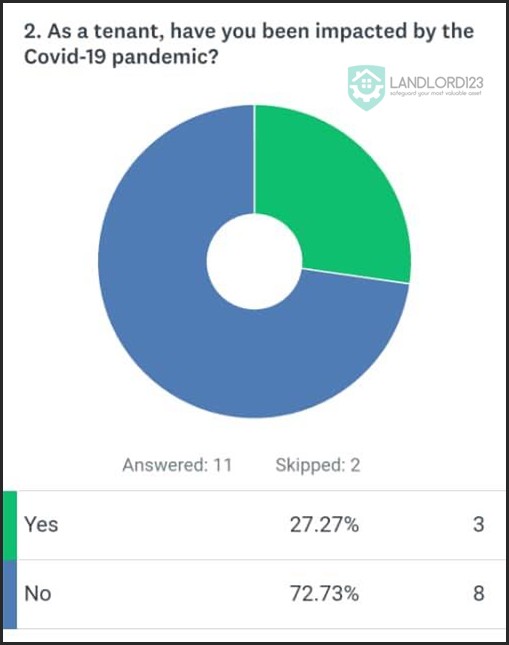

Tenants are less affected by the pandemic

On the other hand, when it came to tenants, only less than 30% of respondents answered that they too, had been impacted by the Covid-19 pandemic. The majority (72%) replied in the negative for this question, but this could also be due to the fact that the respondents were mostly landlords and thus not affected from a tenant point of view.

Cash flow problems for landlords due to default rental payments or reduced rental income

One of the biggest challenges faced by landlords in this survey is cash flow problems as tenants default on rental payments. A landlord who relied solely on rental income as a source of income said that his tenants ‘owe me over $42,000 and… it has impacted my family and credit a lot’.

Another landlord faced a similar situation where the tenant did not pay the full rental or utilities for months, and eviction has become an additional problem. ‘Everything has been delayed and [I only] got half of the payment of each. Tenants owe me around $3,000 so far. I am looking to sell the property and the tenant is asking me to pay them to move out.’

Reduced rental income is also part of cash flow issues for landlords, as evidenced by a respondent who shared that the tenant who previously rented an entire unit is now only renting a single bedroom, and it was a challenge to look for new tenants to rent out the rest of the unit.

Not all doom and gloom for landlords

One landlord was optimistic, however, saying that as a landlord, rental payment delay was to be expected in the current situation, and there was a need to consider offering some reduction in rent to assist and retain the tenant. Another respondent had a similar view, as ‘is hard to find a replacement once tenants move out. Nice renovation and good pictures of the property are a must to increase visibility during the marketing period.’

Despite the negative impact from the Covid-19 pandemic, some landlords are still faring better than others. According to one respondent, ‘My tenant could not pay the rent timely as they said they were impacted by the current pandemic, so they left and I have found another tenant. So far, the [rental] payments have been on time.’ Another landlord said that they were managing ‘just fine’ with no tenant refusing to pay or move.

Renter’s market during the pandemic

In fact, one could even say that it’s a renter’s market during the pandemic. This is the time where, despite the supply and demand ratio of properties for sale, the overall economic conditions do not favor big ticket property purchases, and instead the shifts power to those looking to rent property. Renters have the ability to seek the best deal depending on their income and desired location, whereas landlords feel the pressure to decrease rents in order to attract tenants.

One tenant noted that they just ‘stayed home, went out with a mask, and most times had my groceries delivered’ to minimize being exposed to the virus.

Low-income group the worst hit

All over the world, the most negatively-affected by the Covid-19 pandemic is undoubtedly those in the low-income group, who rely on daily income or social aid to survive. As one respondent answered, ‘Rent is too high and it seems like it’s not getting better especially for low-income people on disability. I had to move somewhere I really didn’t want to but the rent is cheap (between $400 and $500) which is all I can afford with no deposit required.’

Urban low-income families are much more likely to be unemployed, have cut working hours and experience greater challenges in accessing healthcare and home-based learning during this time. A Unicef report on families living in urban low-cost flats in Malaysia showed that low income female-headed households are exceptionally vulnerable, with higher rates of unemployment at 32% compared to the total heads of households. Unemployment could lead to individuals or families being evicted from their rented homes because they are unable to pay the rent on time, as savings are used for more urgent necessities such as food.