Penang’s first premium outlet mall expected to open ahead of schedule

Design Village Penang in Batu Kawan, Penang’s first “premium outlet” mall, is expected to open a month ahead of schedule in October next year, said Savills Malaysia MD Allan Soo. The outlet mall is being developed by PE Land (Penang) Sdn Bhd, and Savills Malaysia is the leasing and retail development advisor. The 400,000 sq ft outlet mall is located on 40 acres of mixed-use development comprising Design Village Penang, a hotel, serviced apartments and high-end condominiums. The entire development has a total estimated GDV of RM1 billion, while the outlet mall is estimated at between RM200 million and RM300 million. The single-storey open-air mall will house 150 stores of international and regional brands, including luxury anchor stores such as Hugo Boss, Aigner, Armani Exchange and Hackett. Shuttle services to and from hotels and Penang International Airport will be offered, and there will be 2,500 parking bays, children play areas and eateries. (The Malaysian Insider)

CapitaLand’s 3Q net property income up 18%

CapitaLand Malaysia Mall Trust (CMMT) reported an increase of 18% in its 3QFY15 net property income (NPI) to RM59.8 million, due to new contribution from Tropicana City Mall and Tropicana City Office Tower, along with higher contribution from East Coast Mall following the completion of its two-year asset enhancement works. CMMT also saw its net profit for 3Q jump 46.9%, while revenue rose 16.7%. Part of the group’s strategy to achieve stronger positioning and better trade mix for Tropicana City Mall is to undergo tenant mix adjustment and grow income contribution upon the next tenancy renewal cycle. (The Edge Markets)

Indonesian property giant increases stake in MCT

Indonesian property giant Ayala Land Inc. (ALI) has invested an additional US$92 million (approximately RM387 million) in Malaysian development and construction company MCT Bhd, increasing its stake from 9.16% to 32.95%. ALI’s wholly-owned subsidiary Regent Wise Investments Limited had exercised its option to acquire additional shares of MCT. ALI chief finance officer Jaime Ysmael noted that MCT’s pipeline of integrated, mixed-use projects in Subang Jaya, Cyberjaya and Dengkil in the Klang Valley aimed to capture the demand of middle-income and affordable market segments, and that a partnership with MCT would enable ALI to expand its footprint in Southeast Asia in line with its diversification goals. (Manila Bulletin)

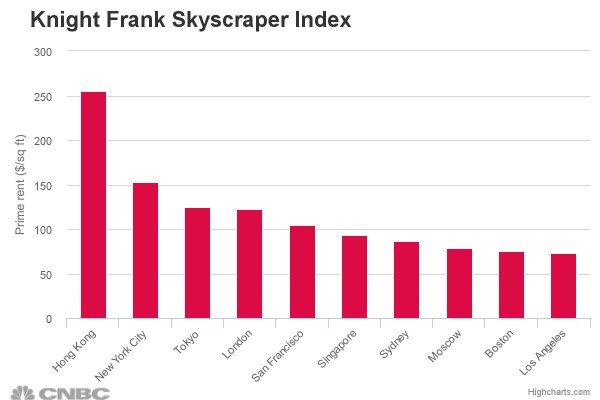

Hong Kong: The most expensive city in the world for office space

According to property consultancy Knight Frank’s “Global Cities: The 2016” report, Hong Kong is the most expensive city in the world to rent office space in high-rise buildings within the central city area. Prime rent for a skyscraper office in Hong Kong is estimated at $255.50 per sq ft per year. In comparison, prime rent in Singapore, which is often used as a yardstick for such rentals, is less than half the price at $93.25 per sq ft. The prime rent for a 880-sq ft office with kitchenette and meeting area would amount to $225,000 per annum, while the most expensive office rental, at Two International Financial Centre in Hong Kong’s Central District, is about $264 per sq ft annually. It is forecast that rental in Hong Kong will increase by 12% by end of 2018 due to lack of supply. (CNBC)

Naim offers once-in-a-lifetime discount for Sarawak properties

Property development and construction company Naim Group of Companies (Naim) is offering discounts of up to 20% for selected property units until Nov 5 to mark its 20th anniversary. The discounts are for selected units at Kuching Paragon, Bandar Baru Permyjaya, Miri and Bintulu Paragon. The offer has attracted great response from interested buyers, who can logon to the Naim website for registration. Balloting will commence once the number of buyers exceeds the number of units offered. Cash buyers can enjoy up to 20% discount while non-cash buyers will get up to 10% discount. (The Borneo Post)

Student rentals the way to go for investors

Student accommodation rentals have become increasingly popular with property investors, thanks to the rising number of tertiary institutions catering to both local and overseas students. A Kerinchi and Pantai specialist realtor commented that she often advises her clients to invest in properties that are close to public transport and aim for student tenants to guarantee tenancy. Foreign student tenants fetch higher rental returns compared to locals. Most of her student tenants are from overseas, especially China, who do not mind paying more for mid to high-end studio units, as they have a strong financial background. Foreign students make up a steady tenant pool because Malaysia has already positioned itself as a higher education hub in Asia, recording annual growth of over 16%. (The Malaysian Insider)

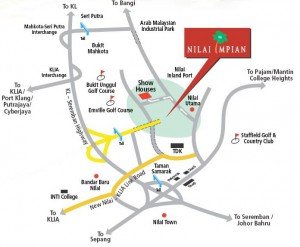

RM30mil Nilai Impian interchange now open

RM30mil Nilai Impian interchange now open

The Nilai Impian interchange in Nilai, Negri Sembilan was launched yesterday by Sime Darby Property, and is now completed and ready for use by the public. The new interchange will provide highway users with better access to the Nilai Impian township and adjacent areas, as well as help resolve traffic congestion issues. It was built as a joint initiative between Sime Darby Property, the Malaysian Highway Authority and PLUS. Nilai Impian is a vibrant township located in Nilai with direct links to the North South Expressway (NSE), occupying more than 730ha of lush green landscape with a GDV of RM5.9 billion. (The Malaysian Insider)

Redha Kedah/Perlis urge gov to reduce compliance cost

Real Estate and Housing Developers’ Association (Rehda) Kedah/Perlis has urged the state and federal government to cut compliance cost in order to reduce house prices, which have increased steadily every year. This is due to the fact that developers transfer the compliance cost to buyers, and that high compliance cost was one of the factors making housing “unaffordable”. Based on the association’s study, he said the compliance cost in Kedah and Perlis currently was 10%, and this was high for the states. Compliance costs under the state government for each housing unit include land subdivision, approval for earthworks, approval for landscaping, cancellation of interest restriction and contribution for road and drainage plan. Under the federal government, more than 20 charges must be paid, including to Tenaga Nasional Bhd, Indah Water Konsortium and Telekom Malaysia. (The Star Online)

DBKL skyscraper plan axed

The plan to replace Menara DBKL 2 with a new high-rise building has been cancelled, as the government has decided that the multi-million ringgit project was not feasible in the current economic climate. The decision was arrived at after reviewing commitments and projects planned for the capital city in preparation for Budget 2016, in which the priority is to build more affordable housing. (Malaysia Chronicle)