(Source: Bloomberg)

We know Hong Kong property is one of the most expensive in the world, but just how expensive is something we can’t really wrap our heads around, especially when it’s stated in terms of commercial property. However, this recent news is the perfect example of the extreme absurdity of Hong Kong’s atrocious residential property prices, and why this writer is suddenly feeling much more optimistic about the current trend of affordable housing in Malaysia.

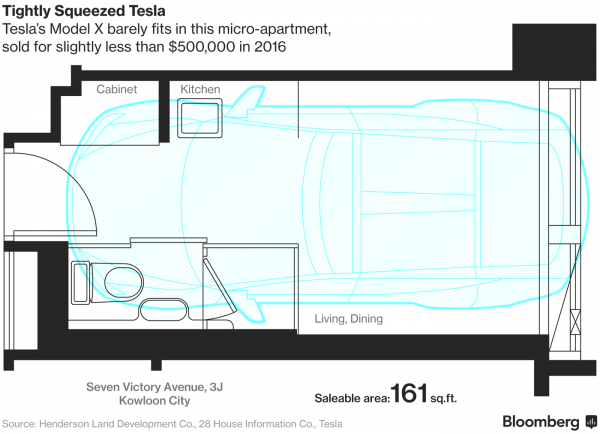

Tesla Model X. Yup, the size of this car, but with the doors closed. (Image from Tesla)

Not many would fancy living in an apartment the size of a Tesla Model X, but for many Hong Kong residents, owning one would be a dream come true. So imagine paying half a million dollars for an apartment barely bigger than a parking lot.

That’s right – a micro-apartment measuring about 161 square feet in Hong Kong was sold by property giant Henderson Land Development Co. for slightly less than $500,000 (RM2.2 million). An actual Tesla Model X in Hong Kong starts at around $150,000.

Image from Bloomberg

As Hong Kong housing prices reach new highs and keep the city the most unaffordable for housing in the world, developers including billionaire Li Ka-shing’s Cheung Kong Property Holdings Ltd., Kowloon Development Co. and Henderson Land have been offering more and more units of smaller and smaller size. Another developer, Chun Wo Property Development Ltd., plans to build apartments as small as 128 square feet — about the size of a California garden shed.

While small apartments were just 5% of new housing in 2010, they jumped to 27% as of last year, according to government figures that forecast an increase to 43% next year. Yet their prices climbed 99% in 2010-2016 — more than twice as fast as bigger homes that are unaffordable for the majority of Hong Kong’s population.

“The pool of buyers for small flats is getting bigger and bigger because people have to downgrade their expectations of the size of flats they can live in,” said Nicole Wong, regional head of property research at CLSA Ltd. in Hong Kong.

The higher cost of smaller units is demonstrated by the square footage price: At a Kowloon City development, a 181 square foot apartment on a high floor sold in May for HK$25,897 (RM14,200) a square foot, or HK$4.69 million (RM2.6 million). A larger apartment that’s similarly positioned sold two days later for HK$23,047 (RM12,600) a square foot — a HK$2,183 (RM1,200) difference.

The trend reflects the unintended consequences of government policies meant to cool the property market, which are instead driving demand for the smallest apartments. Developers, looking to help the government achieve supply targets while aiming to lower the buyer’s price threshold, need to recover the record prices they’re spending at land auctions — so they’re squeezing more units into a single plot of land.

Take a look at a Hong Kong microflat with this 360 video . Use your mouse to move around.

Even Hong Kong’s actual parking spaces cost more than homes in the rest of the developed world. It was reported that a Hong Kong investment executive had forked out HK$5.18 million (approx RM2.8 million) for a parking spot at the Upton apartment complex in Western Hong Kong’s Sai Ying Pun.

Incoming Chief Executive Carrie Lam, who takes over on July 1, the 20th anniversary of Hong Kong’s return to Chinese rule, has promised to increase the home ownership rate by providing government help for people too wealthy for public housing and too poor to afford an apartment of their own.

The government, which champions the free market, has no immediate plans to prevent housing size from getting ever smaller. “At this stage the government leaves flexibility to the market so that developers can respond to the needs of the market appropriately,” said Terry Wong, a government spokesman.

Time to become Ant Man, I guess.

Sign up with Estate123.com to list your properties for FREE today, and follow our Facebook page for more interesting property news and updates!