ECRL can proceed if better terms obtained, says PM

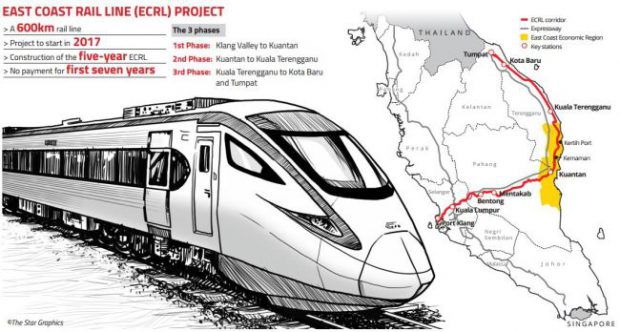

The government will proceed with the East Coast Rail Link (ECRL) if it can obtain more favourable terms through renegotiation and the project’s cost is brought down, said Tun Dr Mahathir Mohamad. Putrajaya does not think that the project “should cost RM55 billion” as has been announced, he said. Under the existing arrangement, payments were made “without regard for the progress of the construction”, he added. He expressed confidence that the government could reduce the overall cost quite significantly, and noted that the issue was giving the contract to a Chinese company, which not not benefit Malaysians. (The Edge Markets)

Govt to review Railway Assets Corp land development plans

The federal government will review proposals to develop three plots of land belonging to Railway Assets Corporation (RAC) worth hundreds of millions of ringgit which had been given in principle to private developers, said Transport Minister Anthony Loke. The proposals to develop the plots of land, estimated to be about 24 acres in Pudu, Batu Tiga (Shah Alam) and Bangsar were approved by the previous Barisan Nasional-led government through direct negotiations. “All the plots of land are in prime areas and there has been no signing ceremony, just agreements in principle,” he said. (Malay Mail Online)

MBSB to convert RM1bil conventional assets to Islamic assets

Non-bank lender Malaysia Building Society Bhd (MBSB) aims to convert its conventional assets worth about RM1 billion, which makes up about 10% of its assets, to Islamic assets over the next two years, as part of its plans to becoming an Islamic bank. The conventional assets include home mortgage loans. “Currently, more than 90% of our asset portfolio is [already] Islamic and we will continue to convert the remaining conventional assets to Islamic assets over the next two years, said its president and CEO Datuk Seri Ahmad Zaini Othman. The group is now in the integration stage to boost its operation by putting in place a single platform for Internet banking, and aims to have a full-blown Islamic Internet banking platform by March next year. (The Edge Markets)

Malaysia, Thailand popular with Chinese middle-class seeking cheaper homes

Malaysia and Thailand are a hit with China’s burgeoning middle-class who are on the lookout to buy houses cheaper than those in other countries or possibly even in their own cities, the South China Morning Post (SCMP) reported. “Most middle-class Chinese can’t afford to buy a 5 million yuan (RM3.08 million) home in Australia or the US. But we found the booming Southern Asian countries with the cities’ high property returns are more profitable and practical to purchase for middle-class mainlanders, who are actually eager to follow in the footsteps of the tycoons and celebrities, and own property overseas in the emerging markets,” said a property firm owner. “The two countries are among those with the fastest economic growth in Southeast Asia and are loved by Chinese people,” he was quoted saying, also noting that Singapore was considered too costly to invest in and Vietnam being an unfriendly nation to China citizens. (Malay Mail Online)

Tabung Harapan Malaysia breaches RM100mil mark

Collections for Tabung Harapan Malaysia (THM) have breached the RM100mil mark, less than a month since it was launched. A total of RM108,215,946.39 has been collected as of 3pm on Monday (June 25). The fund was set up on May 30 for Malaysians to contribute towards reducing the country’s debts. Only donations in ringgit will be accepted. Finance Minister Lim Guan Eng had said that donations to Tabung Harapan Malaysia will only be used to settle government debts. (The Star Online)