Ever since the Goods and Services Tax (GST) was implemented in April this year, there have been protests, reports of decades-old shops closing down, angry social media outbursts, and overall chaos and discontentment from the public, be they business owners or consumers. Amid all the hoo-ha and confusion surrounding GST, life still goes on. With the pending initial GST collection revenue announcement from the government expected in August or September later this year, many are waiting with bated breath to know the full extent of how much Malaysians have paid in just a few short months.

Businesses

When it was first announced (or rumoured) that the government would be implementing a tax on consumer goods and services, many businesses worried that they would lose customers. Further down the road as more and more details were revealed, their concerns turned inwards to their own operations, when it became apparent that businesses small and big were required to register and have a GST-compliant system in place.

Three shops in Penang that had been open for decades decided to close their business before April 1 due to the impending GST implementation, and their plight was quickly taken up and highlighted in the media. A Chinese medicine shop in Bukit Mertajam, which had been operating for the past 74 years, closed for good on April 1; a sundry shop with six decades of history in George Town, Penang closed down; another sundry shop in Air Itam likewise opened its doors for the last time the day before GST was implemented, and at least six or seven traditional businesses in Sri Tanjong, Tawau decided to close down. In most of these cases, the reasons cited for closing shop was not only the GST, but also the costs needed to hire accountants, elderly shopowners who were used to handling their accounts by hand, and not being techologically savvy.

Yoo Chian Hooi seen calculating his traditional Chinese medicine shop’s account at Bukit Mertajam in Penang on March 30, 2015. (Photo from The Malaysian Insider, pic by Hasnoor Hussain)

Just recently, it was reported that one of Malaysia’s oldest publishing houses, Berita Publishing Sdn Bhd, announced its plans to stop its magazine production due to financial losses, due to tough competition, dwindling advertising returns, unable to maintain staffs, and the final killer being GST.

However, the Finance Ministry told reporters that the reason traders were closing their shops was not due to GST, but the fact that their children were not keen to take over the business, as well as failure to compete with supermarkets and franchises. Either way, it is a shame to see these long-familiar traditional businesses go, as they serve to remind us of humble beginnings and a simpler life.

The Working Class

A recent survey by Jobstreet revealed that 90% of the respondents don’t think they will be able to cope with their daily expenses since the implementation of the GST, and 24% were facing problems with expenses even before it came into effect. The changes to people’s personal lifestyle and spending habits in an effort to reduce the burden of GST include packing food from home, taking public transport, and carpooling.

Of course, when asked about salary, some 98% of respondents hoped to get a pay raise to help cope with the increased cost of living. (I mean, who doesn’t want a pay raise?!) In addition, respondents also expected certain employee benefits from their companies, the top one being petrol allowance (63%) to help soften the pinch of taxes on other items.

That’s all well and good, but how does GST affect property?

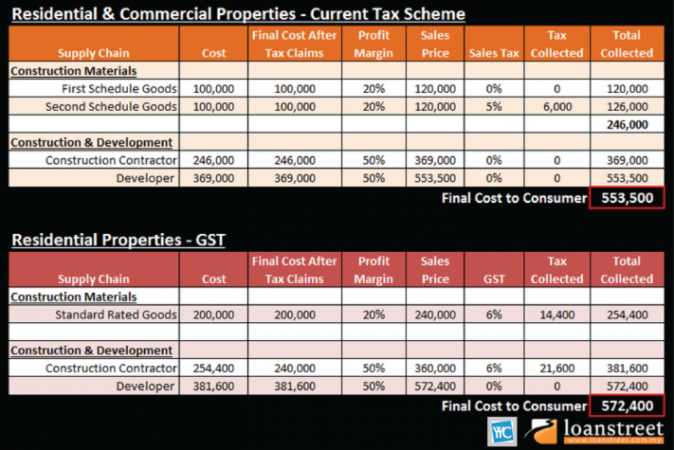

It is undeniable that the real estate market has also suffered a blow from the GST, as property developers report lower sales in the weeks following April, and the government increases its efforts to come up with policies to allow for more affordable housing to be built. This article by Loanstreet offers helpful insight into how the prices of properties in Malaysia differ, both before and after the implementation of GST.

It is important to note that there is increase in both residential and commercial properties, as building materials and services are subject to 6% GST. Unlike normal things like household goods or clothes, where the tax is passed on to the final consumer, no taxes will be charged for purchase of residential property. However, this means that the developer has to bear the cost of the tax from building, and unless they are willing to bear the cost (not likely) or simply out to do charity, you can be sure that they will implicitly try to include the tax costs into the final sale price. On the other hand, commercial properties are subject to taxes, therefore commercial properties will definitely be more expensive after GST.

So, it’s back to the main question: How are you coping with GST? If you’re planning to buy property, maybe it’s time to learn how to save more, or earn more.