Reports reveal that the market for luxury residences shows no sign of slowing down, instead reaching new highs as luxury property prices soar worldwide.

It seems that the demand for luxury residential properties is scaling new heights, with some going up to a record-topping $100 million, according to a report by Christie’s International Real Estate, owned by auction house Christie’s. In downtown Manhattan, there are condominiums priced at $20 million and above, while in France, a villa was sold at $146 million.

Affluent Americans and Europeans, Russian and Middle Eastern moguls, and Chinese billionaires make up the population that is catering to this market. With over 1,800 billionaires worldwide, it’s no wonder that ultra-luxury homes around the world have now become “collectors’ items” for this group of wealthy individuals. These properties are not only part of their investment; they are also ‘trophy homes’, scarce commodities that include bragging rights.

There is no shortage of supply of these mega-luxury homes around the world (cities like Dubai, New York, Singapore immediately come to mind), but the factors driving demand for these properties aren’t always clear. These factors can include the growing ranks of the uber rich, the trend of owning real estate, low interest rates, and of course, investments.

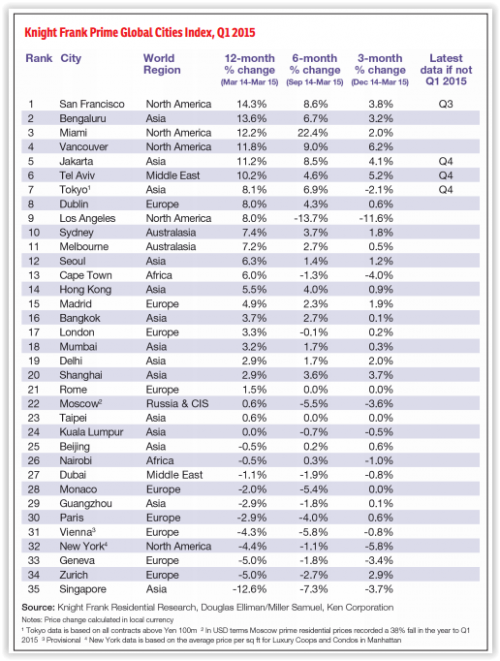

Statistics by the latest Knight Frank Prime Global Cities Index, which tracks luxury residential prices across major cities, revealed a 3.9% increase in the year ended March 2015, with North America and Australia showing strong growth. In fact, the growth of cities in these two areas combined contributed 1.6% of the increase, which shows that demand for luxury homes in the property market is still very much alive and thriving.

The index shows global luxury properties are on average 45% more expensive since 2009, when the financial crisis hit. North American cities like San Francisco, Miami and Vancouver reported remarkable growth (over 11% per city). Sydney and Melbourne ranked 10 and 11 respectively, with an average of 7.3%. Asian cities such as Bengaluru (Bangalore), Jakarta, Tokyo, Seoul, Hong Kong, Bangkok, Mumbai, Shanghai and Taipei had positive growth, whereas Kuala Lumpur showed no growth compared to a year ago.

In short, where there is demand, there will be supply, and vice versa. Demand for mega-mansions and penthouses has accelerated as wealthy buyers seek havens for their cash and search for alternative investments such as art and collectible real estate.

Source:

The Edge Financial Daily (15 May 2015)

Bloomberg Business (link)

Wall Street Journal (link)