Eco World acquires two plots of Batu Kawan land for development

Eco World Development Group Bhd has acquired two parcels of land measuring 374.5 acres in Batu Kawan, Penang for RM875.24 million, cementing its commitment to the Penang property market. The lands which are strategically located within close proximity to the Second Penang Bridge will be developed into two townships known as Eco Horizon and Eco Sun. Both are expected to generate a combined GDV of RM7.76 billion. The proposed acquisitions are in line with its strategy of concentrating on the nation’s three key main economic corridors: Klang Valley, Penang and Iskandar Malaysia, Johor. In Penang, the group is focusing on the mainland Batu Kawan growth corridor. The two proposed projects will complement the group’s successful Eco Meadows township on the mainland. (New Straits Times Online)

Govt urged to build more low-cost flats in Penang

The Federal Government is urged to build more People’s Housing Projects (PPR) for low-income groups who are not qualified to obtain housing loans in Penang. State Housing, Town and Country Planning Committee chairman Jagdeep Singh Deo said the state was now in the midst of identifying several plots of land for the Federal Government to build such housing. “Records showed that Penang, with 999 PPR units from four projects so far, has the lowest number of such units after Labuan which has 500 units from one project,” he said. He also called for Bank Negara to relax its conditions for housing loan applicants, as it was found that there was a 60% bank loan rejection rate among applicants for low-cost and low medium-cost units. (The Star Online)

BCB plans bite-sized launches amid soft property market

Johor Baru-based property developer BCB Bhd, which saw its earnings grow sixfold over the last four years, is scaling down its property launches with smaller projects amid the weak local market. Group managing director Datuk Tan Seng Leong said that with the tightening in loans by banks, about 80% of house buyers’ loans are rejected, and hoped that the authorities would relax the rules, citing Australia’s policy of allowing up to 70% of salary to service loans. BCB plans to divide projects into more phases and introduce only a few units in each phase, which would help gauge market response. For its high-end condominium project, Elysia Park Residence @ Medini in Iskandar, the group only began the second phase development after it secured 80% confirmed sales in phase one. The group has other ongoing developments in Johor and Klang Valley. (The Edge Markets)

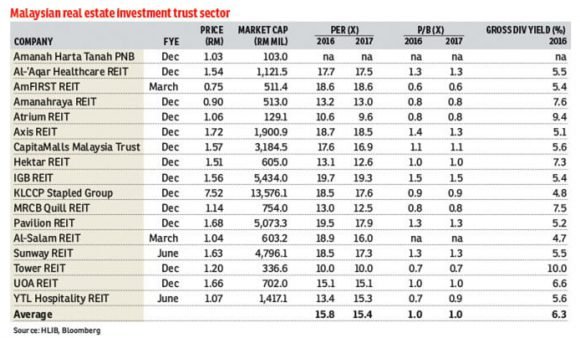

Unchanged fundamentals for Malaysian REITs

Given the challenging economic outlook amid yield compression due to the recent share price rally, Malaysian Real Estate Investment Trust (REIT) sector remains at “neutral” with preference on stocks with combination of high yield, good asset quality and strong management. Underlying fundamentals remain unchanged with slower organic growth caused by slower rental reversion by major mall operators due to subdued store sales. The huge office space supply and slower business expansion could also cause downward pressure on rental yield for REITs. However, local consumption may improve gradually in the second half of 2016, given normalisation of the GST effect, festive seasons and measures to support disposable income. (The Edge Markets)

Image from The Edge

Genting Plantations buys land in Indonesia for US$42.15mil

Genting Plantations Bhd is acquiring nearly 22 hectares of land in Indonesia through the purchase of two loss-making companies – Cahaya Agro Abadi Pte Ltd (CAA) and Palm Capital Investment Pte Ltd (PCI) – for a combined US$42.15 million. GENP intends to fund the acquisition via internal funds and external financing. The acquisition of CAA and PCI will give GENP the rights to develop 8,095-ha and 13,900-ha of land in West Kalimantan respectively into oil palm plantations. The acquisitions are in line with the group’s long-term strategy to increase interest in the palm oil business, consistent with confidence in the continued growth prospoects of the industry. (The Edge Markets)

Selangor Properties posts RM16.9mil net loss in 2Q

Selangor Properties Bhd posted a net loss of RM16.9 million in 2QFY16, from a net profit of RM7.13 million a year ago, attributed to deeper loss from investment holdings and weaker preformance across all business segments, despite stronger performance from property investment. Quarterly revenue was 31.6% higher at RM30 million, from RM22.79 million a year earlier, driven by higher turnover from property investment and investment holding. Its investment properties in Menara Milenium (Damansara Heights) and Claremont Shopping Centre in Perth, Australia continue to enjoy high occupancy rates, and it plans to launch a high-end 18-storey condominium at Damansara Heights in the second half of this year. (The Edge Markets)

Malaysia’s third oldest Catholic Church to get RM2.5mil facelift

Malaysia’s third oldest Catholic Church – the Assumption Church in George Town, Penang – is set to get a facelift via a RM2.5 million restoration project. The 156-year-old church, located within the Unesco core zone, will be closed for 14 months beginning Sept 1. It also houses one of Southeast Asia’s oldest pipe organs which was assembled in Penang in 1916 and is Malaysia’s largest church pipe organ. The church was first built in 1860 and in 1928, underwent its first extension when two wings were added. (New Straits Times Online)

Assumption Church in George Town, Penang (Photo from The Malay Mail Online)